FLOKI Coin Price Jumps 33% In One Week Amid Bullish Chart Patterns

Key Insights:

- FLOKI breaks resistance and gains 33% in a strong technical rebound.

- On-chain data shows mixed signals amid price recovery momentum.

- Weekly chart confirms structural reclaim above key support level.

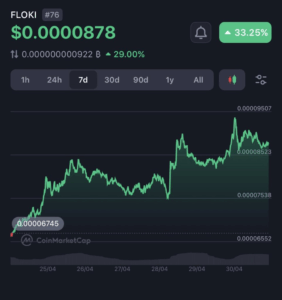

FLOKI Coin price rocketed throughout the past week, increasing by over 33%. Its price surged from $0.00006745 to a high of $0.00009507 between April 24 and May 1.

This impressive weekly performance ranked among the strongest in its category. FLOKI’s momentum is driven by strong optimism from traders and analysts. Its upward trend continues with promising tech developments and meme coins gaining traction.

The CoinMarketCap 7-day chart showed a consistent bullish momentum regarding the FLOKI coin price. Between April 24 and April 26, the token experienced growing buying pressure around $0.00006745. This buildup led to a sharp price surge on April 28, signaling strong market momentum.

The token experienced a strong upward surge, pushing its price beyond previous resistance zones. This momentum led to a new local high at $0.00009507, reinforcing its bullish trend.

Next, it dipped into a slight consolidation phase and has stayed near $0.0000878 as of May 1. This phase reflects a clear uptrend, marked by successive higher lows and higher highs. The pattern signals strong technical control from buyers, reinforcing bullish market momentum.

Before, the $0.00007538 level was seen as a ceiling, while it currently provides short-term support. To continue bullish, this zone will have to be sustained above.

FLOKI Coin Price Shows Strong Structural Recovery

A significant structural recovery can be seen on weekly charts. The price has recovered from macro support at around $0.000048, which has declined for months.

The green candle shows that 13.75% of the profit has been achieved. However, more importantly, the price has moved back to a significant horizontal level, serving as resistance in early 2023.

FLOKI’s reentry into a larger trading channel that was not previously available to it is near $0.000150. During earlier phases of the project, this horizontal channel has been an area for consolidation.

As FLOKI Coin price enters this zone, the potential for further price gains increases. The key to continuing its upward momentum in the upcoming weeks will be market stability and keeping levels above the regained border.

The most notable breakouts in this structure over a weekly timeframe are precursors of a long-term sentiment shift. While daily prices can be erratic on a few days, weekly closes lead to more reliable trend direction.

This reclaimed range signals a potential shift if bullish sentiment continues rebounding sustainably. Holding above this level could mark the early stages of building stronger bullish momentum in upcoming candles.

Daily Timeframe Reveals Classic Wedge Breakout

Looking at daily charts, we notice a classic falling wedge pattern formation from February until mid-April 2025. As a rule, falling wedges are seen as bullish reversal patterns, and Floki’s actions perfectly match this assumption.

The token exceeded the descending resistance line with decent buying volume and pierced the $0.000077 zone. This breakout signaled a strong upward trajectory for FLOKI Coin price.

The movement targets the $0.000120 to $0.000150 range, reinforcing bullish momentum. The move is reinforced by indicators like the MACD rolling over and histogram bars green for the first time in weeks.

With this strength, the volume oscillator falls to a 14.65% decline from the 10-day average, which signals a slowdown in participation. However, its overall fate is still in place as the price creates a new series of higher highs and lows.

Expecting a short-term consolidation around the $0.000085 area, holding there could be the platform to take another higher push.

On-Chain Metrics Show Caution Amid Price Rallies

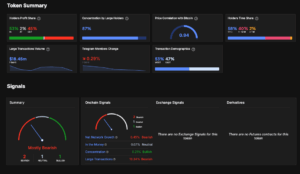

Technical analysis signals strength, but other on-chain metrics give a more detailed picture of the state of the current FLOKI ecosystem. As per data from IntoTheBlock, 53% of holders are in profit, and 45% are underwater.

This means that sentiment is back, but most holders still wait for the price to hit break-even or for a positive return. Large wallets are highly concentrated, with 87% of the circulating supply controlled by big addresses.

The behavior of these large holders determines whether this figure stabilizes or destabilizes the price, as they indicate a centralized holding pattern. In particular, during low liquidity periods, particularly short-term, their decisions usually determine the token’s short-term direction.

FLOKI Coin price also has a very significant 0.94 correlation coefficient with Bitcoin. Therefore, this indicates that broader market movements driven by Bitcoin will significantly influence the token’s price action.

Despite FLOKI Coin’s price growth, Telegram membership has dipped 0.29% over the past seven days. This slight decline has also led to lower community engagement, reflecting a cautious sentiment despite bullish market movement.

The signal dashboard is left mixed. The net network growth is minimal, posted at 0.45%, which is bearish. While transaction volume has dipped from previous levels, $18.45 million across the past week sits in large territory and is bearish.

These indicators suggest that the price increase has yet to spill over into significant growth in user activity or network expansion. Currently, the FLOKI Coin price is breaking through a critical technical zone.

The $0.0000878 region acts as a key pivot point for price movement. Breaking this level could signal an uphill push toward $0.000100, the next psychological barrier.

If bullish momentum continues, the wedge breakout suggests further upside potential. The target range could extend near $0.000150, reinforcing strong market trends.

Key support would lie at $0.000075, the former resistance level becoming support. The next point of defense, if selling pressure ramps up, would come below this at the weekly of low $0.00006745.

The price should continue to close above short-term supports, accompanied by a steady volume to sustain the rally.