Key Insights:

- Near Protocol’s price is poised for massive upside momentum, supported by bullish price action and on-chain metrics.

- Investors and traders have shown strong interest and confidence in the asset.

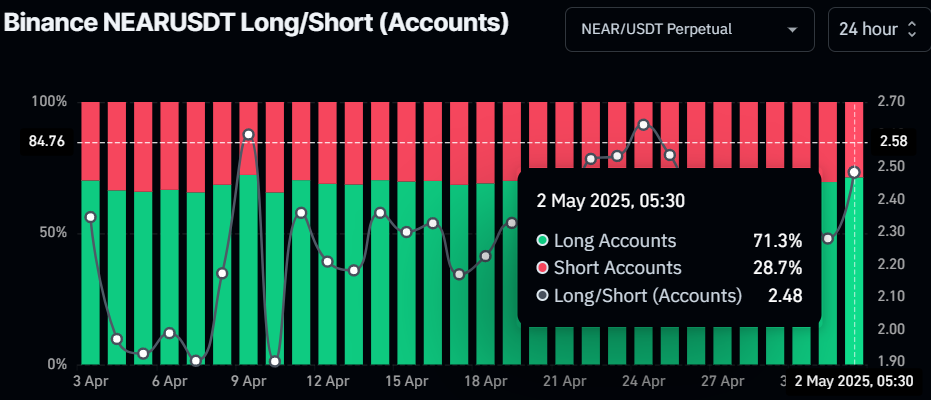

- On-chain data reveals that 71% of NEAR traders are taking long positions.

After breaking out of a prolonged descending trendline, the NEAR Protocol price has been hovering near the key support level of $2.40 for over a week.

Some view this ongoing price consolidation as a breakout retest, while others see it as a sign of selling pressure ahead of a potential price decline.

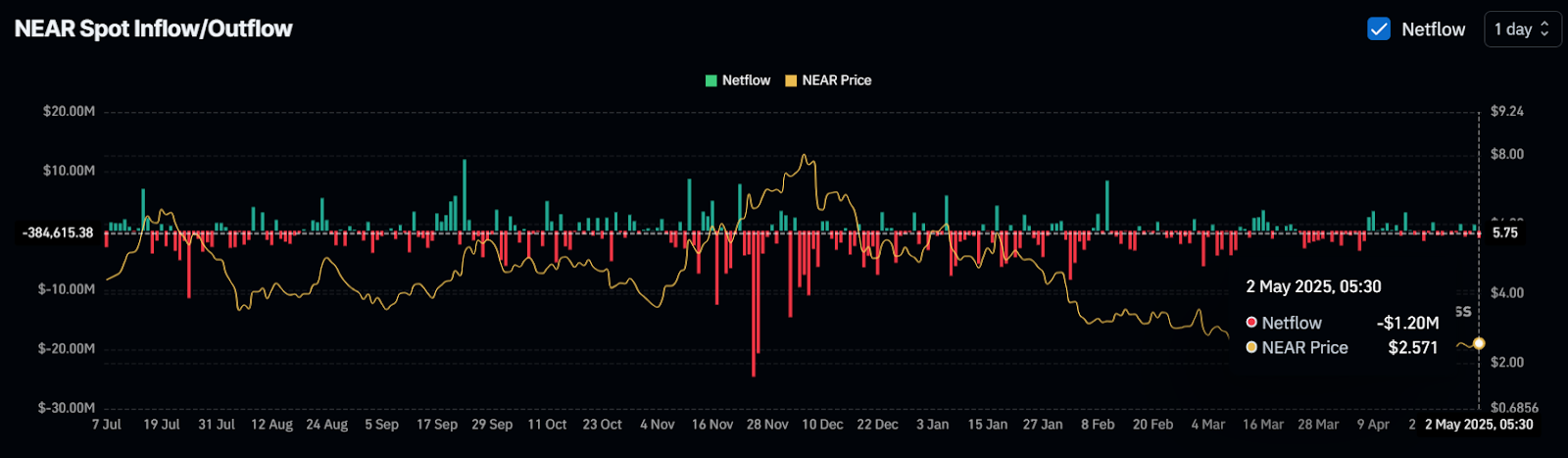

$1.20 Million Worth of NEAR Outflow, Time to Buy?

Looking at the on-chain metrics, this bearish speculation seems unlikely, as they are flashing bullish signals and indicate that the NEAR Protocol price is poised for a rally.

According to the on-chain analytics firm Coinglass, exchanges across the globe have recorded an outflow of approximately $1.20 million worth of NEAR tokens in the past 24 hours.

This substantial outflow from exchanges indicates potential accumulation and could lead to buying pressure and further upside momentum.

In addition, traders on Binance are strongly favoring the long side, reflecting a bullish outlook. At press time, the Binance NEARUSDT Long/Short ratio stands at 2.48, indicating strong bullish sentiment among traders.

This metric suggests that traders on the exchange have built 2.48 long positions for every single short position. Currently, 71.30% of NEAR traders on Binance hold long positions, while 28.70% hold short positions.

Meanwhile, the NEAR OI-weighted funding rate currently stands at +0.0062%, indicating strong buying pressure among traders.

When combining these on-chain metrics, it appears that bulls have been dominating the asset and could support NEAR Protocol’s price in experiencing upside momentum in the coming days.

Despite these bullish on-chain metrics, at press time, NEAR was trading near $2.59, having recorded a price surge of over 0.70% in the past 24 hours. During the same period, its trading volume jumped by 15%, indicating heightened participation from traders and investors compared to the previous day.

Generally, a rising asset price accompanied by increasing trading volume indicates strong bullish momentum and further suggests upside potential.

Near protocol (NEAR) Price Action and Technical Analysis

According to expert technical analysis, NEAR appears bullish and is poised for significant upside momentum. The daily chart reveals that the NEAR Protocol price has recently broken out of a prolonged descending trendline and is currently retesting the breakout level.

However, this retest appears to be a price consolidation around the key support level of $2.45, which NEAR has been hovering near for over a week.

Based on recent price action and historical patterns, if the NEAR Protocol price holds above the $2.45 level, there is a strong possibility it could surge by 20% to reach the $3.10 level in the coming days.

On the other hand, if the NEAR Protocol price falls below the key support level, it could pave the way for downside momentum.

At press time, NEAR’s Chaikin Money Flow (CMF) stands at 0.07, indicating strong buying pressure from traders, which appears to be a bullish sign for the asset.