Solana Dips Ahead Of Incoming $600 Million Token Unlock $142 Next?

- Solana’s price has recently dropped to around $155, with technicals ringing alarm bells of a further fall to $142.

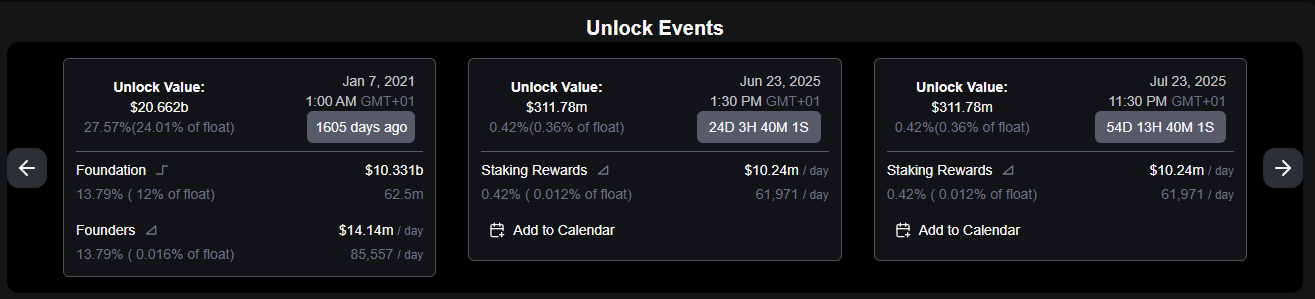

- An upcoming $600 million SOL token unlock between June and August is a major source of selling pressure.

- Solana currently outperforms Ethereum in 30-day DEX trading volume and fee generation.

Solana is walking on thin ice at this point. The altcoin’s price recently dropped by double digits after failing to break above the $185 level, and was holding its ground around currently trading around $155. This stands as its lowest point in over a week.

While Solana continues to dominate the conversation in terms of network activity and in certain performance metrics, there are a few major concerns to be aware of.

Ethereum Still Leads In TVL

Solana has risen over the years to become the second-largest blockchain in terms of Total Value Locked (TVL).

DefiLlama data shows that the network currently has standings of around $11 billion locked in decentralized applications. This figure stands as more than a 20% increase over the last month, which is encouraging in its own right.

Despite this growth, Ethereum still holds the reins with its low fees and scalability through rollups.

Solana Overtakes Ethereum in DEX Volume and Fees

Meanwhile, Solana still leads Ethereum in terms of decentralized exchange (DEX) performance. In fact, over the past 30 days, Solana-based DEXs have held around $94.8 billion in trading volume, compared to Ethereum’s $64.8 billion.

What’s more, Solana also outperformed Ethereum in terms of fee generation.

The network brought in $48.7 million in fees during the same period, compared to Ethereum’s $36.9 million. This is especially interesting, considering Ethereum’s larger deposit base. Overall, the trend shows that Solana is capturing more value per dollar of user activity.

Still, Ethereum’s layer-2 networks have been gaining traction too, with $59.2 billion in DEX volume within the same timeframe.

$600 Million in SOL Unlocks Could Pressure the Market

This is where the pressure starts to mount. According to data from DefiLlama, 3.55 million SOL tokens could be on queue for release in June and August ($311 million in June, $311 million in July). At current prices, this stands as more than half a billion dollars worth of new supply entering the market.

What makes this even more disturbing is the origin of these tokens. Most were acquired from the FTX/Alameda estate at a much lower price point (around $64). This makes it almost certain that the tokens will be sold for a profit, immediately they hit the market.

Even though Solana offers an 8% staking yield (much higher than Ethereum’s 3%), its annual supply inflation rate of 5.2% reduces the real return for stakers. Meanwhile, many DeFi platforms provide better yields through stablecoin deposits. As such, SOL is slightly less attractive than Ethereum for yield-seeking investors.

The Bull Case isn’t Dead, But the Road is Bumpy

Despite the challenges, Solana still holds strong in and off the charts. The Fibonacci retracement tool shows a clear rejection from the $187 price level according to the charts.

The bulls are now likely watching the $155 price level for any signs of a recovery, because a break below would lead Solana straight down towards anywhere between $142 and $134.

The RSI has retreated further towards the neutral zone. This means that if the bears gain any more dominance over the rest of the market, a price decline could indeed happen.

In the long run, Solana’s success will depend not just on performance metrics, but on how well it manages risks. Overall, Solana’s recent pullback isn’t necessarily a red flag for long-term investors.