The $ada price, representing Cardano’s native cryptocurrency, has experienced notable fluctuations in the United States market over the past month. As digital assets face renewed scrutiny from regulators and shifting investor sentiment, $ada’s trajectory offers a revealing snapshot of broader trends shaping the crypto landscape in 2025. This article examines recent price movements, regulatory developments, expert insights, and what these changes mean for investors and stakeholders.

Recent Movements in $ada Price

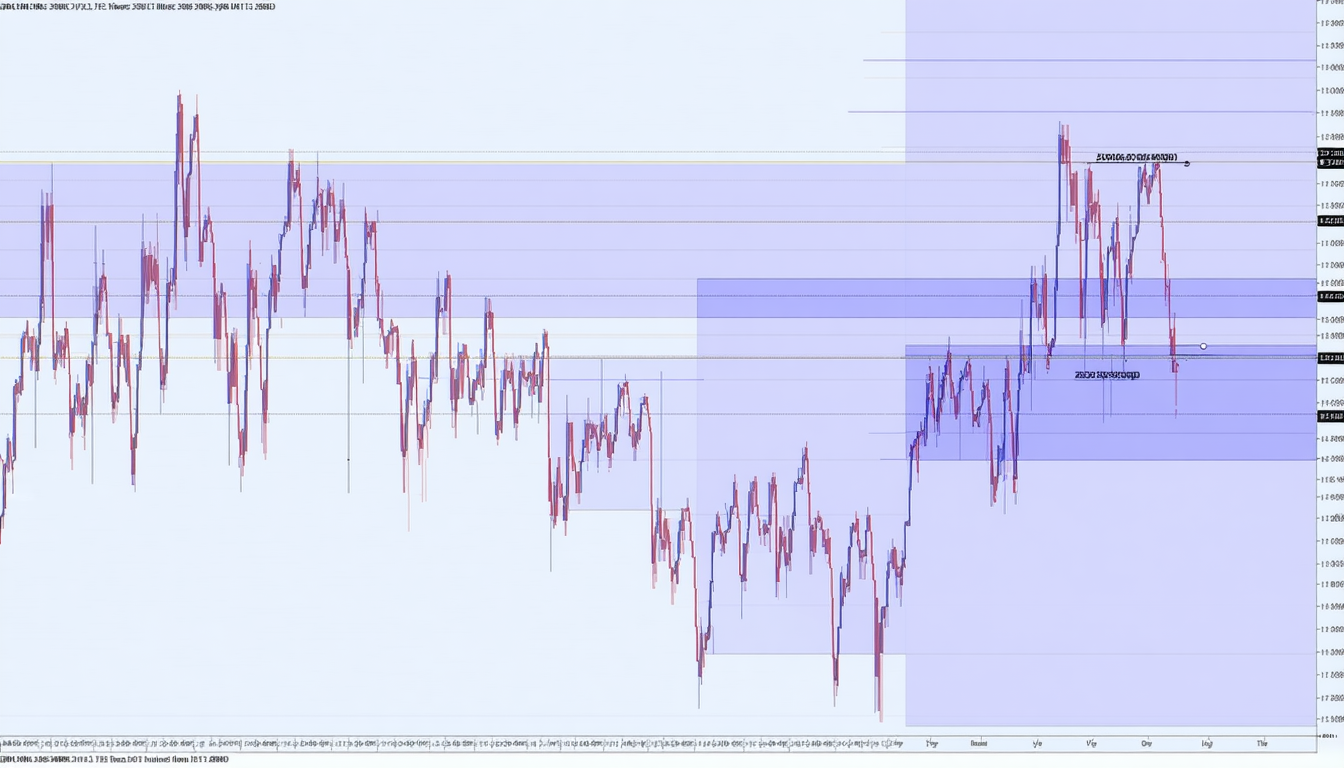

Cardano ($ada) began June 2025 trading at approximately $0.48 on major U.S.-based exchanges such as Coinbase and Kraken. By mid-June, its value had surged to a monthly high of $0.61 before settling near $0.57 as of June 16th—a gain of nearly 19% within two weeks.

Key drivers behind this volatility include:

- Increased institutional interest: Several U.S.-based investment funds announced new positions in Cardano following positive blockchain upgrades.

- Regulatory headlines: The Securities and Exchange Commission (SEC) issued updated guidance on staking services that directly impacted proof-of-stake coins like ADA.

- Broader market sentiment: Bitcoin’s rally above $70,000 contributed to bullish momentum across altcoins.

According to CoinMarketCap data (as of June 16th), Cardano remains among the top ten cryptocurrencies by market capitalization globally—holding steady at around $20 billion.

Regulatory Developments Impacting U.S. Investors

U.S.-specific regulatory actions have played a significant role in shaping recent trends for the $ada price:

- In early June 2025, the SEC clarified its stance on staking rewards taxation—a move welcomed by many ADA holders who participate in network validation.

- The Commodity Futures Trading Commission (CFTC) also signaled openness toward regulated futures products based on Cardano.

“Clearer rules are encouraging more traditional investors to consider ADA,” said Lisa Tran, Senior Analyst at CryptoReg Insights LLC. “However, ongoing uncertainty about classification—whether ADA is a security or commodity—still weighs on long-term confidence.”

These evolving policies have led some exchanges to adjust their offerings or enhance compliance measures specifically for American users trading ADA.

Stakeholder Impact: Traders and Developers Respond

The shifting landscape has prompted varied responses from different segments within the Cardano ecosystem:

For Retail Investors

Many retail traders see current volatility as an opportunity for short-term gains but remain cautious amid potential policy shifts.

For Institutional Players

Hedge funds and asset managers are increasingly exploring exposure through regulated products rather than direct spot purchases due to compliance considerations.

For Developers

Cardano’s developer community continues rolling out upgrades aimed at improving scalability and smart contract functionality—factors that could influence future demand for ADA tokens if adoption accelerates among decentralized application builders.

“Technical progress is critical,” noted Dr. Marcus Bellamy of Blockchain Research Group NYU. “But regulatory clarity will ultimately determine how much capital flows into projects like Cardano from mainstream sources.”

Broader Implications for Cryptocurrency Markets

The performance of the $ada price serves as both a barometer for altcoin sentiment in America and an indicator of how regulation shapes innovation within blockchain ecosystems:

- If favorable policies persist or expand under new federal leadership after November’s elections, analysts anticipate further upside potential not just for ADA but other proof-of-stake assets.

- Conversely, any restrictive measures could dampen enthusiasm despite underlying technological advancements.

A recent survey by Digital Asset Monitor found that over half (54%) of active crypto investors now factor regulatory news into their portfolio decisions—a marked increase compared with last year’s results.

Looking Ahead: What Comes Next?

As summer progresses—and with several key legislative proposals pending before Congress—the outlook for the $ada price remains closely tied to both macroeconomic factors (such as inflation data) and micro-level developments within blockchain governance circles.

Industry experts suggest monitoring these areas:

- Upcoming hard fork events scheduled by Input Output Global (IOG), which may boost network capabilities;

- Potential ETF approvals, which could open doors to wider institutional participation;

- Ongoing dialogue between industry groups like Blockchain Association USA and federal agencies regarding token classification frameworks;

“The next six months will be pivotal,” predicted Sarah Kimball from FinTech Policy Watch DC.“If constructive engagement continues between policymakers and innovators,the United States could emerge as a global leader—not just in regulating digital assets,but fostering their responsible growth.”

Conclusion

In summary,the recent surge—and subsequent stabilization—in$ada price reflects both optimism about technological progress within Cardano,and caution stemming from evolving U.S.regulatory dynamics.As lawmakers refine oversight mechanisms,and developers push forward with ambitious upgrades,the coming months promise continued intrigue around one of America’s most-watched cryptocurrencies.For traders,institutional players,and everyday users alike,$ada remains firmly at center stage amid ongoing transformation across digital finance markets nationwide.