Key Insights:

- XRP price trades near $2.16, with bulls defending the $2.13 level to avoid a sharp breakdown.

- Whales dumped 200M XRP tokens, raising fears of a price dip.

- Ripple invests in Canada’s XRP ETF launch, boosting institutional exposure globally.

XRP price is trading at $2.16, slightly down by 0.84% in the past 24 hours, as bulls attempt to defend a fragile support zone at $2.13. This defense comes amid two contrasting developments: a surge in institutional momentum via two Canadian ETF launches and growing bearish pressure from large-scale whale sell-offs.

While the ETF debut boosts XRP’s long-term appeal, recent on-chain data shows significant outflows from major holders. As a result, XRP price remains caught between long-term optimism and short-term caution.

XRP Price Holds Support but Faces Pressure

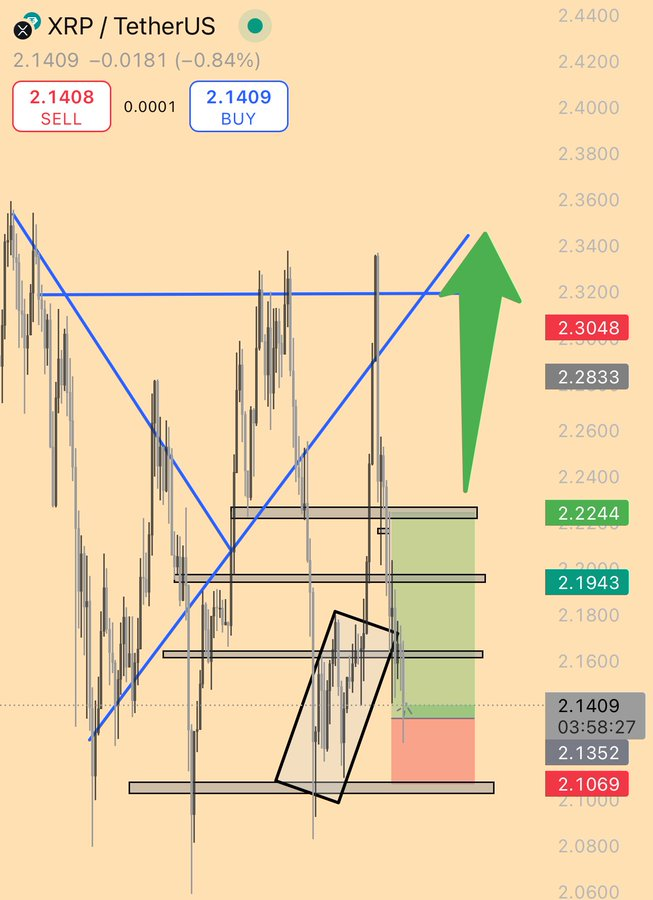

The current chart structure reflected XRP price holding a narrow range, anchored around $2.13 support and capped by resistance at $2.22. Analyst Rai Imran identified an inverted wedge structure where trading remains sideways with no definite direction in price movement.

This support zone is important. If the XRP price closes below $2.13, the next support could be tested around $2.06. Nevertheless, in case buyers pick up steam and rally beyond $2.22, short-range targets towards $2.30 might be feasible.

At the moment, the momentum is not strong, and the volume does not indicate directional biases. Multiple failed wicks up to $2.20 have failed to enact an upward trend, and selling pressure has been followed by cautious buying. The support of this tier implies the fact that bulls are not too tired yet, and there is little in the way of upside conviction.

Whale Holdings Drop by 200 Million XRP

Santiment data confirmed that whale wallets holding between 100 million and one billion XRP have reduced their positions by approximately 200 million tokens. These coins have transferred to exchange wallets, which shows possible short-term liquidities.

Although it does not necessarily indicate a long-run capitulation, the trend indicates an increased danger from risk aversion of the big-holders. These movements have a tendency of causing oversupply in the market and when retail is low that is when it is likely to happen.

XRP price has not yet shown a strong reaction to this change, but such volume shifts can build selling pressure over time. Little accumulation by smaller investors makes the situation worse because there is no balance demand in the market.

Despite the fact that no single wallet dictates this trend, a decline in the exposure of whales collectively points to short-term uncertainty. The price may keep rising or falling within a limited range until accumulation picks up or when there are high whale inflows.

Ripple-Backed ETF Launches on TSX

Amid mixed short-term signals, institutional adoption of XRP continues to grow. Canadian asset manager 3iQ has launched XRPQ, a spot XRP ETF listed on the Toronto Stock Exchange. This marks one of the first regulated XRP investment products in North America.

The ETF allows investors to gain exposure to XRP without holding the asset directly. The initiative has also received the support of Ripple, which has invested in the fund, but the amount was not revealed. The company pointed out that the assets of the fund will be stored in segregated cold servers.

In a bid to spark interest early, 3iQ is not imposing management fees in the first six months. The XRPQ ETF sources coins via regulated OTC platforms, aligning with institutional security standards.

The launch follows another XRP ETF, XRPP, introduced by Purpose Investments on the same day. These parallel launches give Canadian investors access to XRP price exposure through regulated financial products, with the potential to attract institutional investors globally.

U.S. ETF Approvals Still Awaited

While Canada moves forward, the United States continues to delay XRP ETF decisions. More than ten XRP-related ETF applications remain pending before the U.S. Securities and Exchange Commission. No schedule has been confirmed, with analysts anticipating potential updates as early as October 2025.

A U.S.-based ETF would provide broader access to XRP price exposure, particularly for institutional portfolios governed by American regulations. Until now, Canadian offerings are the most open regulated solution.

The divergence between on-chain behavior and ETF launches reflects the split in market sentiment. Short-term selling from whales suggests caution, while Ripple’s involvement in institutional funds signals long-term belief in XRP price potential.