Key Insights:

- An Ethereum whale purchased $29 million worth of ETH in four days, including a $7.48 million buy just 9 hours ago.

- BlackRock purchased $15.46M in ETH via Coinbase Prime, adding to its growing Ethereum ETF position.

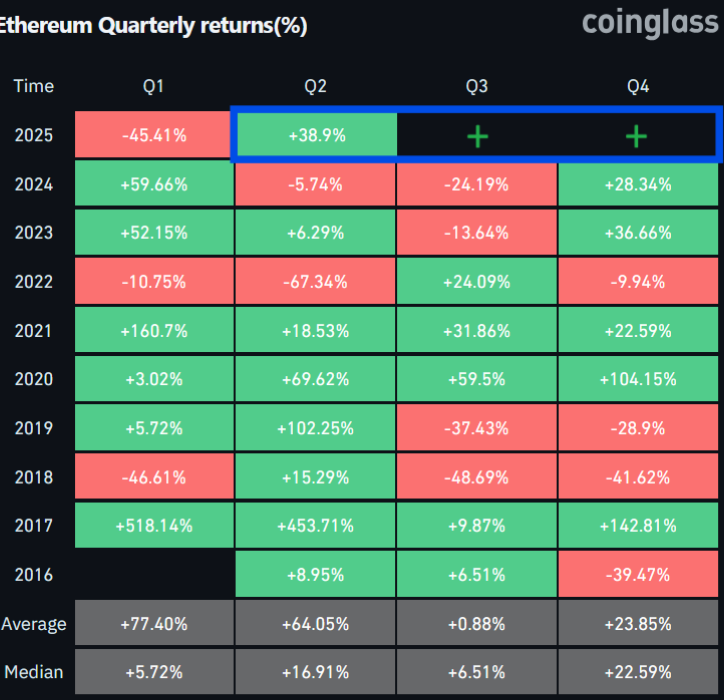

- Ethereum price gained 38.9% in Q2 2025 after a 45.4% drop in Q1, historically rallying in Q3 and Q4 with strong double-digit returns.

Ethereum (ETH) is experiencing huge accumulation, as recent data suggest that whales and institutional investors are stepping in. The sustained inflows have led to speculations of an Ethereum price rally in the coming quarter.

Whale Purchases Intensify Amid Ethereum Price Fluctuations

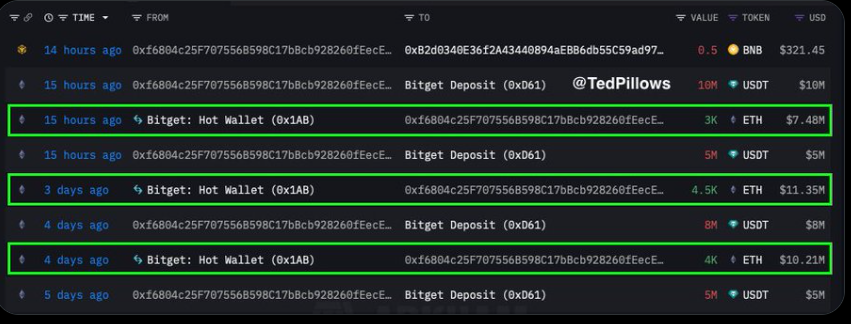

Over the past four days, a single Ethereum whale has acquired approximately $29 million worth of ETH. One of the most notable transactions occurred nine hours ago, involving a $7.48 million purchase of 3,000 ETH. Blockchain records indicate that this accumulation was conducted through Bitget hot wallets, with transfers heading to a single receiving address.

Notably, the transaction pattern revealed a broader accumulation strategy, with previous buys including $10.21 million, $11.35 million, and $8 million within the same timeframe. These figures suggest that the whale remains undeterred by recent market fluctuations.

As Ethereum price maintains key technical levels, large entities continue to acquire positions. Consequently, these reinforce the trend of strategic holding during periods of consolidation.

BlackRock Adds $15.46 Million to Ethereum ETF Holdings

More so, institutional involvement also remains strong, with BlackRock executing a $15.46 million Ethereum purchase just two hours ago. The transaction was routed through Coinbase Prime and added directly to the ETHA Ethereum ETF wallet. This activity occurred alongside other large-scale Bitcoin ETF inflows, underscoring a broader institutional strategy toward digital assets.

In addition, the recent ETH acquisition by BlackRock followed multiple ETF-related transactions over the past week. Data from multiple sources confirms that BlackRock has added tens of millions of dollars in ETH to its ETF vehicle since early June.

As retail activity shows signs of hesitancy, ETF managers are steadily increasing exposure, indicating a shift in portfolio allocations across institutional frameworks.

Ethereum Price Quarterly Performance

Meanwhile, analyst Carl Moon pointed out that Ethereum price posted a 38.9% gain in Q2 2025, recovering from a 45.4% decline in Q1. This pattern of sharp reversals has been observed in past years, with historical data indicating that ETH tends to perform more strongly during Q3 and Q4.

For example, in 2020, ETH returned +59.5% in Q3 and +104.15% in Q4, while in 2021 it saw gains of +31.86% and +22.59%, respectively.

On average, Ethereum Q4 return stands at approximately 23.85%, based on data from 2016 through 2024. If this trend continues, Q3 and Q4 2025 could provide a favorable backdrop for further price appreciation.

Additionally, the asset’s behavior following strong Q2 rebounds has typically coincided with higher trading volumes and expanding open interest in derivative markets. This signalled increased market participation.

Institutional Inflows Support Market Structure

More so, combined ETF inflows across multiple issuers exceeded $11 million on June 17 alone, with BlackRock contributing $36.7 million in ETH over recent sessions. ETF products such as ETHA have become a primary method for institutional entities to gain Ethereum exposure without direct custody. This structure simplifies compliance while offering investors access to Ethereum’s underlying performance.

Furthermore, data across the past two weeks showed sustained inflow activity even amid Ethereum price corrections. ETF metrics suggest steady capital movement into Ethereum-focused funds, supporting longer-term positioning strategies.

If this momentum continues, coupled with whale accumulation, Ethereum price may enter a structurally stronger phase as the market transitions into the second half of the year.