Could XLM Price Surge To $1 Amid Predictions Of Bullish Breakout?

Key Insights:

- XLM price surged 7.03% in 24 hours, reaching $0.245 before a slight pullback.

- MACD showed bullish divergence on the 3D chart, signaling weakening bearish momentum.

- Open interest in XLM derivatives rose 3.23%, showing new capital entering the market.

Stellar (XLM) has drawn fresh interest following a 7.03% surge in the last 24 hours. This significant rise in XLM price has boosted its visibility in the market. Market participants are watching closely as indicators suggest a possible breakout.

A price rise started at $0.2198, then reached $0.245 before experiencing a minor drop. This raised questions about future market direction. Market participants have noticed the current consolidation phase around crucial support areas.

These areas have maintained their position despite the generally bearish market conditions. Technical analysts across the industry are exploring different pathways that could lead the XLM price to $1.

Technical Analysis Shows Possible Reversal Patterns for XLM Price

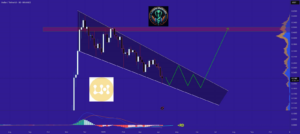

Stellar has remained inside a descending channel since November 2024. The 3-day XLM price chart revealed it is approaching the channel’s lower boundary. Analysts employing traditional cycle analysis suggested that this might signal an oversold area.

The MACD indicator showed regular bullish divergence, often interpreted as a weakening of the downward trend.

Trader interest in anticipating a trend reversal would likely increase when the divergence extends its development. The market monitors the early confirmation signal from breaking above $0.24.

Volume analysis on the same chart indicated heightened trading activity near resistance zones. These zones range between $0.46 and $0.50.

The present price point matches previous accumulation zones. It represents an ideal target when traders expect a break to come through.

Analysts believe that maintaining a breakout above the resistance point could reinforce upward price momentum. This movement is expected to drive the price action in a stronger direction.

Derivatives and Sentiment Suggest Market Shift

Stellar network initiated a new trend trajectory based on rising derivative and spot market engagement. At press time, XLM price was trading at $0.2352. On the other hand, its value increased by 7.03% throughout the previous 24 hours.

This drove the trading volume to $287.62 Million at a 21.17% growth rate. XLM token possessed a $7.24 Billion market value alongside 30.78 billion circulating units from its maximum 50-billion-unit total.

The price triggered an initial surge from the original level of $0.2198 before surpassing $0.245 and settling in its current position. XLM exhibited this trend during its initial accumulation period and when it reacted to outside variables.

Increasing investor demand is demonstrated by the current 3.97% relationship between volume and market capitalization in XLM.

XLM derivatives markets witnessed significant growth as their volume jumped 5.63% above $300 million. At the same time, open interest increased by 3.23%, which indicated new position openings.

The early April market data showed funding rates switching from negative values to reaching minimal positive numbers. Indicators suggest that short positions are probably closed now, which could signal growing bullish momentum.

The next immediate goal for XLM price is a breakthrough above $0.23. This will open up future possibilities for reaching back into the $0.25–$0.26 resistance area.

XLM Price Structure Hints at a Possible Breakout Setup

XLM price has hovered around $0.2352, reflecting renewed strength. This uptick followed its movement from the lower boundary of a descending triangle pattern.

A descending triangle pattern within consolidation periods indicates changing market direction after traders break through its formation. The market showed possible base formation as it remained in a bearish trend and yet displayed static price action.

Recent weeks have shown that buyers maintain their position at $0.1902. This way, it indicated growing support for the market. As long as this support stays strong while the trading volume increases, an upward price move with sustained durability may develop.

The market needs to breach the $0.26 resistance level to transition from a bearish to bullish structure. This breakthrough is crucial for traders aiming to strengthen upward momentum.

A clean gap above $0.26 would likely increase purchasing interest before the XLM price reaches $0.40. The market experts await active trading volume and stable crossover points above resistance levels.