Key Insights:

- Ripple (XRP) maintained $2.1896 while touching the 50-day EMA, indicating potential trend evolution.

- The Smart Money and the crowd stayed bullish on this altcoin’s potential.

- The Federal Reserve Board announced it would pull back its crypto restrictions.

XRP price analysis suggested a possible shift in market sentiment. The Federal Reserve’s decision to remove restrictions on crypto and stablecoins for banks could have a significant impact. This development may influence XRP’s future price movements.

XRP Price Analysis

XRP price analysis shows the asset holding steady at $2.1896. It briefly touched the 50-day EMA at $2.1985, signaling potential trend changes. This movement suggests an evolving market direction soon.

Before the current session, the 20-day EMA at the $2.1307 price level functioned as temporary support after its retest attempt.

The convergence of short-term and mid-term Exponential Moving Averages confirmed rising bullish pressure. This sent prices toward $2.45 after crossing the 50-day Exponential Moving Average.

The $2.20 entry with positive candle-flow appeared favorable due to EMAs crossing paths. If XRP failed to break the $2.1985 level, it could move towards $2.13 based on the 20-day EMA.

XRP price faced potential short-term bearish movements. This could reach the 200-day EMA at $1.9730 if the price fell and break the current support at $2.18.

The token showed an extended downward trend. It continued to block higher price movements toward the $2.65–$2.70 zone. A bullish market outlook would become more powerful if the price closed above the 50 EMA while volume increased.

A price decline below $2.17 would signal a rejection of the current long outlook by invalidating the current bullish stance. The forthcoming movement of XRP depended on how the price reacted to its significant moving averages in both examined situations.

Sentiment of XRP Market Participants

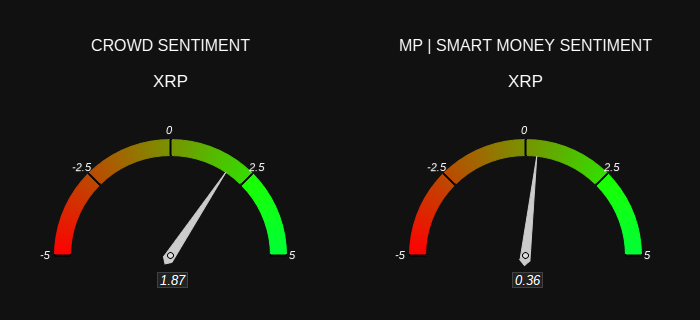

The crowd sentiment index for XRP price reached 1.87, indicating moderate bullishness. Retail traders remain optimistic about the token’s potential.

Smart money sentiment reported at 0.36 indicated institutional investors showed restrained optimism. However, there were indications of bullishness.

Retail buying activity has driven an immediate upward price momentum. However, this rally could stall if institutional volume fails to provide sufficient support.

This demonstrated price volatility as retail traders maintained a crowd sentiment above 1.5. Still, institutional investors showed weak smart money support.

A rise in smart money sentiment above 1.5 would verify the potential for a robust price increase. A reading below zero would indicate the potential for rejection at main resistance levels.

XRP enjoyed a positive market sentiment following its approval by smart money. This would serve as an essential condition to maintain its upward price trajectory.

How XRP Could Benefit from the Fed’s New Update for Banks on Crypto

The Federal Reserve has granted banks permission to engage with digital assets. This applies to all crypto categories without requiring prior approval. These updated regulations provide broader support for XRP and other cryptocurrencies.

The new policy has expanded opportunities for traditional financial institutions. They can now offer crypto custody, trading, and settlement services.

These regulatory developments held great importance for XRP users. This was due to the inherent nature of XRP to be used mostly for payments.

XRP’s banking infrastructure connection could benefit from expanded liquidity. Broader cooperation within the banking sector may enhance its integration with payment systems.

The future trajectory of XRP both regulators and banks implement toward crypto solutions remained essential for the payment coin’s development. Price impact from bullish momentum would depend on how positively financial institutions adopted and used the product.