Key Insights

- Polygon Network (POL) finally broke out of its 5-month-long bearish trend.

- Polygon price prediction suggests that POL could soar by 17% in the coming days.

- The network has launched its highly anticipated update, the “Agglayer Breakout Program.”

Polygon price has finally broken out of its prolonged bearish trend. This shift opens the door for a potential upside rally amid the ongoing market recovery.

Following the breakout, the Polygon price prediction has gained attention. Analysts are now evaluating how the native token POL might perform in the coming days.

Key Price Momentum

POL was trading near $0.25 at press time and had recorded a modest price surge of 1% over the past 24 hours. However, during the same period, the asset’s trading volume dropped by 45%, indicating lower participation from traders and investors.

Over the past seven days, Polygon price has surged by 33%, reflecting strong market momentum. This rally was fueled by shifting sentiment, bullish price action, and the Agglayer Breakout Program update.

Following the latest program update, investors have shown strong interest and confidence in the asset. This led to a notable price surge and bullish breakout.

A recent report highlights a new development program supporting early-stage blockchain startups on Agglayer and Polygon. It provides funding and essential resources to help these projects grow.

In return, they reward POL stakers with a project token airdrop ranging from 5% to 15% of the total project supply. This top-class development on the Polygon Network is benefiting the POL price.

Polygon Price Action & Technical Analysis

Expert technical analysis and Polygon price prediction suggest that the asset appears bullish. The token is now poised for massive upside momentum.

POL price recently broke above a descending trendline and a critical horizontal level at $0.24. This breakout overcame a strong resistance zone, potentially signaling further bullish momentum.

It broke out, and the token’s price closed a daily candle above that level. This confirmed the breakout as successful.

Polygon price prediction could remain bullish if POL price stays above the $0.24 mark. The price may gain upward momentum, signaling continued strength. This rally could push the price by 20% until it meets the next resistance level in the coming days.

However, Polygon price prediction for the bearish side will be activated if it closes a daily candle below the $0.24 level. Otherwise, it will remain bullish.

As of now, the asset appears to be trading below the 200 Exponential Moving Average (EMA) on the daily time frame. This indicated that POL has been in a bearish trend.

NFT Sales Surge on Polygon

Polygon Network’s NFT sales have seen a significant surge in activity. Over the past seven days, sales reached $22.1 million, reflecting strong market demand. This rise coincides with the bullish price action, further signaling positive momentum.

Ethereum recorded only $21.8 million in sales during the same period. Whales have ramped up their participation amid bullish developments. They have been actively accumulating tokens from the breakout to recent updates and rising NFT sales.

Data from Santiment reveals that whale wallets holding 10,000 to 100,000,000 POL have accumulated tokens. This indicated that the Polygon price continues to follow its upward momentum.

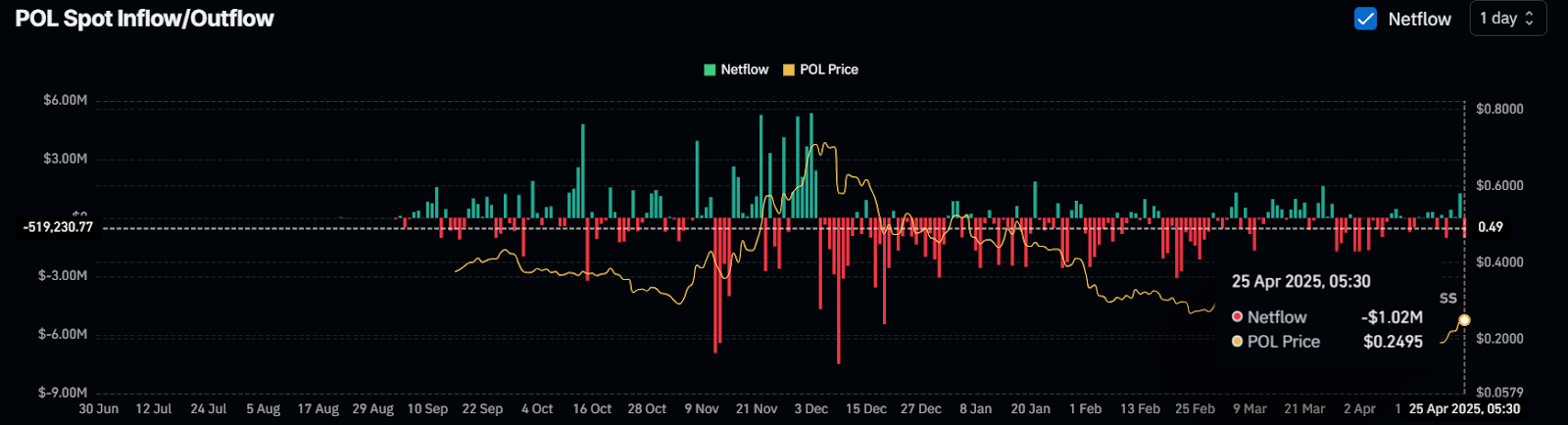

On-chain metrics further support this bullish outlook. Coinglass’s spot inflow/outflow data reveals that exchanges have witnessed an outflow of $1.01 million worth of POL coins. Such outflows from exchanges can create buying pressure and trigger a further upside rally.

Bulls have been in control of POL, driving its recent price surge. Their support suggests continued upside momentum in the coming days.