Key Insights:

- Onyxcoin consolidates around $0.02 as indicators support potential uptrend continuation.

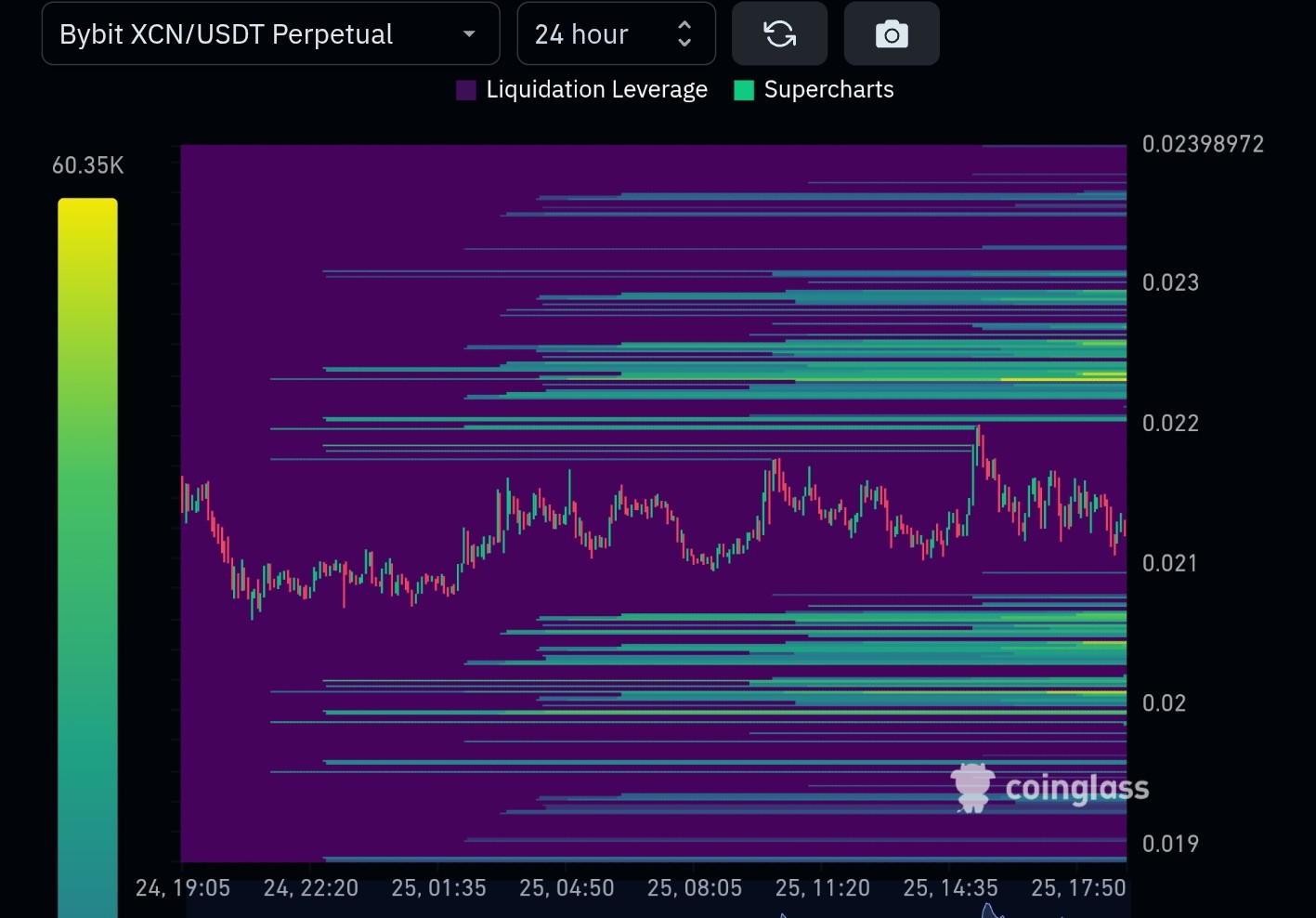

- XCN liquidation heatmap revealed high liquidity concentrations between $0.022 and $0.024. The densest liquidity was observed in the $0.0228 to $0.0232 range.

- The simultaneous increase of open interest, volume, and trade count indicated participants expected the price to continue rising.

XCN price may continue its upward trend. The volume, trade count, and open interest increase signals vigorous market activity. These factors suggest growing investor confidence.

XCN Price Stability and Market Indicators

The $0.021 price level emerged as a strong support zone for the XCN price. It held firm after the recent upward movement, reinforcing market stability.

A positive trading pattern emerged because the 9 EMA maintained a position above the 21 EMA. This confirmed that the rising price movement could continue.

The Buy&Sell indicator exhibited momentum, staying at 49.54 for sell and 65.14 for buy. Still, it remained above its central line, which indicated potential continuation of bullish movement.

The RSI maintained a position above 62.76, indicating that bullish energy had not faded. This could lead to further upward movement.

Holding above the $0.0200-$0.0202 support zone could push XCN price toward $0.025. This move would align with previous momentum levels, reinforcing the trend.

The small buy volume bars illustrating positive momentum supported a positive outlook in the market. The asset maintained consistent volume numbers at 170.79M, indicating that firm investor interest was present in the market.

A drop below $0.0201 and $0.0179 could revive seller activity in the market. This would weaken the bullish trend and shift momentum toward a bearish outlook.

If support at $0.015 failed to hold, it could cause XCN to return to a price test of that level. XCN may sustain its current structure in the market. Price reactions at the $0.0233 and $0.025 levels in upcoming sessions will influence its next move.

XCN Price Consolidation and Liquidity Dynamics

XCN/USDT pair on Bybit’s exchange showed high liquidity concentrations between $0.022 and $0.02398. The densest liquidity was observed in the $0.0228 to $0.0232 range.

The zones showed substantial potential for short liquidation, which suggested a potential price rise to activate them. Long liquidation opportunities awaited if XCN price reached the $0.020 and $0.0195 zones while showing high buying interest.

At a value of around $0.021 as of press time, XCN price held itself in a very restricted price consolidation area. The bulls could regain control after position wipes, leading the price toward reaching $0.0232 immediately.

However, the lack of momentum could push the price downwards until it reached $0.020 to maintain positions and restore leverage zones. The following price movements depended on the order of targeted liquidity zones.

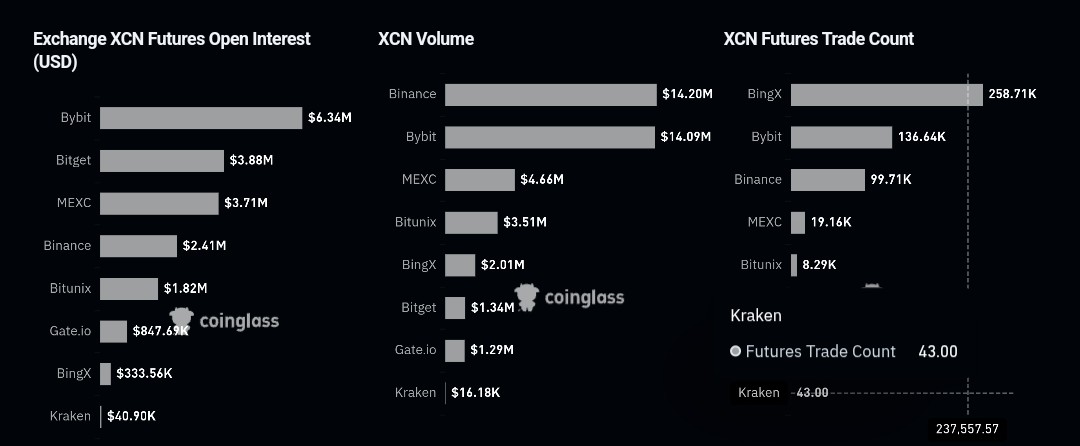

Futures OI, Volume, and Trade Count

Additionally, the derivatives market of XCN showed a significant presence from speculators. The speculative positions on Bybit reached $6.34M while Bitget held a second place with $3.88M in open interest.

Binance and Bybit controlled most of the activity with $14.20M, while Bybit generated $14.09M in trading volume. XCN futures trade count from BingX showed 258.71K trades, surpassing both Bybit at 136.64K and Binance at 99.71K.

The simultaneous increase of open interest combined with volume indicated that participants expected price movement to continue upward. High open interest levels posed a risk of market liquidations. These threats emerged whenever the market moved against prevailing positions.

Since the market was decentralized, as the moderate participation by MEXC and Bitunix suggested, it reduced the possibility of manipulation.

XCN price could continue its rising trajectory if heightened volumes were maintained above $0.021. This way, prices may experience short-term fluctuations if the number of trades diminishes.

For the next move of XCN crypto, price and volume indicators would confirm the direction, thus predictions remained neutral until that time.