Highlights:

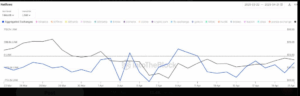

- Chainlink whale transactions surged 671% in 24 hours, moving 38.64 million LINK tokens.

- Over $120 Million worth of LINK exited centralized exchanges in the past week.

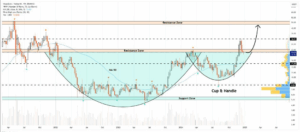

- LINK price targets are set at $30.92 and $50.50 after a breakout from the weekly cup and handle pattern.

Chainlink whales conducted an extensive 38.64 million LINK token transfer within one day, producing a 671% rise above previous large transaction rates.

Blockchain analytics firm IntoTheBlock registered this action as one of the largest LINK token movements during the recent week.

Additionally, over $120 Million worth of LINK tokens left centralized exchanges during this week, thus showing a change in investor behavior.

This could lead to an upward price movement. More so, attention has intensified on Chainlink price prediction, together with technical analysis and whale behavior, leading experts to believe an essential phase for the altcoin has begun.

Chainlink Whale Activity and Exchange Outflows

Data from IntoTheBlock reveals that the 24-hour whale transaction volume in LINK reached 38.64 million tokens, the highest in the past seven days.

The previous low for the week was around 2.31 million LINK, marking a noticeable uptick in whale engagements.

While the data does not explicitly distinguish between purchases and sales, the sheer scale of movement has captured the interest of analysts watching for price volatility triggers.

Over the past week, more than $120 Million worth of LINK has been withdrawn from exchanges, suggesting that many holders are choosing to store their assets off-platform rather than prepare for short-term selling.

Typically, when assets move away from exchanges, it indicates a reduction in available supply for trading, which could lead to upward price pressure if demand remains steady.

Chainlink’s ability to maintain higher levels of off-exchange holdings could catalyze stronger price performance.

Chainlink Price Consolidation Persists

The heightened activity of whales did not stop Chainlink from sustaining its consolidation phase.

CoinMarketCap’s current statistics show LINK at $14.96 per token, at press time. It was up 13.95% over the last seven days.

During that period, trading volume also surged by 38% to approximately $357 Million within the last 24 hours.

Notably, Chainlink attempted to sustain a rally after rebounding from a monthly low of $10.20, climbing back above $15.53 before facing resistance.

The price action has since formed a technical cup pattern over the last 30 days, indicating that LINK remains in a broader consolidation phase.

Technical Outlook Suggests Possible Breakout for Chainlink price

Additionally, technical analysis provided by market analyst Whales_Crypto_Trading emphasized that LINK is forming a falling wedge pattern on the 2-hour timeframe.

This formation, characterized by converging downward trendlines, typically precedes a breakout to the upside if buyers can overcome the descending resistance.

LINK’s price behavior around the $10.00 level has demonstrated multiple bullish rejections, indicating robust support at lower levels.

The analyst further identified key upside targets at $10.55, $10.88, and $11.24 upon a successful breakout.

A close above the 50-period moving average could provide additional confirmation for bullish momentum.

More so, the analyst noted that if the top altcoin falling wedge pattern breaks successfully, LINK price good rally even past $27.

Volume profile analysis also reveals a relatively low resistance zone above the current price. This suggests that any breakout could advance rapidly if accompanied by strong buying volume.

Critical Levels to Watch for Chainlink’s Next Move

Chainlink’s Relative Strength Index (RSI) currently hovers near the neutral zone, indicating that the altcoin is neither heavily overbought nor oversold.

This neutral RSI position leaves room for movement in either direction, contingent on market sentiment and whale behavior.

Sustained accumulation and positive exchange flow trends could favor an upward price movement towards the $20 to $25 range in the medium term.

On the downside, if LINK fails to maintain support above $13, it could face renewed selling pressure that might drive prices back toward the $10 support.

In a more optimistic outlook, Whales_Crypto_Trading projected LINK price could hit past the $50.50 mark, following a strong breakout from the weekly cup and handle pattern.

The formation of this classic bullish structure signals that Chainlink may be entering a new phase of upward momentum.

Holding above the key breakout resistance further strengthens the case for a sustained rally, with interim targets at $30.92 before aiming higher.