AVAX Price Prediction: Turning Point At $17 As Market Forces Build Behind The Scenes

Key Insights:

- AVAX rallied massively from $13 to $23, signaling that it may start a rally once it breaks above $30.

- As whales bought in the range of $29 to $31, retail traders moved out, and AVAX attracted more than $10 million in daily inflows.

- AVAX futures open interest touched $80 million, indicating increased interest in anticipation of a move towards levels above $35.

While many altcoins showed their recovery towards levels seen late in the year 2024, AVAX price prediction analysis suggested that Avalanche was on the same path.

With open interest and spot net outflows from the exchanges rising, the strong weekly AVAX prices could be backed for further increases.

AVAX Price Prediction Analysis

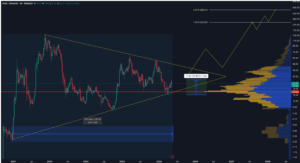

Since 2021, AVAX saw its prices squeezed into a narrow range of higher lows and lower highs, suggesting a major buildup was in progress.

Recently, the cryptocurrency saw a strong rise from $13 to $23, which amounted to a 76.86% increase. After seeing a strong jump from $17, this movement was formed near a key support area from history.

Because horizontal support met with strong volume in this area, the possibility of investor interest was high.

If prices had risen further above $30, that could have let bulls take the market to $95 and target further highs at $230.97 and $368.41.

Yet, the system was still easily upset. Slipping beneath $19.00 may have meant a move down to the support points of $9.50 and $5.10. It is the same old zone seen last year, and repeating it could reverse the current bull market.

The follow-up volume for a breakout would have matched history’s explosive moves. Alternatively, lower volume could have extended the price consolidation.

AVAX Spot Net Outflows Surge

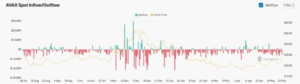

Further, a marked shift in AVAX market behavior emerged as large-scale players became more active.

A notable inflow exceeding $10 million in a single day brought activity close to levels last seen in late November, when inflows reached about $27 million.

This coincided with a sharp 116% rise in network fees over the week, suggesting increased transactional demand likely tied to institutional or large-volume investors.

Activity clustered around the $29–$31 range—an area known historically as strong resistance—hinted at strategic accumulation at these levels.

At the same time, retail traders appeared to pull back, as shown by consistent outflows from December to early February, particularly during declines below $30.

In May, prices steadied near $30, potentially setting the stage for a breakout. If buying pressure had sustained, AVAX might have moved toward $35 or even $40, which had previously acted as a high in December.

Yet, if buyers lost momentum and could not defend the $30 level, the price might retreat to lower supports near $25 or even $20, challenging the bullish outlook.

Speculation Heats Up Amid Interest Hike

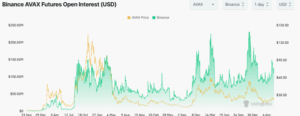

Moreover, there has been growing speculation in AVAX, with the open interest on Binance futures reaching past $80 million while the price was just over $30.

Reaching this level reminded of the market a few weeks ago, when AVAX was close to $55 and open interest crossed $200 million.

When the overextension happened, a sharp correction followed. In late December and mid-March, the open interest above $90 million was followed by big drops in the price.

If price and interest went up and AVAX reached the $35 resistance, the rally could have faced big downswings linked to too many bullish positions.

Yet, if the increase went on without dropping, it could reflect serious confidence and open the door for $35 to be exceeded, as $40 and $45 were waiting above.

The difference between the increasing interest in futures and the slow prices made traders believe a big move was possible, but it was not clear which way it would go.