Bitcoin Price Faces $200M Sell Wall at $113K — Will It Top Out?

Key Insights

- Bitcoin price reached a new all-time high of $111,861 before a slight pullback to $110,683

- Spot Bitcoin ETFs see $609M in inflows, with BlackRock adding $530M in a single day.

- Sell wall near $113K with $200M in orders may limit short-term price breakout.

Bitcoin (BTC) price is currently $110,683, which is a 4.11% increase on the day. The 24-hour trading volume has gone up 74.3% to $218.33 billion, thanks to both retail and institutional investors. The current rise is happening as people around the world pay more attention during Bitcoin Pizza Day.

On May 22, 2025, Bitcoin set a new record at $111,861.22, but it dropped 0.95% afterwards. Nevertheless, price is now being held back by resistance at $111,000 to $113,200, with nearly $200 million in sell orders lined up.

Bitcoin Price Tests New Highs While Sell Pressure Builds

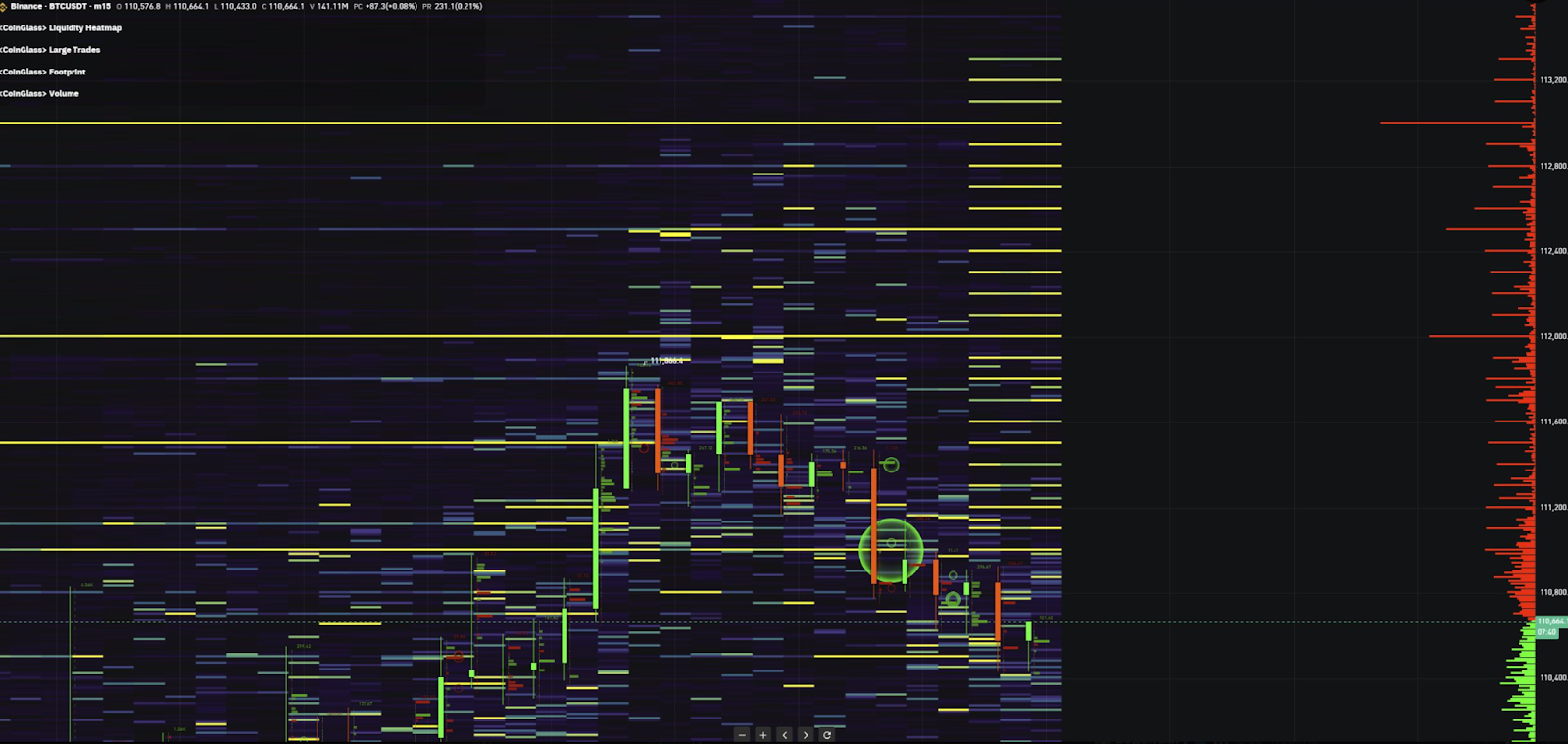

Bitcoin achieved a new record high of $111,861 during early trading on May 22, its first time ever above $111,000. According to CoinGlass, the current price ranges from $111,000 to $113,200 is experiencing significant selling pressure.

For every $100 rise in the price, there are roughly $8 million in sell orders which build up to a total sell wall of $200 million.

It will be difficult for market participants to move beyond this range unless spot buying increases. If there are many large passive sell orders, they could cause a temporary top in the market unless institutions or market makers take them.

Record ETF Flows and Fresh Highs Support Bullish Structure

But a break higher might be possible as around $609 million was added to spot Bitcoin ETFs on Wednesday due to rising interest in Bitcoin’s recent surge.

On May 21, BlackRock purchased $530 million of BTC for its iShares Bitcoin, according to data from SoSoValue. The increase in inflows helped push BTC to its highest levels yet.

Glassnode Bitcoin’s realized cap also reached a new high of $911.5 billion, along with a market cap of $2.17 trillion.

The rise in new inflows proves that institutions are demanding more Bitcoin and that funds are accumulating Bitcoin at higher rates. This demonstrates that the market is confident even as prices get close to resistance areas.

Bitcoin’s realized cap went from $1 million to $1 billion in just two years, from 2011 to 2013, according to historical chart data. Still, it took six years to move from $100 billion to $1 trillion. This means the asset class is maturing, so more money is needed to help prices rise gradually.

Cycle Psychology and Long-Term Behavior Point to Ongoing Trend

Meanwhile, a Bitcoin price chart over a long period suggests that we may be entering the “Thrill” phase of the market cycle.

This pattern builds on the earlier periods of doubt, hope, optimism and belief which Bitcoin has just finished. Should the current trend continue, the price could head toward “Euphoria” in the next phase.

Recent BTC performance and the way people think about its price are both reflected in the market cycle chart.

Many traders are now thinking that the rally can continue, even after it has reached new highs. Although these cycles cannot always be repeated, they help see how buyers are feeling.

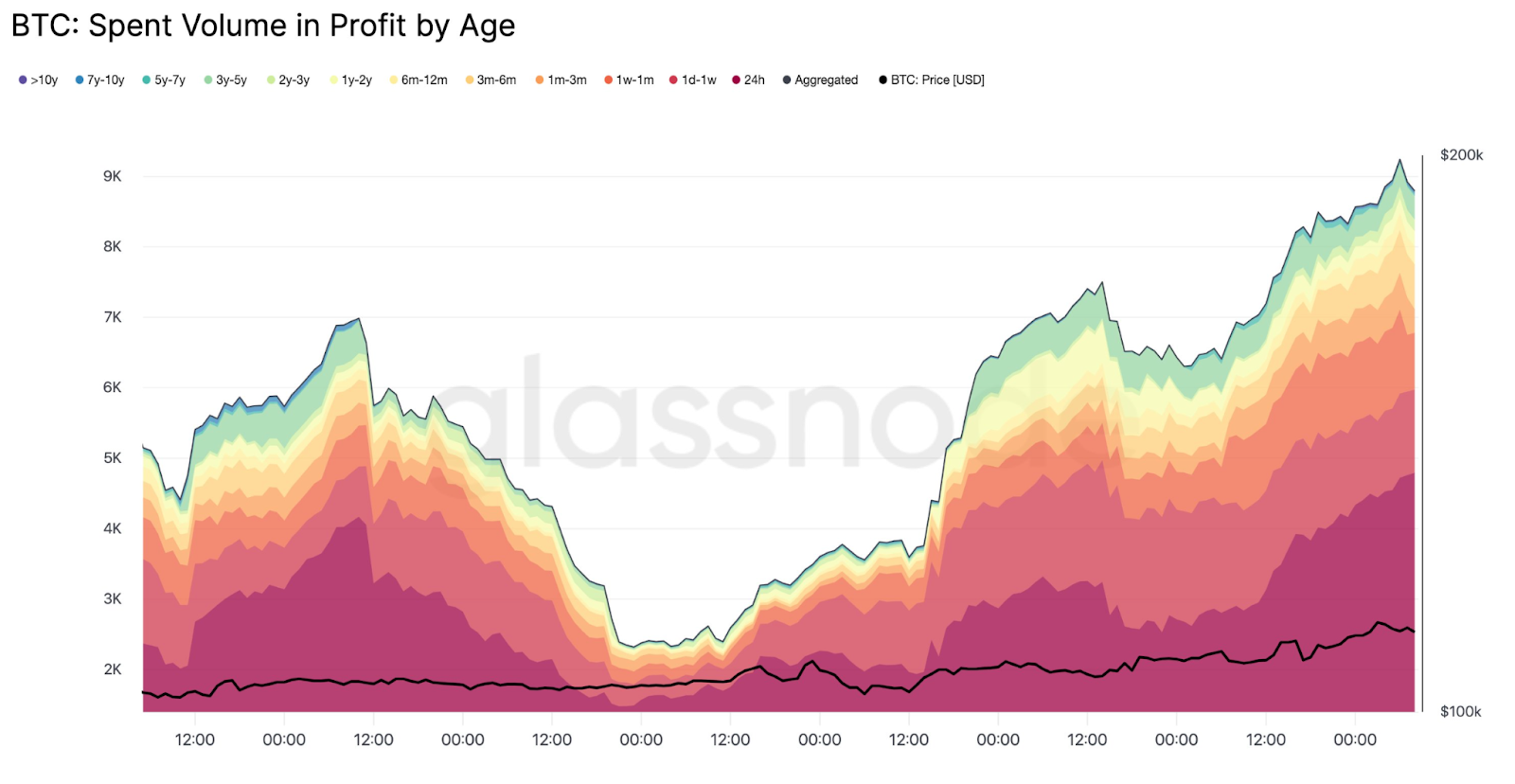

What’s happening on the blockchain also supports this. According to Glassnode, coins that are less than a month old now make up 76.9% of all activity, compared to 44.6% in December 2024.

Meanwhile, coins that are more than six months old have declined to 13.4% from 24.7%. The fact that long-term holders aren’t selling their coins implies they believe the price will rise further.

Social Attention Remains Low Despite Price Surge

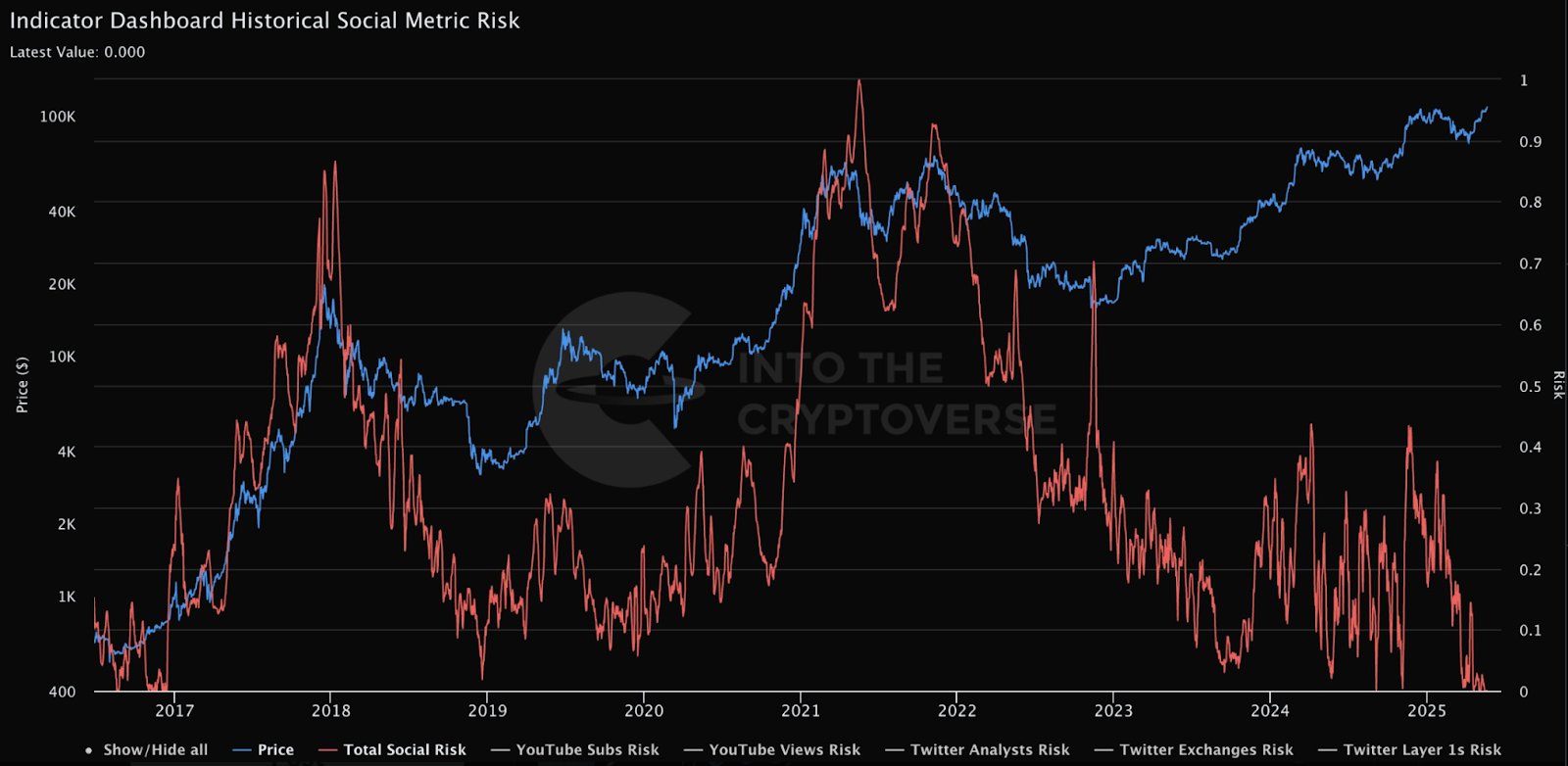

Even though Bitcoin reached its highest price ever this week, there is very little chatter on social media about it.

According to IntoTheCryptoverse, social risk is now at its lowest point in many years. YouTube and Twitter are examples of platforms that usually see increased engagement when big moves happen.

In the past, BTC has reached its highest prices when social interest was high, not low. The silence in the market could suggest that institutions are leading this rally, not retail traders.

If the market price is not reacting strongly to retail talk, it may not be as overheated as some think.

This trend is significant since it often happens when people buy on emotion. These days, people are less likely to make emotional decisions in front of others.