Brett Coin Price Prediction: Can Wedge Breakout Signal a Rally to $0.3?

Key Insights:

- BRETT coin forms a falling wedge; breakout above $0.08 may signal a rally toward $0.30 based on pattern projection.

- Over 800,000 holders support BRETT despite a 30% drop from its $0.10 high, showing strong community backing.

- Long liquidations peaked at $600K in late May, indicating a market reset and potential for new upward momentum.

BRETT coin, a meme-based cryptocurrency on the Base network, is attracting attention after a wedge pattern formed on its daily chart. This comes after the coin’s recent correction from its all-time high near $0.10.

Technical traders are closely watching for a breakout from this consolidation. With rising interest in meme coins and renewed buying activity, BRETT’s next move could shape short-term sentiment.

Current Market Showing a Drop in the Brett Coin Price

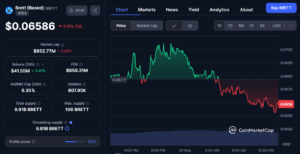

BRETT coin was trading near $0.05 at the time of writing, down over 30% from its recent peak above $0.095. The token saw heavy retail participation during its rally in April and May. Since then, price has been moving sideways within a narrowing wedge formation, suggesting reduced volatility and trader indecision.

Trading volume has dropped from its peak levels, indicating that most traders are waiting for a confirmed move.

CoinMarketCap data shows the daily volume remains healthy relative to the market cap. BRETT’s market cap stands above $650 million, with over 9.9 billion tokens in circulation.

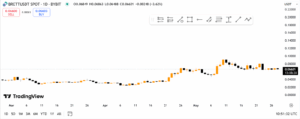

The wedge structure is supported by converging trendlines, with lower highs and higher lows forming. This compression often results in a breakout, and traders are watching for confirmation on the daily chart. A move above the upper trendline could trigger increased buying.

The wedge pattern developed over the past two weeks is commonly interpreted as a continuation formation. Before the wedge, BRETT rallied strongly from $0.025 to $0.095 in less than 30 days. After such parabolic gains, price correction and consolidation are common across similar assets.

More charts show support forming around $0.060 and resistance near $0.075. Price is now nearing the upper boundary of the wedge.

A breakout above this trendline with strong volume could push the token to retest previous highs. The projected move, based on the prior trend, could reach the $0.265–$0.30 range if momentum holds.

Volume remains a key factor. Declining volume within the wedge supports the bullish scenario, but a volume increase must accompany a breakout. Without this, the breakout may fail and lead to further consolidation or downside.

Liquidation Data Showing Increasing Long Positions on Brett Coin

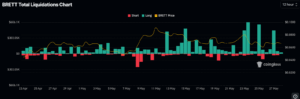

CoinGlass liquidation data from the last week shows that a large number of long positions were closed near the $0.08 price level. This suggests many traders were overexposed at the top and were forced to sell as the price dropped. This phase has likely removed weak hands and leveraged positions from the market.

Short liquidations have remained minimal, which shows there hasn’t been a strong reversal to squeeze bearish traders yet. If price breaks out from the wedge with volume, a short squeeze could help accelerate the move. This is common in meme coins where sentiment can shift quickly.

Volume analysis shows that buyers are stepping in near $0.065. However, the lack of sustained buying pressure has kept the price below the $0.07 resistance zone. Analysts are watching for open interest to increase as a potential sign that traders are positioning for a breakout.

Future Price Targets and Support Zones

If BRETT breaks above $0.075, the upcoming targets for the price are $0.10 and $0.12. Such levels are drawn from existing highs and the Fibonacci series. If it starts to build up, the price may rally toward $0.265–$0.30. I use the prior move’s height to project what the breakout point should be.

However, if the price falls below the lower wedge support, bearish targets are found at $0.060 and $0.050. Buying started in these zones before the last major decline. Watching the market is $0.055, which was the foundation for the previous run to $0.10.

It appears that a choice will need to be made. The attitudes of investors toward the whole crypto market. Monitoring the amount traded, when trendlines are broken, and the funding value is important for an early indicator of direction.