Cardano Price Prediction: Will ADA Break $0.640 Resistance Or Pull Back?

Key Insights:

- Cardano price showed a strong bounce from the BOS at $0.6310 which was up about +6%.

- Cardano reclaimed the $23B market cap level.

- Negative market sentiment for ADA from both the crowd and smart money.

Just like other cryptocurrencies, Cardano also relief after the easing of U.S. tariffs with the prediction citing of potential rally if the momentum could be maintained.

Cardano Price Prediction

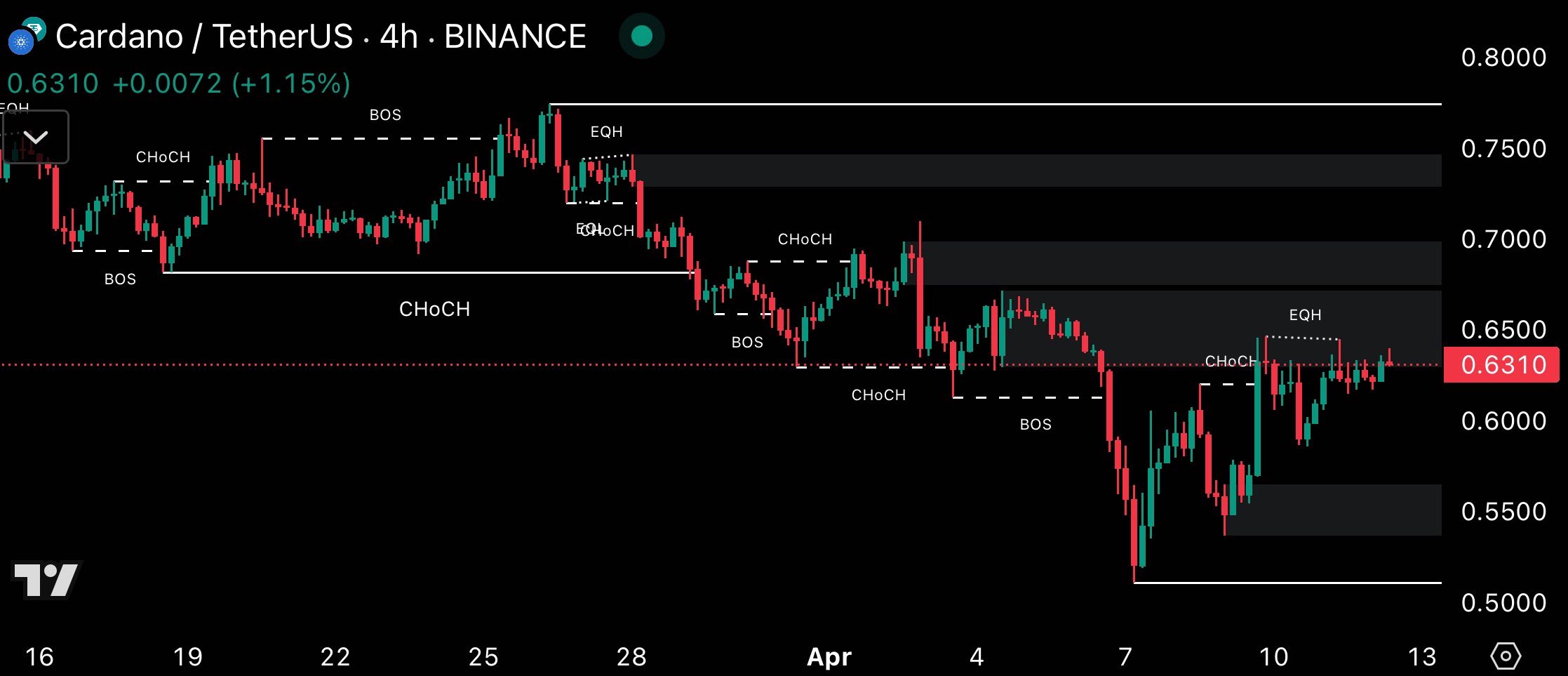

Cardano price prediction based on the 4-hour chart showed multiple essential features emerging.

Market momentum shifted based on the succession of Break of Structure (BoS) and Change of Character (CHoCH) price action patterns.

A break of structure pattern first suggested upward movement until it became obsolete when a Change of Character emerged, suggesting reversal patterns.

The price declined further before setting a new BoS lower structure.

ADA then started a major descent that took it beneath $0.6000 before reaching its low of $0.5000.

A BoS followed by a CHoCH pattern emerged after which a possibility of upward market movement became evident.

The price settled into a potential demand area that developed near $0.5500.

The exchange rate developed a powerful upward reaction at $0.6310 BoS support and maintained its position at $0.6310 while rising by 1.15%.

The price movement indicates potential new bullish power which could sustain for a short period. Major resistance appeared at $0.6500 with an identified Equal High designation.

The price may aim for the $0.7000 level and $0.7500 EQH resistances if it crosses the $0.6500 barrier.

Failure to raise momentum would send the price beneath $0.6310 BOS to potentially reach either the $0.5500 demand zone or descend to a 0.5000 low.

Two equal high points with liquidity grab potential can be found in each direction.

Price movements in this period showed strong resistance levels and supportive areas leading market changes.

Cardano Reclaims $23B Market Cap

The market capitalization of ADA surpassed $23 Billion after successfully recovering from its previous loss.

Cardano’s market value rose to $23.29 Billion following its price reaching $0.6188 as of press time which showed a substantial 3.67% daily drop.

Market capitalization has increased to $21.87 Billion because of this positive trend demonstrating new investor trustwaves.

The value of Cardano according to its fully diluted valuation (FDV) has increased to $29.71 Billion.

Trading volume had reached $699.93 Million since it decreased by 10.03% over the last 24 hours.

The ratio between trading volume and market capitalization stands at 3.2% even though total transaction volume decreased.

The maximum sustainable supply of ADA is set at 45 billion while the maximum possible quantity reaches 44.99 billion.

Meanwhile, the number of ADA coins circulating in the market stood at 35.28 billion.

The remarkable price rise during this previous day has been the direct cause of reaching this significant milestone.

The present market evaluation of Cardano indicated its profile score was marked 75% which suggested steady momentum in the market.

Cardano has reached a notable achievement through its successful recovery of the $23 Billion market cap.

Cardano’s Crowd v Smart Money Sentiment

The present sentiment analysis showed ADA had generated negative forecast patterns based on data from both crowd and smart money sources.

The bearish stance between these two groups exists at very different intensity levels.

The crowd sentiment indicator demonstrated a value of -1.42 at this time.

ADA possessed a lower value indicating stronger negative expectations about future price movements from general market participants.

The Smart money sentiment indicator amounted to -0.43 at the time of writing.

This group expects a price decline but their expectations are not as strong compared to those of the overall market participants.

The conflicting outlooks between short-term crowd-based price movements and longer-term smart money expectations imply future market volatility and possible misalignment of price dynamics.