Chainlink Price Prediction: LINK Eyes Breakout As Liquidation Pressure Rises

Key Insights:

- Chainlink price rose from the $12.00 zone to $14.53, with a 5.83% increase.

- Between $13 and $15, the LINK faced a strong selling force which resulted to liquidation.

- Chainlink CCIP helped Hong Kong’s CBDC (e-HKD) to be exchanged with the Australian stablecoin A$DC.

Chainlink price prediction pointed to a potential breakout amid the rising liquidation pressure for the traders who went short on LINK.

The rising liquidation pressure on sales was as result of the broader market recovery in cryptocurrency space.

Chainlink Price Prediction Analysis

Chainlink price prediction showed LINK gained new confidence by rising from the $12.00 zone to end the week at $14.53, with a 5.83% increase.

The chart showed that share trading stayed between $5.50 and $9.50 until it sprang and broke out above $17.94.

Nevertheless, the value went back down and is now forming a downtrend that it appears to be testing once more.

It seemed that the recent pattern could turn out to be an inverse head and shoulders formation. If LINK is above $17.94, it might end the downtrend and indicate that the trend will continue upwards.

A protracted rise above that point may push the price to test the next resistance at $27.09. If it’s breached, cash worth $30.84 can be got easily.

Should the trend improve even more, the area around $52.99 might become a target for the long run.

Alternatively, if LINK is not able to surpass the $17.94 level, it could revisit the $12 area or go back to $10. For now, the downtrend line is a big challenge for bulls.

It is important for traders to observe $17.94 to confirm a possible breakout and $12 as the supportive floor. With the background events and easy to recognize levels, the market seemed ready for even bigger movements.

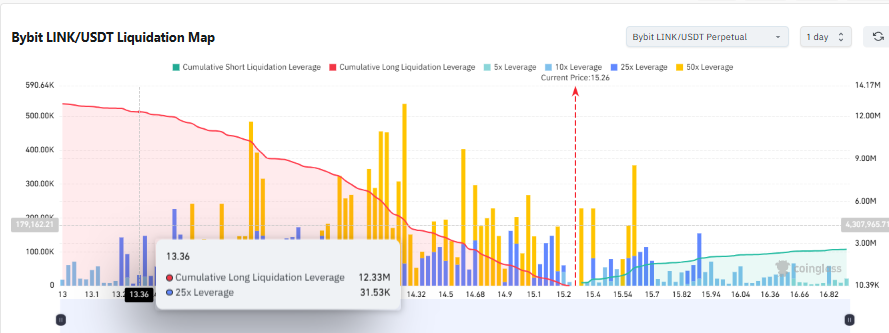

Chainlink Price Prediction Using Liquidation Map

More analysis on Chainlink price prediction showed between $13.00 and $15.00, the market faced a strong selling force. This situation could result in many long liquidations.

At the time of writing, approximately 12.33 million positions were at risk. This was mainly due to 1.27 million contracts with 31.53K times leverage.

With the price at$15.26, it meant that many traders with high metal exposure were just a slight increase away from serious trouble.

The good news was that cumulative short liquidations were on a slow rise above $15.40 and featured sizeable 5x and 10x leverage around $15.50–$15.70.

A break below $14.30 could bring about a massive wave of liquidations from traders. Though, if Chainlink keeps rising, it could push short positions positioned above $15.40 out of the market.

It seems that close to the existing price, the market would continue to be close until leveraged positions are exited.

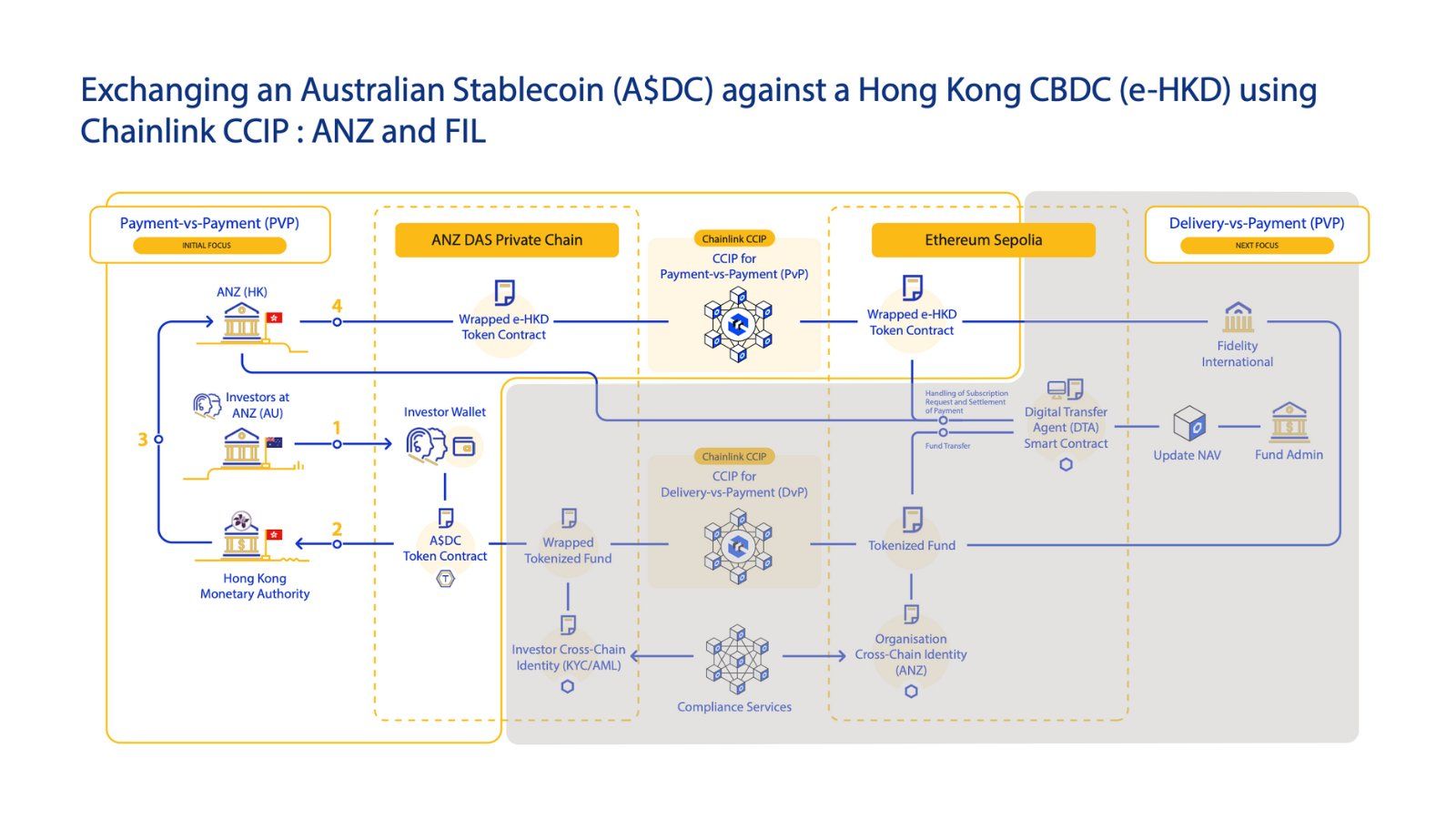

Using Chainlink CCIP On CBDC

Worth noting, using Chainlink CCIP became possible for Hong Kong’s CBDC (e-HKD) to be exchanged with the Australian stablecoin A$DC.

Chainlink’s capability to work with other systems helped carry out the PvP mechanism during Phase 2 of the program.

At ANZ (Australia), speculators got tokenized tokens for Australian dollars called A$DC, whereas the Hong Kong Money related Specialist discharged e-HKD.

The resources were moved from one put to another and wrapped, utilizing Chainlink CCIP and Ethereum Sepolia for dealing with.

Chainlink made it conceivable to exchange tokenized stores utilizing DvP, with the assistance of a Computerized Exchange Specialist keen contract run by Devotion.

The compliance and personality confirmation assignments were done in any case of the blockchain utilized by the members.

The setup got rid of middlemen, improved the way settlements were managed, and made finance more programmable.

By having Visa, China AMC, and Fidelity, Chainlink was supported by many institutions and may play a key role in making CBDCs and stablecoins work across the world’s financial markets