Dogecoin Price Prediction: DOGE Maintains Support As $0.21 Emerges As Key Buy Zone

- Dogecoin price prediction holds key support near $0.21, tested multiple times with strong trading volume confirming buyer interest.

- RSI nears oversold at 30, signaling possible pause in selling; MACD shows bearish momentum with potential reversal signs.

- Short liquidations exceed longs, suggesting forced short covering may create upward pressure around Dogecoin’s $0.21 support.

Dogecoin fell slightly below its trendline support at $0.21, which is becoming an important spot for traders to buy. Transferring price movements in recent days haven’t seemed to affect the crypto’s performance, suggesting it can serve as a base for further movements.

People participating in the market are watching volume and prices carefully as Dogecoin closes in on the threshold with more trading going on.

Current Dogecoin Price Action and Market Movement

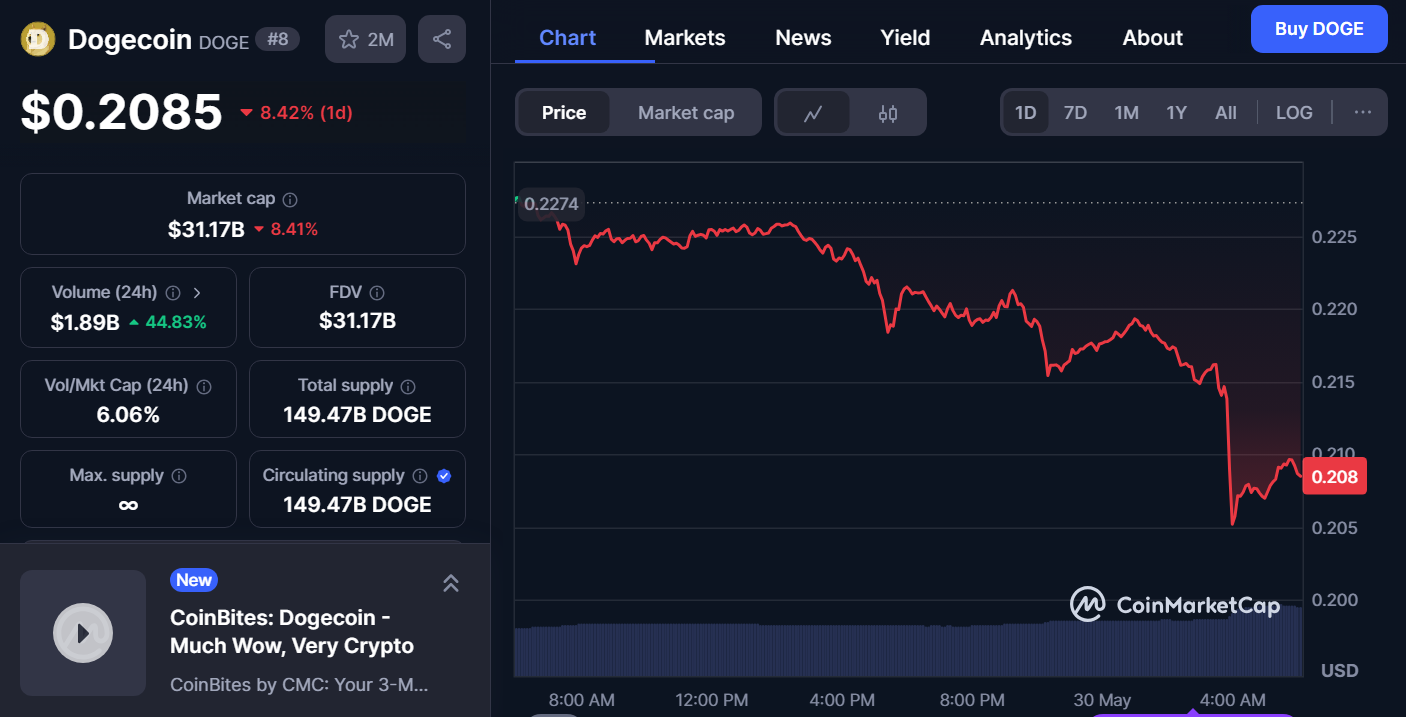

While writing, DOGE was trading just above $0.2, slightly lower than its recent highs near $0.24. Prices have been able to hold at the trendline, making it crucial for the market’s immediate stability, say analysts. Even after the dip in price, interest in trading remains high.

In the last 24 hours, DOGE dropped around 8% and more sellers contributed to its fall close to $0.20 to $0.21. Both buyers and sellers are making efforts to achieve balance close to this important price level.

As prices fall, the number of trades can increase, letting active traders be spotted, but that does not indicate support is gone. Traders of options should look to see whether the price remains at $0.21 or falls beneath it.

Technical Indicators Reflect Bearish Momentum With Possible Rebound

The MACD and RSI are currently displaying an atmosphere favoring a bearish market. MACD remains lower than the signal line and this pattern is reinforced by the falling histogram. It is clear that these factors support the recent fall in prices.

But the RSI is getting close to 30, so it could indicate that buyers might soon reduce their activity. Still, it predicts that either prices team up or begin to rise even if there is no immediate turnaround.

Those following the market closely are reviewing these indicators to decide if Dogecoin’s price will rise or sink further. For a bullish signal, you need to see the price move and stay above the trendline.

Volume Trends Support Active Market Participation

In the past 24 hours, more than $1.8 billion worth of Dogecoin has been traded. The price fluctuations we’ve seen recently mean more people are getting into trading. A lot of trading activity tends to happen when support areas see increased volume.

The fact that this ratio exceeds 6% points to somewhat low circulating volumes in the market, if we compare it to Dogecoin’s market cap.

The degree of trading at this level is sufficient, thanks to the steady price movements caused by enough liquidity.

Open interest in derivatives for Dogecoin is also fluctuating, as options volume and open interest go up. Since there is lots of hedging and speculating within this price range, the market’s short-term direction is said to become more uncertain.

Key Support Levels and Market Outlook on the Dogecoin Price

Dogecoin is now finding support at $0.21. Should prices not budge, this situation could result in stronger prices later. A price drop under the trendline could bring more selling and a check at the $0.20 support area.

Traders are closely watching how Dogecoin responds near the trendline, hoping for additional buying or a price move above it. This level also matches where buying interest was heavier on the last upswing.

Those involved in the market should look for signals by closely examining the next price bar and changes in trading volume, since these give a clearer view of Dogecoin’s near-term movements. For anyone looking to get in on Ethereum, securing the $0.21 level matters a lot.