ETH Price Prediction: Can It Surpass $2800 As Price Mirrors 2017 Pattern?

Key Insights:

- Ethereum formed a falling wedge, suggesting a reversal after this decline.

- ETH/BTC valuation is now structured in much the same way as in 2017.

- Coinbase Prime recently transferred 3.33K ETH worth $8.65 million to BlackRock.

Ethereum (ETH) price prediction shows that ETH could be set for another surge after a recovery that sent the crypto back above $2000 following an extended downtrend that had reigned since 2024.

That way, ETH price and blockchain activity suggested price could be set for more uptrend. Here is why;

ETH Price Prediction Analysis

ETH price formed a falling wedge on the 12-hour chart, suggesting that the price could move higher after a decline.

Although it reached its peak at $2,750, ETH started making lower highs and lows, which moved it between two downward-sloping lines.

After the price fell under the wedge support level, it tested $2,365, closing at $2,375.51 and falling by 4.90%.

ETH may attempt to rise much higher, hitting the barrier at $2,700, if it bounces back to the wedge and breaks through the $2,500 zone.

In case the recovery does not happen, the situation could get more serious. Should ETH break below the pattern, its price might head lower to support at $2,250 or even down to $2,100.

The overall trading activity was low, hinting that the breakout had not been strong so far. If trading volume is higher around the wedge boundary, bears could end up losing and bulls gaining control.

The formation of a falling wedge hinted that the pressure was almost using up its power, and ETH could rise from that. Still, if price fails to push past $2,500, bears cannot be ruled out in the next few days.

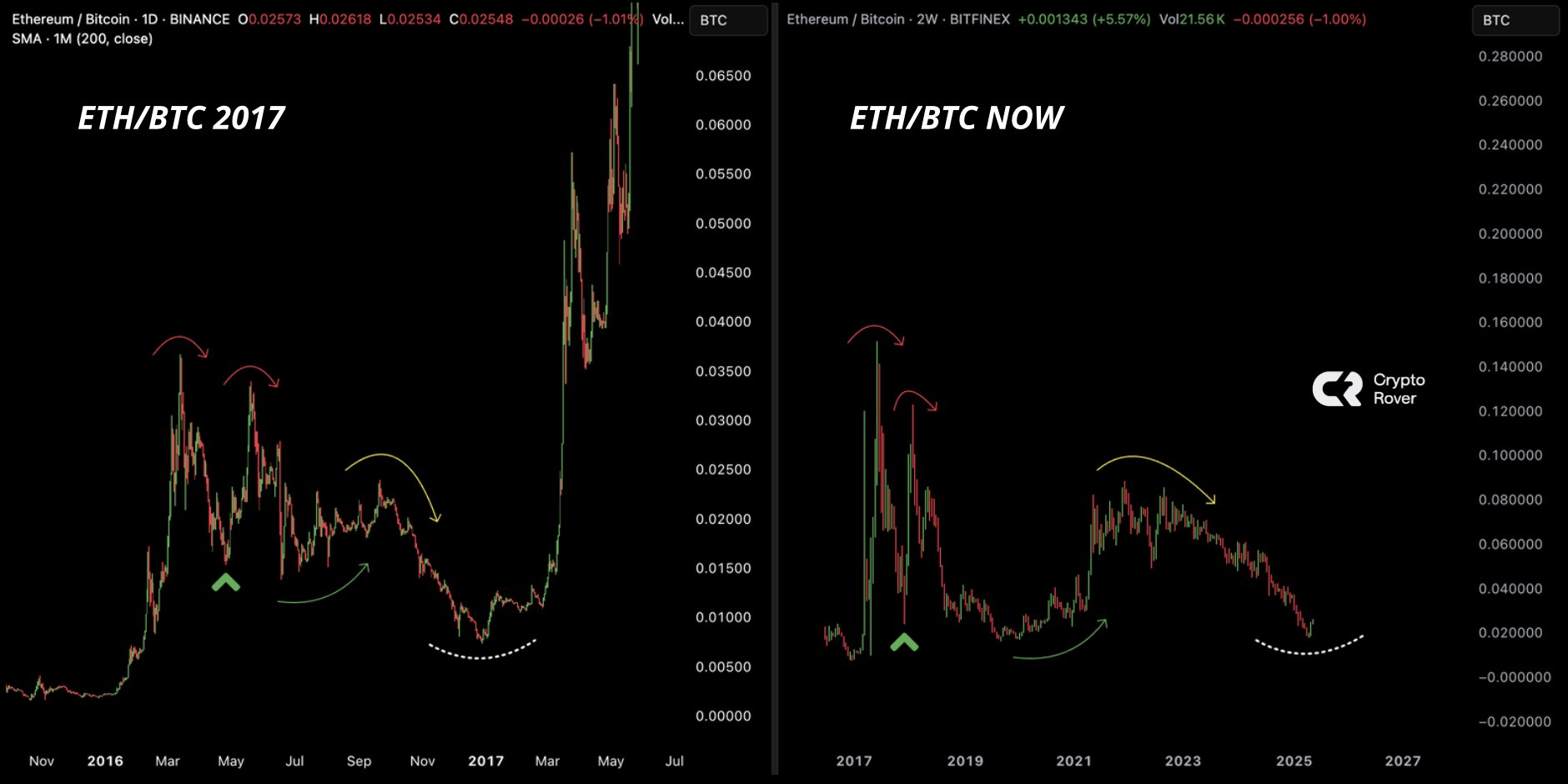

ETH Price Mirrors 2017 Pattern

As of press time, the prices in 2017 were structured in much the same way. In 2017, ETH reached a double top of 0.035 and 0.04 BTC, corrected down to 0.015 BTC, then started a sharp rise that brought ETH to 0.065 BTC.

Currently, ETH-per-BTC reached 0.085 BTC twice in 2021, then headed into a noticeable downturn. Additionally, it stood near 0.025 BTC, exactly where the big surge in 2017 started.

The key feature of both periods was high peaks, slight peaks, and notable corrections. Since history tends to repeat, ETH could be at the low point now, preparing for a recovery.

A price higher than 0.035 BTC may encourage the bitcoin price to rise to the range of 0.045–0.065 BTC. Still, ETH can fall to 0.015 BTC once again if 0.020 BTC is not supported.

Though the charts appeared fundamentally the same, confirmation that it’s a fractal would require a clear breakout.

At the time, the resemblance was based on history, while the actual outcome relied on the power of the market and how much Bitcoin controlled it.

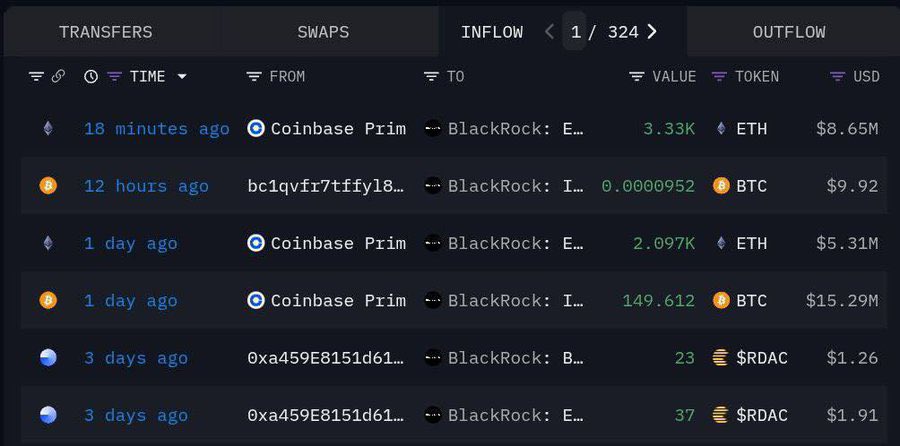

BlackRock Buying Ethereum from Coinbase

Meanwhile, inflow data from the blockchain showed Coinbase Prime recently transferred 3.33K ETH worth $8.65 million to BlackRock.

The latest transaction was one of several as institutions continue building their Ethereum holdings, with another 2.097K ETH worth $5.31 million transferred from Coinbase to BlackRock on the same day.

Within 24 hours, the two ETH inflows added up to almost $14 million. When big orders for ETH come from Coinbase Prime, the market often sees price stability or a rise in the price of ETH.

It is common for such investment funds to reduce their exchange activity, suggesting the money was meant for long-term storage.

But just because ETH is bought in large amounts doesn’t mean it always increases in price; if the market weakens, heavy investments could fail to support ETH.

In the short run, these trades can keep ETH’s price within the range.

Although optimism exists, past records reveal that the direction of Ethereum is determined largely by what happens in the market and the amount of activity in the cryptocurrency.