Ethereum Exchange Reserves Hit New Low As ETF Inflows Surge To $285M

Key Insights

- Ethereum ETFs recorded $285M in inflows last week, showing growing institutional demand amid market consolidation.

- Exchange reserves hit a new low, signaling a potential supply shock as fewer ETH tokens remain available for trading.

- Network activity surges with 17.4M active addresses and new yearly highs in daily transactions recorded in 2025

ETF inflows have jumped to $285 million in the past week. Ethereum is displaying strong on-chain and institutional strength. At the same time, exchange reserves hit a new all-time low, indicating rising demand and decreasing liquidity.

These shifts fuel the expectations of a breakout. The cryptocurrency is consolidating near key resistance. However, several metrics suggest that the pressure is building and could soon catalyze a strong directional move.

Institutional Inflows Climb as ETF Demand Surges

Last week, Ethereum-based ETFs saw net inflows of $285.8 million, a sign of increasing institutional appetite. BlackRock, Fidelity, and others reported consistent daily inflows from May 20 to May 30. In particular, listed funds added $70.2 million in net on May 30 alone.

Aggregate data remains positive, despite minor outflows from Grayscale’s ETH fund. New flows show capital rotates to lower-fee ETFs like BlackRock’s and Bitwise’s. This trend indicates that investors increasingly prefer efficient access to ETH exposure.

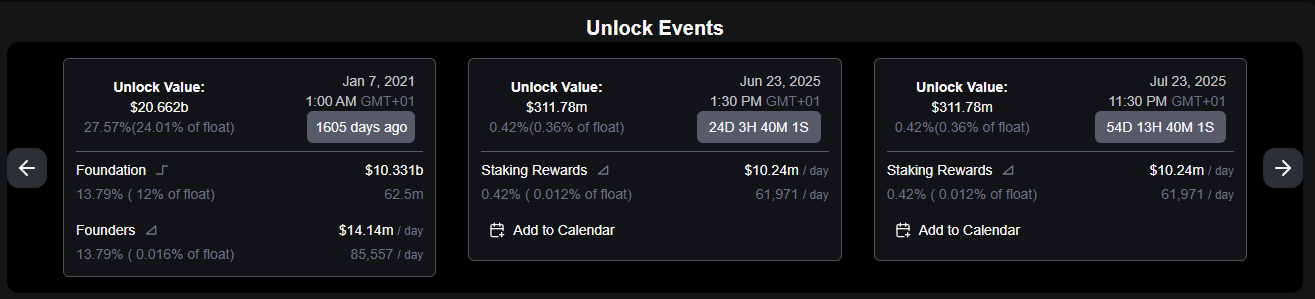

ETF accumulation decreases the supply for sale and moves ETH off exchanges and into institutional custody. The broader reduction in exchange reserves could support upward price momentum alongside this.

Exchange Reserves Drop to Multi-Year Lows

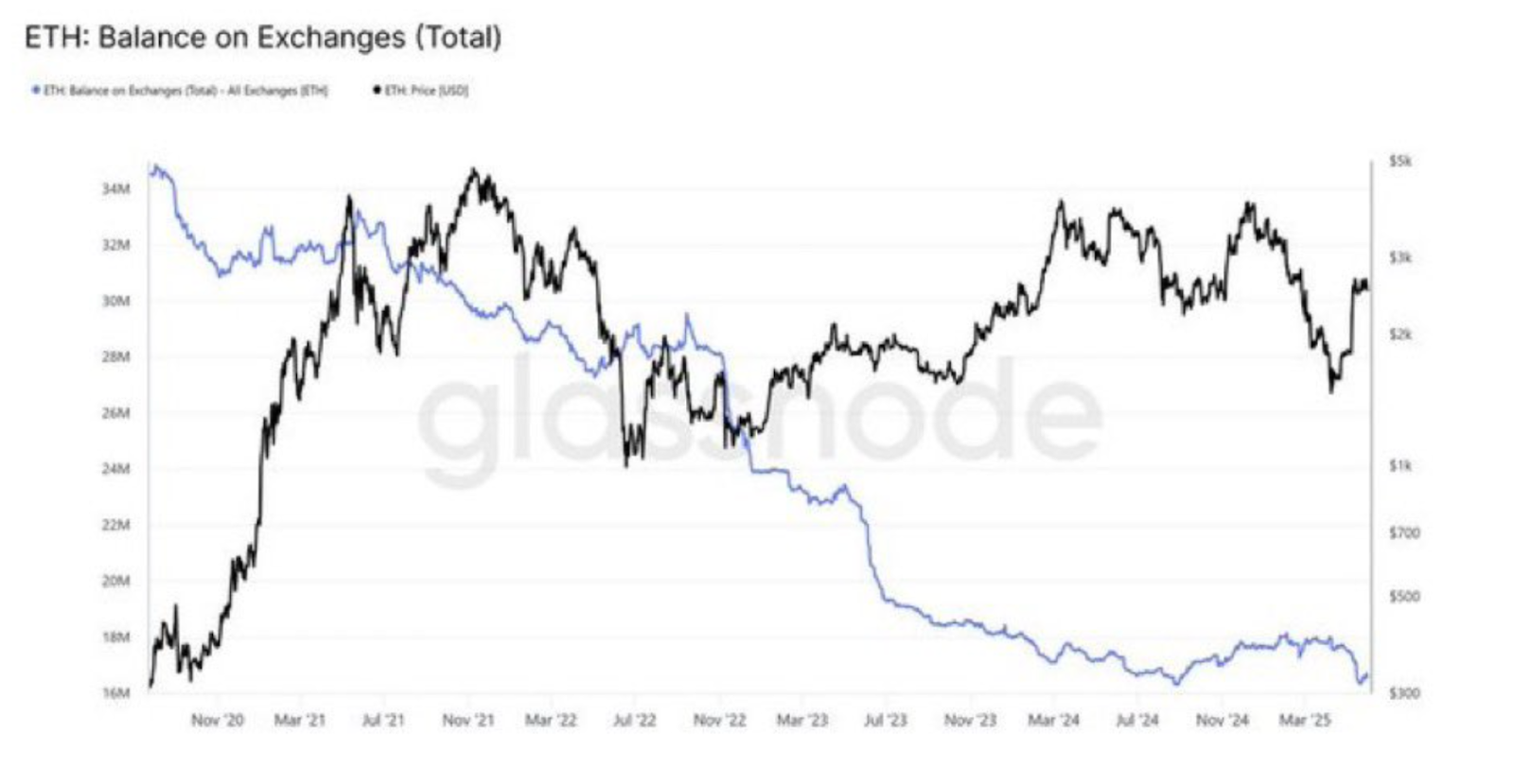

Meanwhile, Ethereum balances on exchanges are at their lowest point since 2018, according to Glassnode data. Since late 2020, the total supply held on centralized platforms has steadily decreased.

This trend has been gaining momentum lately. It suggests the token is transferred to cold storage or used for staking.

Rising inflows to ETFs and institutional products coincide with the sharp decline in available trading supply. ETH is more of an investment than a currency to be sold. This is a potential supply shock if demand keeps rising.

On-chain analysts warn that shrinking reserves during demand spikes cause fast price repricing. With fewer sellers left, buyers must pay more to get the supply. That dynamic could explain Ethereum’s recent resilience despite broader market indecision.

Also, the fewer exchange-held tokens there are, the better the investor sentiment. This is reducing speculative pressure and increasing holders’ positioning for longer-term upside. This also helps with reduced volatility, as aggressive sell-offs are less likely during supply squeezes.

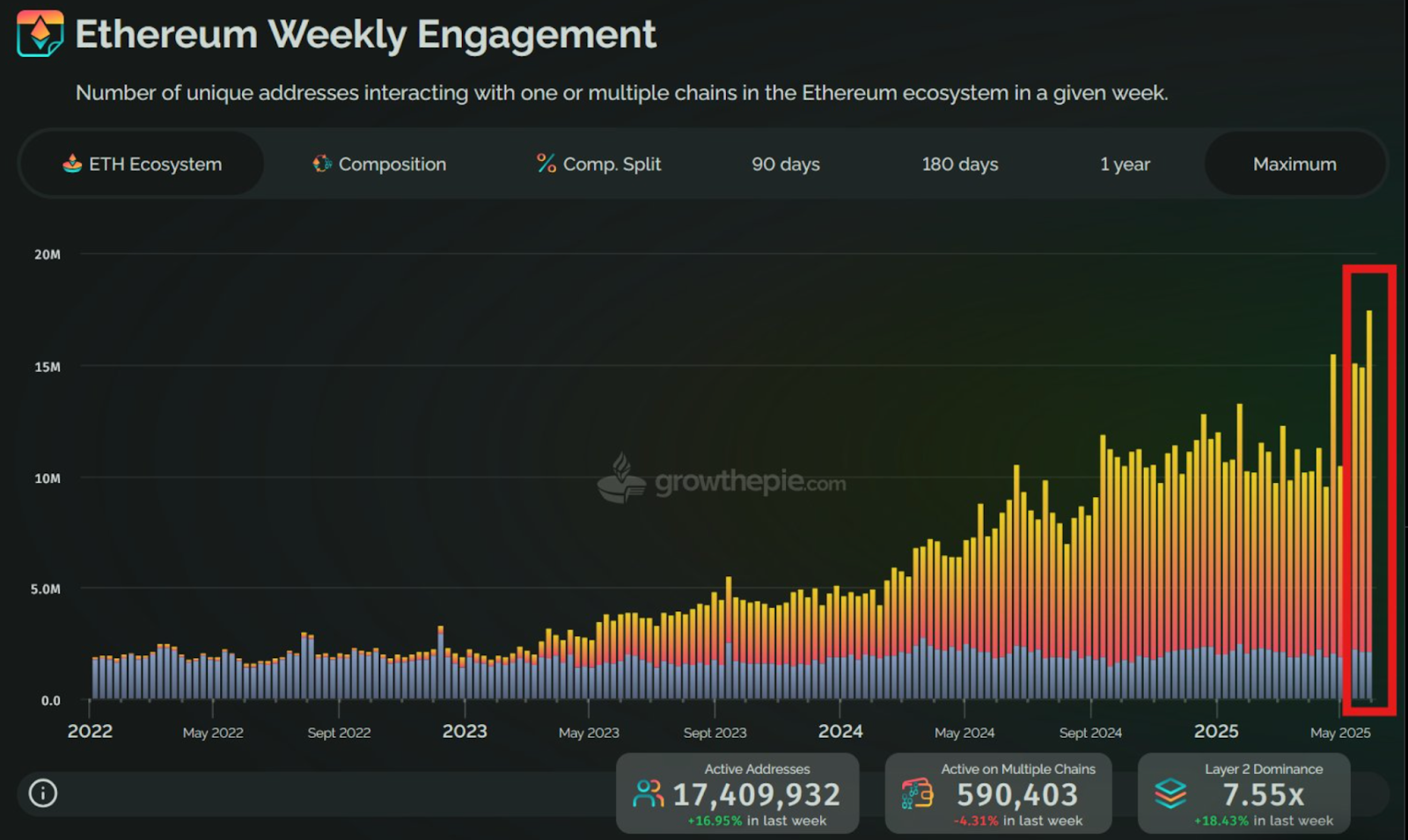

Ecosystem Strengthens as Activity Hits New Highs

Ethereum ecosystem is also surging, with weekly active addresses hitting a record 17.4 million. Rollups and scaling layers now dominate L2 usage over L1 with a 7.55x engagement ratio. On top of that, more than 590,000 addresses interact with multiple L2s every week.

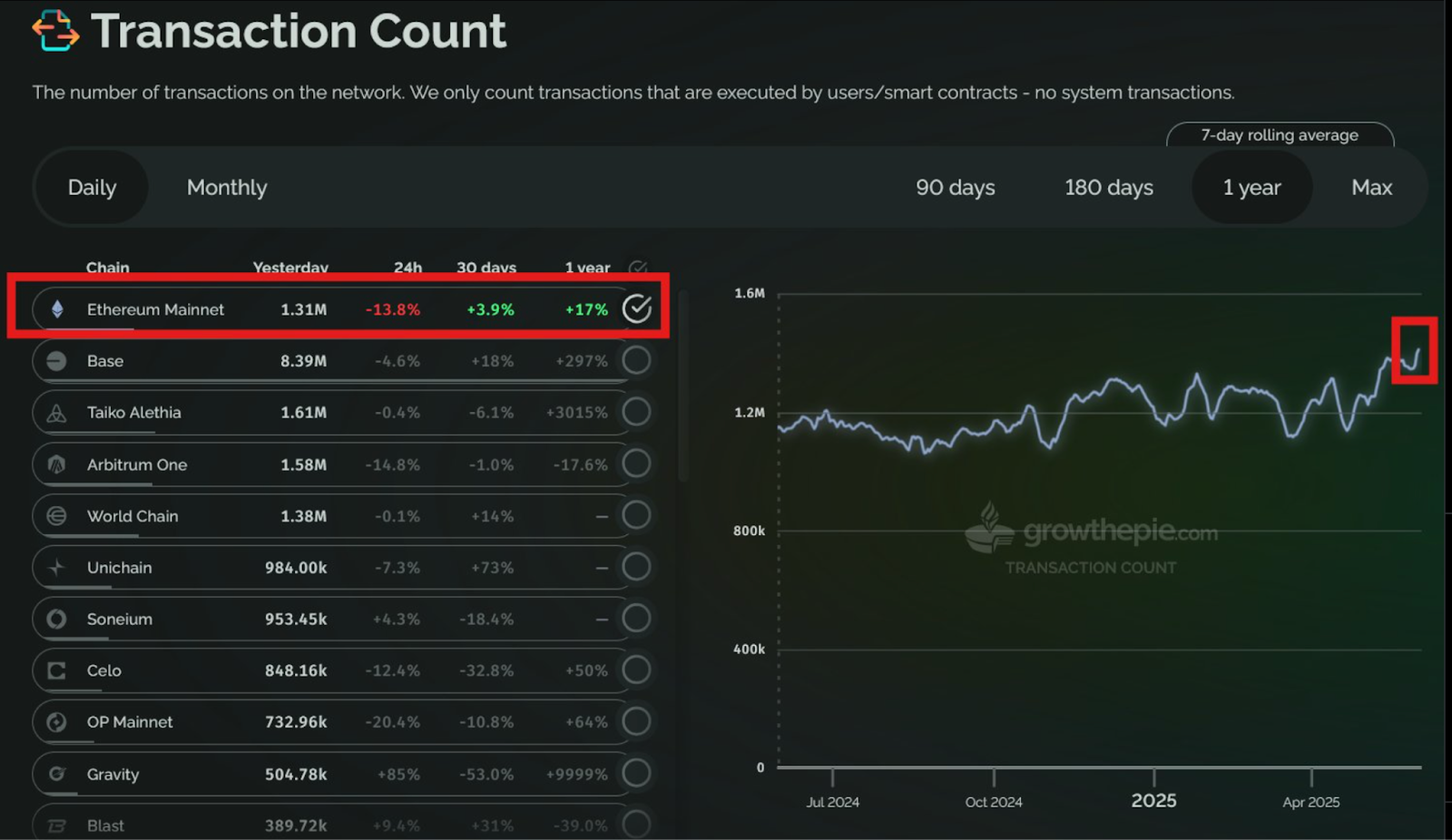

Moreover, according to network usage data, Ethereum Mainnet transactions reached 1.31 million per day, a 2025 high. This is a 17% year-over-year increase, which indicates increasing developer, user, and DeFi activity. The user base is growing steadily, even as transaction costs fluctuate.

These ecosystem metrics show growing demand and usage across the Ethereum stack. Ethereum, the most active programmable blockchain, is still the centre of DeFi and NFTs, roll-ups, and cross-chain bridges. This engagement is the fundamental support of the price structure.

Meanwhile, the token is still consolidating at a significant resistance of just below $2,800. The current price action is a repeat of a previous breakout setup in May.

According to charts, Ethereum is drawing an ascending triangle, a bullish continuation pattern. Targets above $3,500 may become relevant quickly if resistance breaks cleanly. Technicals and low exchange supply and ETF inflows suggest a potential upside surge.

Ethereum fundamentals are strengthening while the market is cautious. This cryptocurrency remains one of the most resilient large-cap assets.

It benefits from ETF inflows, reduced sell-side liquidity, and strong network engagement. A breakout may be the next logical move if macro conditions stay the same.