Fantom Price Breakout: Will Momentum, Volume, & FeeM Effect Keep The Uptrend?

Key Insights:

- Fantom price broke out from a descending triangle, surging from $0.25000 to a high of $0.34798, confirming bullish momentum.

- Fantom price might face pullbacks to $0.25000 or $0.20000 if volume remains low and short interest dominates sentiment.

- Fantoms price action could sustain above $0.30800 if FTM adoption grows and volume exceeds the 300M mark.

Fantom (FTM) price recent performance recorded an amazing 38.68% upward jump from the breakout zone around $0.25, surging to a top level around $0.34798.

The price’s jump was due to a break of a descending triangle formation that, prior, had capped the price in the trade under a diagonal resistance trend line.

Fantom Price Analysis

The confluence of a valid bounce around the $0.18000 support level and a re-entry into the demand zone between $0.20 and $0.25 hinted at renewed buyer strength.

The steep upward thrust confirmed bullish momentum as the price broke above a critical resistance band near $0.308–$0.320.

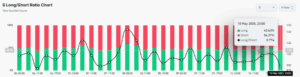

It was unclear whether the rallies of this persistence, 40%, continued to gain momentum amid a significant increase in short interests.

The shorts accounted for 56.37% of volume, while longs accounted for 43.63% – giving a long/short % of 0.77.

This trend suggested that, in the market’s own direction, a major contributor—short interest—was questioning pursuit of that rally.

Statistically, such small ratios warned about following resistances or corrections, so FTM could have dropped again towards $0.25000 if the pessimistic outlook was considered for the asset.

A W-pattern breakout appeared between the last days of April and the first of May, sending a strong bullish message, and targeting $0.35000 as the goal for the bulls.

If support was held at $0.30800, FTM could have then again shot for the area of $0.34798 and observed further gains to $0.36000.

If the price action lost support above the $0.30800 threshold, then FTM would have been at risk of falling to $0.25000 or even $0.20000.

Bullish trends ruled at this time but rising short positions may lead to a reversal in case the market volume fails.

Volume Analysis and Market Participation

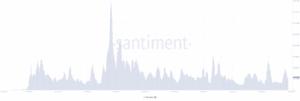

In analyzing the volume profile of FTM up to May 10, 2025, it was realized that adjustment in participating might have contributed to determining whether the recent rally would be sustained or that it would be halted.

Trading volume at 134.18M calmed down after the late-April lows, though far from the late February high level which was around 900M.

This divergence—rising prices without corresponding volume—suggested that the move beyond $0.30800 and toward $0.32052 might not have been conviction-driven.

If volume had continued to decline below 100M while the price attempted to break $0.35000, a false breakout might have developed, risking a retracement toward $0.25000 or the $0.20000 demand zone.

On the contrary, any volume burst over 300M at or near $0.32000 would have verified further rise in momentum to $0.36000 or more.

Even though there was no consistent volume explosions that similarly signaled a cautious approach since the recent highs, the formation of a rounded base in late April may have indicated accumulation, but the inability to extend that momentum may have deterred any additional advances.

Tokenomics Catalyst and Forward Outlook

Using Fee Monetization (FeeM) that rewards builders with 90% of network fees, passing the 1 million FTM token milestone could explain the bullish move up to $0.34798.

The effects of this positive tokenomics shift could have resulted in an influx of speculative buyers and built activity, mirrored by the move above $0.25 and bolstered demand at the $0.20–$0.25 level.

If adoption of this builder incentive had continued to grow, FTM might have sustained levels above $0.308 and aimed for $0.360.

However, with the long/short ratio still at 0.77 and volume near 134.18M, market participants appeared hesitant.

Should the FeeM program fail to translate into tangible activity near $0.32052, price might retreat toward the $0.25000 zone or even revisit the $0.18000 bounce level.

Still, the program could support bullish continuity if supported by stronger participation and volume upticks.