Key Insights:

- Fetch.ai price hits $0.6210 with a 5.77% daily gain, backed by strong trading activity and investor momentum.

- FET supply in circulation reaches 2.39B, with total supply capped at 2.71B, nearing full distribution.

- FET breaks out from a descending wedge, targeting $0.75–$0.80 as volume and price trend upward.

Fetch.ai price has drawn investor interest following its latest price action. A new partnership to develop AI tools has further boosted market attention.

FET has traded at $0.6210, gaining 5.77% in the last 24 hours. Traders are closely monitoring whether it can hit $1 before 2025 ends. Substantial trading volume and a multi-project collaboration could be the early signals of continued growth.

Rising Market Activity and Investor Interest

At press time, Fetch.ai price was trading at $0.6210, with a market capitalization of $1.48 billion. Its 24-hour trading volume has climbed by 32.62%, reaching $185.26 million. This sharp increase shows intense market activity and greater participation from both retail and institutional traders.

The total FET token supply reached 2.71 billion, while currently, 2.39 billion are actively circulating in the market. The total diluted evaluation of the project stands at $1.69 billion.

Given that demand continues to increase, the current figures point to possible expansion opportunities. Decent market liquidity arises from a 12.43% volume-to-market cap ratio, offering traders better flexibility.

A significant boost to FET’s recent rise is its involvement in a new collaboration. Fetch.ai, SingularityNET, Ocean Protocol, and Cudos have merged their tokens into ASI, a unified AI-focused cryptocurrency.

This strategic move aims to consolidate resources and enhance AI-driven blockchain solutions. The Superintelligence Alliance seeks to create a decentralised AI ecosystem. If the merger is completed, it could increase FET’s real-world use and bring more long-term investors into the market.

Technical Indicators Suggest Short-Term Growth

Technical analysis on the 1-hour timeframe shows that FET may continue its upward movement. The token forms a 5-wave impulse pattern using the Elliott Wave theory.

After completing a corrective wave, the price appears to be in wave (5), pointing to a possible target between $0.5883 and $0.6341. The maximum extension is marked around $0.6976.

Retracement levels have been set between $0.4639 and $0.3808. These zones may act as support if the price pulls back.

Traders looking for long-term positions may consider these levels as re-entry points. If Fetch.ai price remains above the $0.60 level, bullish momentum may remain.

On the 4-hour chart, FET has broken out from a descending wedge. This chart pattern often comes before upward movements. After falling to $0.35, the price has recovered and moved beyond $0.564.

Higher volume supports the breakout, which is a positive sign for buyers. The previous resistance points of $0.60 now shows potential to function as a support area.

The price could move directionally towards $0.75–0.80 if support continues to hold at $0.60. Pullbacks are possible in short-term movements, but an upward trend persists. Fetch.ai price could return to its previous level at $0.50 when it falls below $0.60.

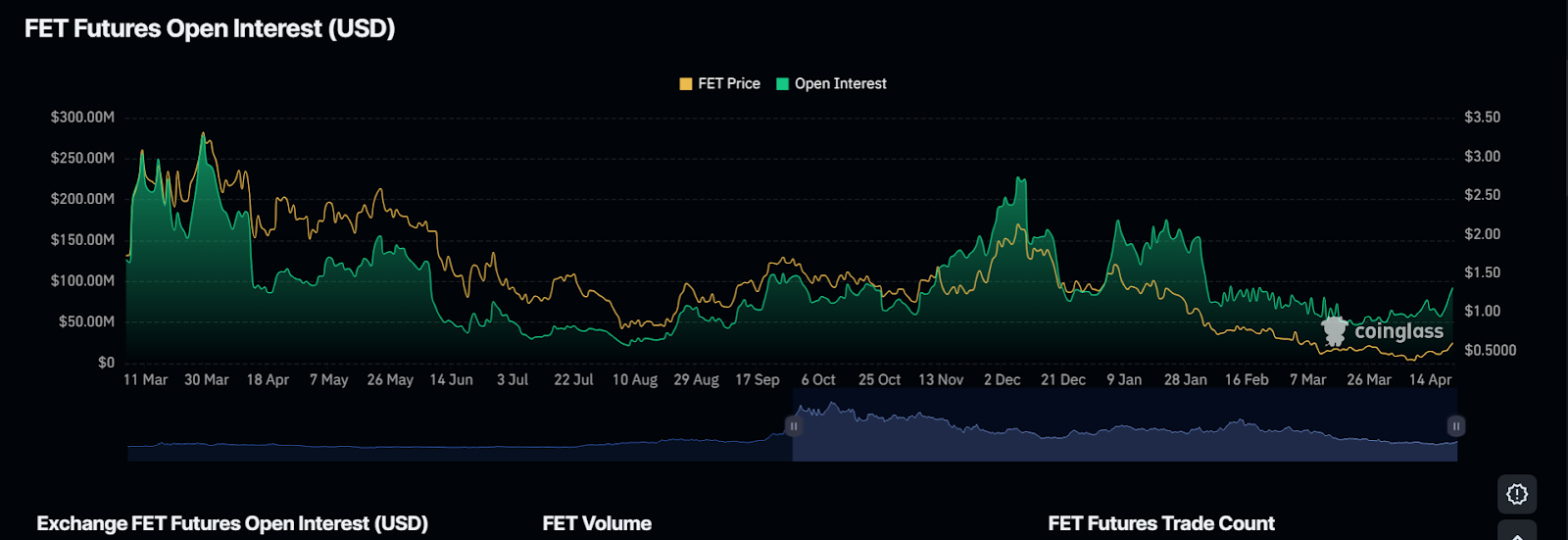

Futures Market Shows Trader Confidence

Fetch.ai’s future open interest in Coinglass keeps increasing toward its recent all-time high of almost $150 million. Market movements strongly reflect trader expectations because the open interest has consistently paralleled price movements.

Market participants boost their active trading positions as open interest rises. They anticipate future price movements, driving increased market activity.

The price of the tokens and open interest rates increased steadily between March and April. The ongoing pattern indicates increasing faith from market participants in the asset.

Market traders adjusted their positions after the Superintelligence Alliance’s announcement. This supported the token price ascent at this specific time.

Growing open interest levels might indicate that investors anticipate the crypto price to exceed $0.60 again. The existing data signifies favourable conditions that should lead the price to reach its $1 target by 2025.

Broader market trends influence Fetch.ai price movement. Investor sentiment plays a key role in determining its future direction. The success of the ASI project merger will also play a key role in its future movement.