HBAR News: Is a Price Surge Coming as Liquidation Risks Start to Decline?

Key Insights:

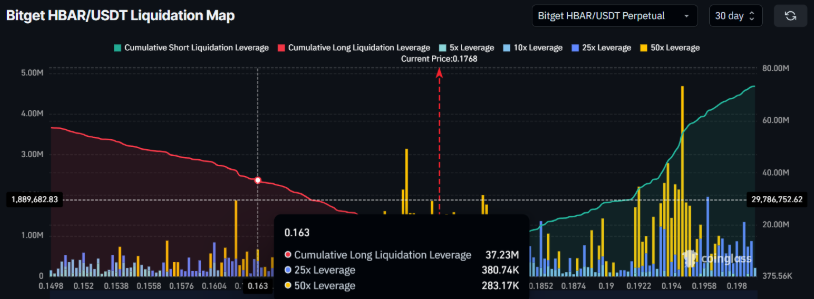

- HBAR avoided $37.2M in long liquidations after bouncing above the key support level of $0.163.

- The MACD indicator confirmed a bullish crossover, ending a three-week bearish trend.

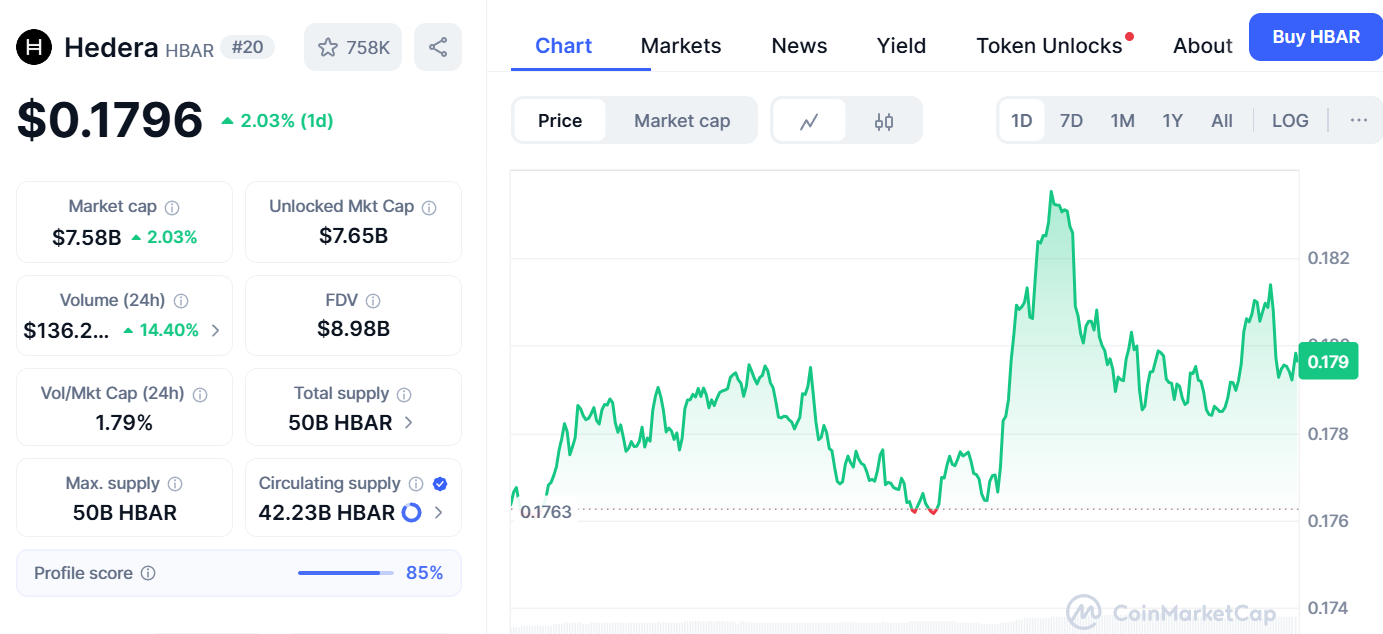

- HBAR is trading at $0.176, just below the critical resistance level of $0.182.

HBAR news: Hedera is showing signs of recovery after weeks of price pressure. A key technical reversal and support hold have created space for bullish continuation as traders regain confidence.

HBAR News: Hedera Avoids $37.2M in Liquidations After Holding $0.163 Support Level

In recent HBAR news, the price movement has helped long-position holders avert substantial losses. According to data from Coinglass, if HBAR price had fallen to the $0.163 support level, approximately $37.2 million worth of long positions would have been at risk of liquidation.

However, the asset bounced before reaching that threshold, reducing immediate downside pressure.

Consequently, this development provided stability to the market as traders avoided cascading liquidations. The avoidance of such a scenario allowed bullish sentiment to return.

Additionally, the support level at $0.163 has now become a critical area for monitoring. Future dips toward this zone could once again trigger large-scale liquidations if broken.

HBAR ETF Verdict Expected June 11

In other HBAR news, the U.S. Securities and Exchange Commission is expected to announce its decision on the spot HBAR ETF on June 11. According to Gilmore Estates, the ruling could determine whether HBAR joins other crypto assets in gaining ETF approval.

Notably, Grayscale’s Hedera Trust and Canary’s HBAR ETF are listed with pending SEC deadlines. The Grayscale product faces its first review by July 8, while Canary’s initial deadline arrives June 11. Traders await clarity as speculation grows over whether approval or delay will follow.

MACD Crossover Signals the End of Bearish Momentum

Amid the HBAR news, technical indicators have begun to show early signs of a momentum shift. The Moving Average Convergence Divergence (MACD) has recorded a bullish crossover. This change marks the first time in over three weeks that the MACD line has crossed above the signal line, suggesting a potential trend reversal.

More so, the bullish crossover indicated an improving sentiment among market participants. It suggests that buying interest is starting to outweigh selling pressure, which may lead to an upward movement. This reversal aligns with the broader market recovery observed across other altcoins over recent sessions, supporting the case for sustained traction in HBAR.

HBAR Now Trades Just Below the $0.182 Resistance

At the time of writing, HBAR is priced at $0.179. It is currently testing the resistance level at $0.182, which has acted as a barrier to further upward moves in previous attempts. If HBAR can close above this resistance, the next price target could emerge near the $0.189 mark.

In addition, flipping the $0.182 level into support could help maintain the current bullish momentum. Such a move would signal market strength and encourage additional buying activity. On the other hand, rejection at this level may lead to renewed selling pressure, which could push HBAR back to the $0.172 support level.

Maintaining price action above the $0.172 mark is crucial. A drop below it could open the way for another retest of the $0.163 support. A breach of that support would increase the risk of another wave of liquidations, potentially dampening near-term optimism.

Hedera Market Cap Growth Gains Analyst Attention

Further on HBAR news, a new research report highlighted Hedera’s rising market capitalization, with Gate.io estimating growth of $3 million monthly. An analyst cited Hedera’s expanding role in Web3 through enterprise applications, tokenized assets, and consistent performance across digital finance sectors.

Moreover, the report compared Hedera’s adoption trajectory to traditional finance benchmarks, noting strong institutional recognition. Its continued development across payment systems and enterprise use cases reflects increasing market confidence in the network’s scalability and long-term potential.