Hyperliquid Surges Past SUI, Could $45 Be the Next Big Target?

Key Insights:

- Hyperliquid price rose 110.15% in 30 days, outperforming 99 of the top 100 cryptocurrencies this month.

- The altcoin reached a new all-time high of $39.93 and surpassed SUI to rank 11th by market cap.

- Hyperliquid Dominates Perpetual Trade Market with Rapid Six-Month Growth Surge

Hyperliquid (HYPE) price action has surprised the crypto market this month, delivering a triple-digit return while overtaking major tokens. Now, investors are asking whether this momentum can continue and push the price beyond $45 toward the next milestone.

Hyperlink Price Surges Over 110 Percent in One Month

Notably, Hyperliquid has recorded a 110.15% gain over the past 30 days, outperforming 99 of the top 100 cryptocurrencies. This rally pushed its market capitalization to $12.58 billion, placing it just outside the top ten digital assets.

In addition, its new all-time high of $39.93 was reached amid heightened market attention and increased institutional involvement. A notable catalyst was a $1.2 billion BTC position closed on the Hyperliquid platform by investor James Wynn. This move drew additional interest from large holders and traders, further fueling the upward price trajectory.

Daily Chart Shows Consistent Bullish Structure

Meanwhile, the Hyperliquid/USDT chart displayed steady upward movement since early April. Daily candlesticks formed higher highs and higher lows, supported by increasing volume. In the past week alone, the token added 47% to its value, while it rose about 1% over the last 24 hours.

Moreover, the consistent performance has placed the asset on several traders’ watchlists, especially as it flipped SUI in market cap rankings. Buyers have maintained control over the chart structure, avoiding sharp corrections and reinforcing overall sentiment.

Technical Indicators Point to Hyperliquid Continued Uptrend

More so, key indicators reinforce the strength of the current uptrend. The Simple Moving Average (SMA) on the daily timeframe showed a steep positive slope, reflecting continued buying pressure. The 12-day and 26-day EMAs are rising in tandem, with no sign of crossover or reversal.

Furthermore, the MACD indicator has maintained a green histogram for over seven weeks. This consistency signals strong momentum, as the MACD line stays above the signal line. Together, these metrics support the possibility of further upward movement if the token maintains its current structure and volume.

If these indicators remain in alignment, traders may consider price levels above $40 as achievable. However, the token must first clear the $39.93 resistance before aiming for a potential breakout.

Key Resistance and Support Levels in Focus

Notably, the immediate resistance is at $39.93, the token’s current all-time high. If Hyperliquid can close above this level with high volume, the next target for bulls could be $45. Reaching this level may require strong participation from both retail and institutional buyers.

In the event of a retracement, support is expected at the $35 level. This zone has acted as a recent consolidation point and could be tested again if selling pressure increases.

Additionally, a deeper correction might lead the token to revisit the $30 support level. Market stability will be essential in guiding short-term price behavior.

Hyperliquid Dominates Perpetual Trade Market

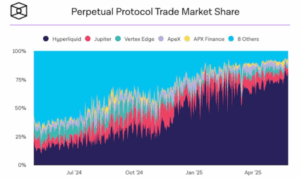

In other developments, Defillama data showed a dramatic rise in Hyperliquid’s market share in the perpetual protocol sector over the past six months. Starting from under 20%, Hyperliquid has steadily captured a dominant portion of the market, overtaking competitors like Jupiter, Vertex Edge, and ApexX. This shift reflects growing user adoption and trading activity on the platform.

Additionally, the most notable growth occurred between January and May 2025, when Hyperliquid visibly outpaced all rivals. The consistent upward trajectory and widening gap indicate strong product-market fit and liquidity. Analysts interpret this as a bullish sign for HYPE token sustainability and future price strength.