Key Insights:

- JasmyCoin saw its trading volume reach the lowest point since June 2024.

- JASMY could hit $0.02159 if the bullish momentum is maintained, but a break below $0.0165 would invalidate this outlook.

- The token gained 12.48% in a single day, showing strong price movement. Its 24-hour trading volume reached 98.89 million, placing it 72nd by market cap.

JASMY news recently revealed that JasmyCoin has experienced very low spot volumes. Despite this, its price continues to show strength, suggesting resilience in the market.

JASMY News: Liquidity Drop and Future Market Outlook

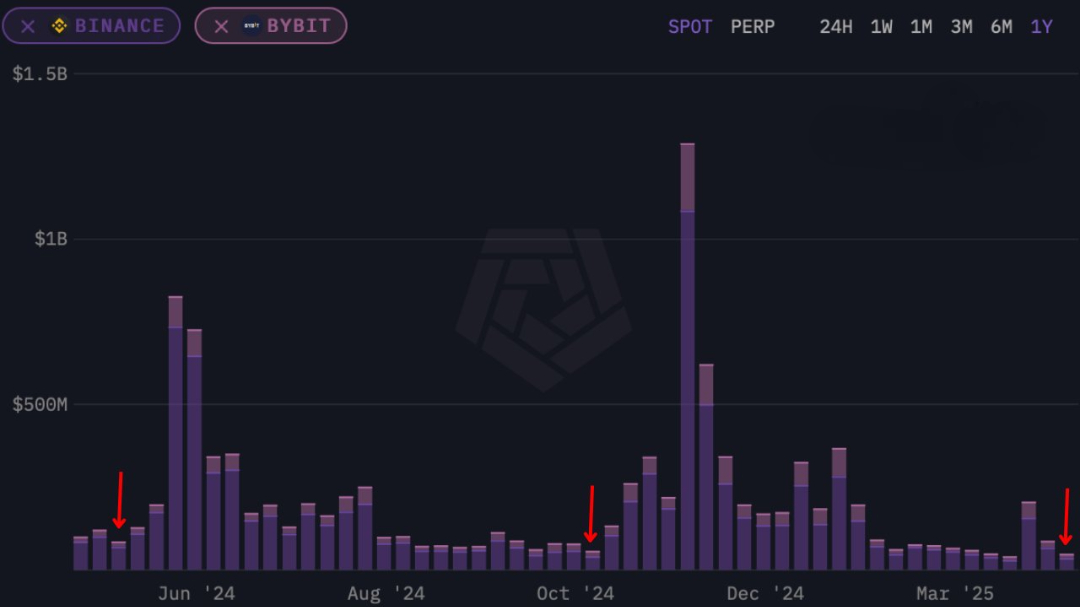

JASMY’s trading activity reached the lowest point since June 2024. The bar showed a value below $150M, which was lower than the previous month’s records.

The activity diminished by over 88% from its previous high of $1.3B that occurred in November 2024. Several important bottoms could be identified which showed that retail investors were leaving the market.

The decrease in spot and perpetual volumes on both Binance and Bybit indicated potential market indifference or maybe market consolidation.

Market price follow-through opportunities remained restricted except when major market drivers appeared. Periods of low liquidity previously led to significant volatility spikes. Despite small trading activity, the price surged more rapidly during these phases.

JASMY news suggested that the token may be stuck in a low volatility zone. If spot and perpetual volumes fail to grow, its price could drift further downward.

To resume control of the market, the bulls required both volume thresholds recovery and fresh capital inflow to JasmyCoin.

Jasmy Price Action Analysis

For the price movement of JASMY, it surpassed the $0.0175 to $0.0178 multi-week resistance zone. This potentially confirmed a bullish continuation pattern.

The price successfully exceeded and closed above the accumulation area, displaying both robustness and fresh buying commitment.

JASMY news suggests price targets of $0.02050 and $0.02159 could be reached. This depends on JasmyCoin holding above $0.0178 with strong trading volume.

The price structure maintained an accumulation area between $0.0160–$0.0170 in April. Sellers repeatedly attempted to break the formation but were unsuccessful.

The recent decisive price ascent maintained its momentum as it signaled the likely completion of the previous period of consolidation. The bullish momentum remained intact only if JASMY managed to stay above $0.01650 while the price held steady.

Otherwise, this setup could collapse and lead to a negative shift in market momentum. If JASMY lost this support level at $0.01650, it would trigger a potential price retest that might reach as low as $0.01500. The defense of $0.0178 by bulls could trigger liquidation above $0.02050.

JASMY’s performance could decide whether its bullish potential would succeed or slow down after confirming its breakout.

Daily Performance of the Coin

JASMY saw a 12.48% price increase in its daily performance. It was backed by $98.89M in 24-hour trading volume, rising by 28.89%. The company’s market cap increased to $933.63M, establishing it in the 72nd position on the market.

The total suplly of 50B JASMY coins had 49.44B circulating supply among which 10.3% was trading against market capital. These statistics showed short-term market focus.

The simultaneous surge in JASMY prices and volumes showed an inflow of new capital combined with increased trading activity. The overall stability of investors in Jasmycoin was supported by its 91.66K holders and $944.11M fully diluted valuation.

JASMY news indicates that price growth could continue if bullish momentum holds. A further increase in trading volume may support this upward trend.

The momentum could probably decline if whale distribution grew or activity levels decreased. Price and market stability could determine whether the price maintains direction.