Litecoin ETF: Approval Odds Rise As Institutional Interest Grows

Key Insights

- The probability of a Litecoin (LTC) ETF by July 31 was 34%, while by the end of the year, it was 74%.

- Multiple global AUM firms continue to file for Litecoin ETF following a few approvals, like the XRP ETF and XXRP by Tecrium.

- Litecoin was the fifth most used cryptocurrency in BitPay payment count.

Litecoin ETF remained a topic of discussion as more altcoins received approvals. However, not all were approved in the U.S. markets.

XRP’s XXRP gained approval from Tecrium in the US, showcasing progress in regulation. Meanwhile, Solana (SOL) secured Brazil’s Securities and Exchange Commission (SEC) approval.

Litecoin ETF Approval: Market Sentiment and Future Prospects

Market participants held different opinions regarding a possible Litecoin ETF depending on their expected launch date.

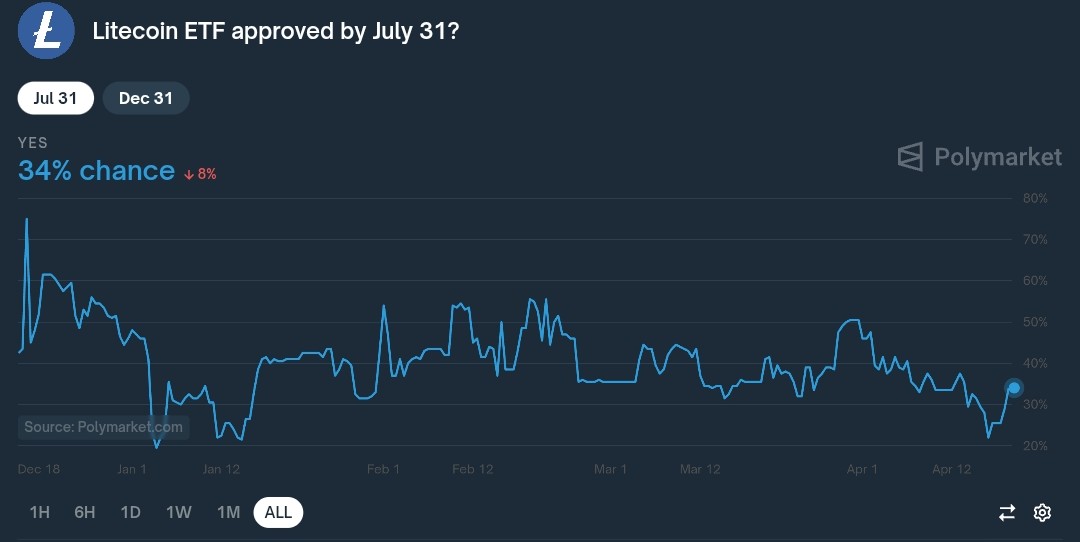

The regulatory intervention schedule for an ETF received a double-digit decline. This reduced the likelihood to 34% by July 31, 2025, according to data from Polymarket.

The probability chart revealed several failed attempts to sustain optimism above 50% since December 2024. This decline stemmed from investor confidence falling below 30%.

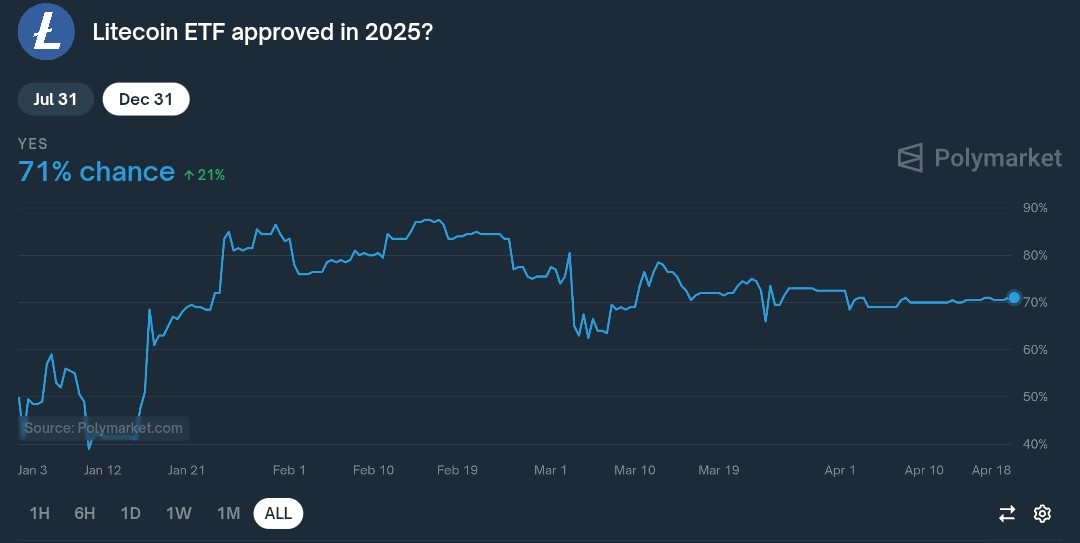

Market expectations regarding Litecoin ETF approval later in 2025 were more optimistic. The statistical forecast for extended approval increased by 71%, a 21% rise for all-time data.

The difference showed that although approval would likely face delays, the participants still believed in securing regulatory approval for the LTC ETF.

A delayed LTC approval during the year could generate additional interest in LTC, prompting either price increases or declines across the market. SEC priorities shifting or further approval delays would potentially reduce expectations about the crypto asset market.

Market analysts believe Litecoin can potentially secure approval for ETFs, aligning it with Bitcoin and Ethereum. However, they anticipate a more cautious and gradual approach in the approval process for LTC.

Litecoin ETF Filings: Institutional Interest Gains Momentum

Approving selected crypto ETFs earlier this year sparked interest among global asset managers. Many have since submitted applications for Litecoin ETF filings, signaling growing institutional demand.

As the movement’s leader, Grayscale planned to transform Litecoin Trust into a spot ETF when the appropriate regulatory criteria were met. VanEck became active in crypto when it filed applications for Litecoin and its previous bids for Ethereum and Bitcoin ETFs.

Bitwise and 21Shares, two digital asset management firms, have joined the ETF market with Litecoin-centered applications. These initiatives aim to provide institutional investors with broader access to cryptocurrencies.

A broad acceptance of LTC by traditional institutions could improve its chances of gaining institutional approval. This could be seen as regulators favoring highly liquid assets and liquid market capacity.

The approval process for ETFs remains uncertain as it depends on market conditions and SEC standard adjustments, which might affect timelines. The rising institutional interest in Litecoin received support through filings submitted by these global AUM firms.

Litecoin’s Transaction Dominance: A Step Toward ETF Approval?

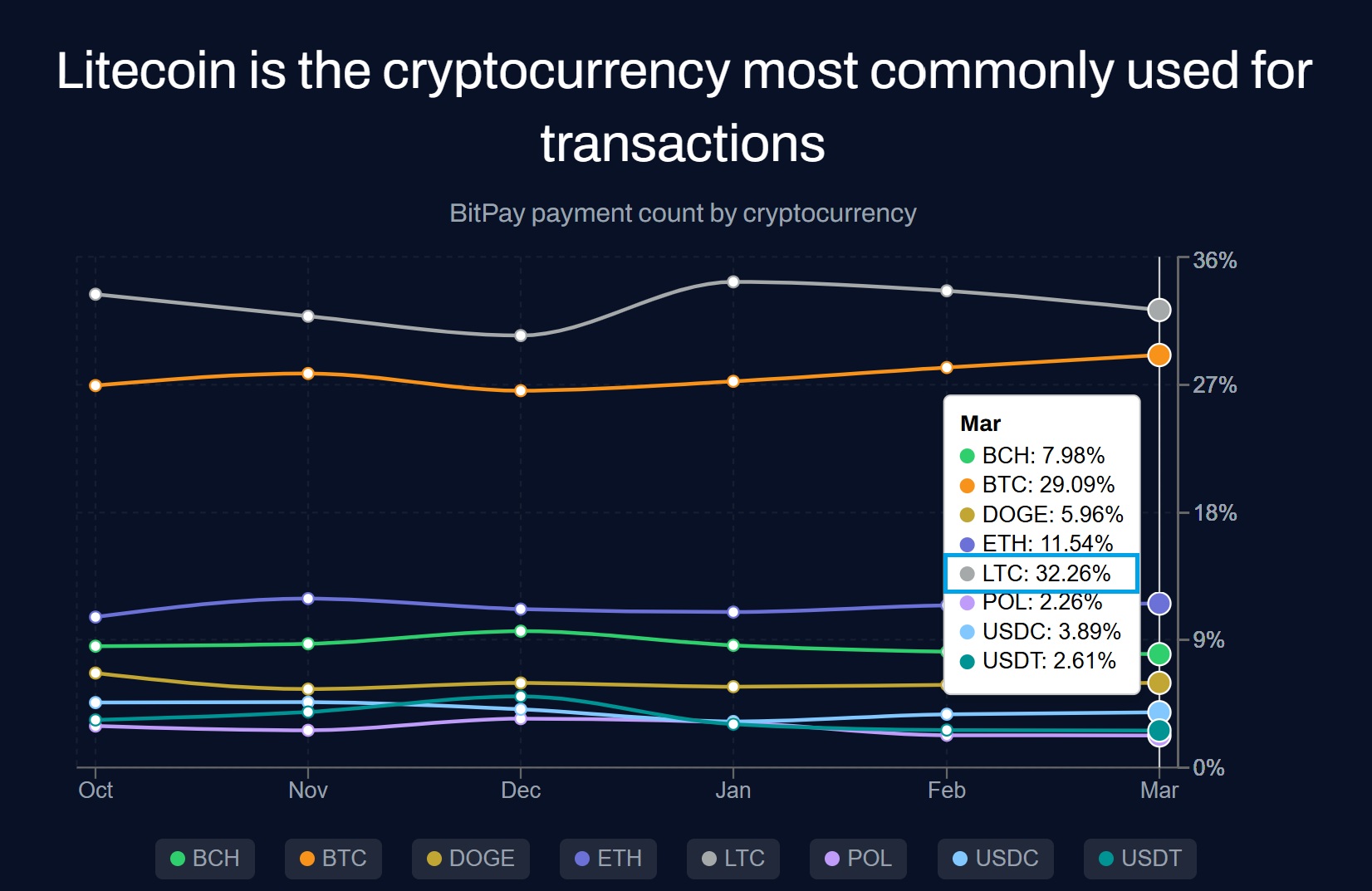

Litecoin processing statistics for March showed that LTC was the primary cryptocurrency with 32.26% of all transactions conducted through BitPay.

The share of LTC exceeded Bitcoin by getting 29.09% while staying well ahead of Ethereum at 11.54%. Bitcoin Cash maintained 7.98%, Dogecoin reached 5.96%, stablecoins reached 3.89% USDC, and a 2.61% USDT share.

Polygon (POL) trailed with 2.26%. Transaction adoption continued to rise for LTC because of its affordable fees and quicker block generation times, contributing to its position.

This meant LTC provided practical advantages for everyday spending, which created valuable evidence that could persuade ETF approval bodies.

Several experts point out that customers’ practical use of blockchain can positively influence regulatory reviews. ETF approval depends on market maturity, liquidity, and effective custody solutions.

The control BitPay has over LTC could strengthen its appeal to institutions. However, the timeline for approval remains a matter of speculation.

This ranking in LTC payments provides stronger legitimacy to its use cases for future regulatory decisions, but does not ensure specific outcomes.