Pepe Crypto News: Bearish Pattern Spotted Amid Price Recovery

Key Insights :

- PEPE appears to form a bearish head, and shoulders price action pattern as market sentiment shifts.

- Following the shift in market sentiment, investors have begun dumping the PEPE meme coin onto exchanges.

- On-chain metrics reveal that $1.27 Million worth of short positions are at risk of liquidation.

Recent Pepe crypto news indicates that the token is losing its recent upside momentum. This follows Treasury Secretary Scott Bessent’s bold statement, which initially boosted market sentiment.

This shift in sentiment and rally has begun to fade as major cryptocurrencies experience a notable decline. However, PEPE continues holding its 2% gain and is trading near $0.000007217.

On the other hand, its trading volume dropped by 8% during the same period. This indicated that traders and investors had limited participation due to notable market volatility.

PEPE Crypto News: Bearish Pattern Spotted

According to expert technical analysis, PEPE appears to form a bearish head and shoulders pattern within four hours. However, the price is currently consolidating within a narrow range near the resistance level of $0.00000733.

This ongoing consolidation is likely due to the recent sell-off and price drop in major assets. This is influencing other cryptocurrencies.

PEPE Price Prediction

Based on historical price momentum, the last time PEPE’s price reached this resistance level, it experienced a nearly 10% drop. This time, PEPE seems to be on the verge of repeating its past performance.

At the current level, there are two possible scenarios that PEPE could face in the coming days. Pepe crypto news points to a potential 10% decline in the meme coin’s value. This drop could bring it closer to the neckline of the bearish head and shoulders pattern.

Alternatively, the meme coin could break out above the resistance level. It could soar by 10% to reach the resistance level of the descending trendline.

In addition to the analysis, PEPE has traded below the 200 EMA on both the daily and 4H time frames. Trading below the 200 EMA suggested that the meme coin has a strong bearish trend with weak momentum.

However, a small rally could also be a potential sell-off signal. To this, many traders and investors may follow.

$3.58M Worth of PEPE Outflow

Looking at this bearish price action, investors have begun dumping the PEPE as it approaches the 200 EMA. Data from spot inflow/outflow indicates that exchanges recorded an inflow of $3.58 Million worth of PEPE in the last 24 hours.

This highlights increased trading activity and interest in the token. This substantial inflow indicates a potential dump and could contribute to the selling pressure that PEPE is currently experiencing.

$9.05M Worth of Bullish Bet

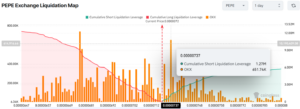

Despite the ongoing bearish price action, traders maintain a bullish outlook for PEPE. On-chain analytics from Coinglass reveal that many place bets on an upward price movement.

On-chain metrics indicate that traders are over-leveraged at the $0.00000678 support level. This includes $9.05 million worth of long positions, reflecting heightened risk-taking behavior.

Meanwhile, $0.00000737 is another over-leveraged level on the upper side (resistance). There, traders have built $1.27 Million worth of short positions.

This over-leveraged level simply reflects how traders have a bullish view of PEPE. However, these positions could be liquidated if the market moves in either direction.