Pi Coin Consolidates At $0.63 Amid Broad Altcoin Weakness, Will It Break Out?

- Pi Coin is consolidating near $0.63 with low volume and forming a bearish pennant on the 4H chart.

- Funding rates for Pi Coin remain negative, signaling sustained bearish sentiment among derivatives traders.

- In contrast, TRX has broken out from a symmetrical triangle and is maintaining support above $0.20, with room for more upside.

The Pi Coin price was close to $0.6295 while writing, indicating that the market was cautious. At the same time, altcoins are facing fresh weakness.

As of press time, Pi Coin’s price was $0.6295, down 0.52% from its 24-hour price. Market players are showing signs of pulling back, as the daily trading volume plunged 32% to $46.2 million.

The current market value of Pi Coin is $4.65 billion; it has a supply of 7.39 billion PI out of a tested and planned maximum of 100 billion PI.

The market in the 24-hour chart stayed choppy throughout the day. The cryptocurrency jumped to $0.635 but took time to slide below $0.63. It shows that Pi Coin’s quick rise may be coming to an end since the coin failed to keep its earlier gains.

Technical Analysis: Bearish Pennant Structure May Limit Immediate Upside

According to 4-hour charts, the price has remained inside a broad bearish pennant formation. Since late May, the stock price has gone down every time it forms a new high or low.

Prices did not go up after the falling wedge pattern broke down, and instead, the asset began moving within a narrower range.

Usually, if a bearish pennant breaks below its support, it suggests that prices will continue falling as they did before. The main support for Pi Coin is below the $0.625 level. Should this level not hold, a further decline may happen to $0.57 and $0.58, as the measured move shows.

The market volume is not increasing, and that suggests both buyers and sellers are uncertain in their actions. The MFI is placed at 59.93, implying that the market may remain within a limited range.

Negative Funding Rates Reflect Cautious Sentiment

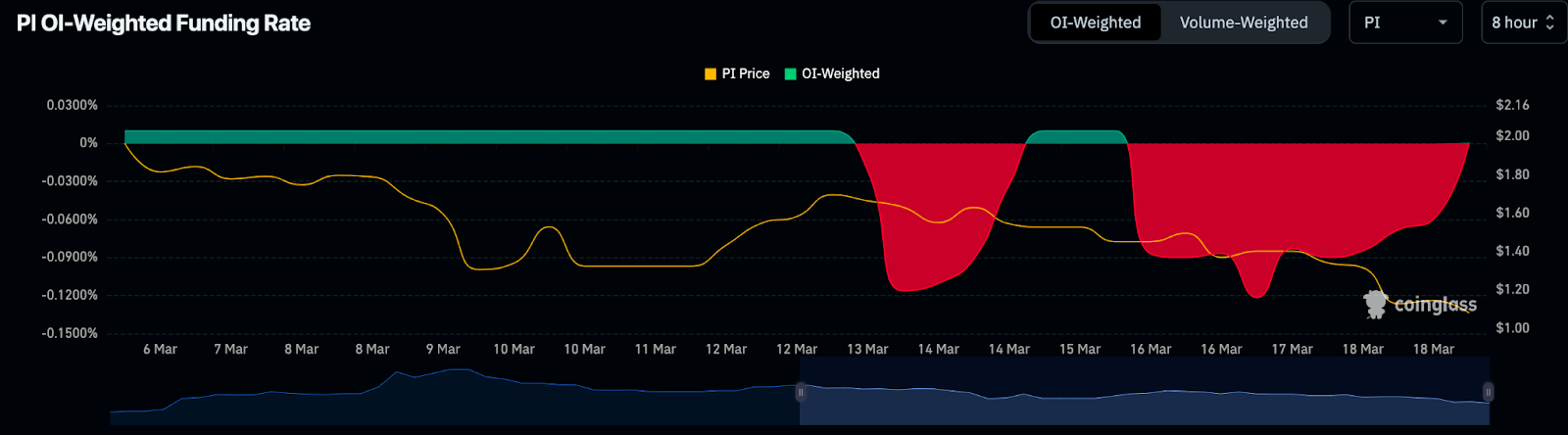

As seen from the OI-weighted funding rate chart in Image 3, the mood in the derivatives market has usually been negative during March. For considerable periods, interest rates were negative, showing that betting against the asset was more common.

At that time, Pi Coin’s value moved from above $2.00 to just above $1.00 on account of the broad drop in the cryptocurrency sector.

Even though there have been some moments when funding rates rose above zero, these did not hold for very long. A trend of negative rates shows that traders are having to pay to keep their short positions.

This could bring about short squeezes when the market moves up suddenly. Still, the continuous lack of funds underlines the uncertainty in the bull’s outlook.

Since the Pi Coin is priced around $0.63, buyers and sellers cannot decide what to do. Although the falling wedge and bearish pennant have been created, buyers are not showing a strong indication that they are ready to buy. Volumes in the derivatives market keep falling, and the available funding data shows that traders are still bearish.

If Pi Coin fails to break over the resistance of the pennant at $0.68 using substantial volume, its chances of dropping again are still reasonably high. Meanwhile, the $0.625 area can secure the possibility for a reversal if the market’s tone changes for the better.

Since Pi Coin had been on a sideways path with limited trading activity, it reflected an overall weakness in altcoins. There are signs of consolidation and future risks going down unless volume increases and the current levels of resistance is surpassed.

In such situations, those assets with solid support and breakout patterns give a clue about an altcoin’s performance in the overall market.