Key Insights:

- For Shiba Inu to flip bullish, the price has to close above $0.000016, but failure could validate the current bearish trend.

- About 69% of Shiba Inu holders are in profit, about 30% in loss while 0.73% is at break-even.

- Shiba Inu’s cumulative short liquidation leverage was $2.88M at $0.00001381.

Shiba Inu (SHIB) coin price prediction suggested price could move to either direction depending on its reaction around $0.0000160 as more shorts pile up above current price.

Shiba Inu Coin Price Prediction

Shiba Inu coin price regained strength after touching low levels near $0.0000108 while building new higher weekly support zones. For SHIB to advance beyond its main resistance threshold it needs to breach $0.0000160.

SHIB’s price outlook brightens if it successfully surpassed $0.0000160 due to which a bullish reversal became possible and price movements toward $0.0000180 and beyond gain potential.

The resistance point proved crucial by being rejected multiple times. The ongoing bearish trend would gain validation if price stayed below $0.0000160.

Another price decline could follow if the market moved towards the $0.0000115 through $0.0000120 support level.

Shiba Inu faced potential price declines if rejection at $0.0000160 happened without increased trading volume which would indicated limited interest from buyers.

Historically, this resistance area functioned as a pivot while another rejection from it could lead to sustained lower-high formations observed since late 2023.

The candlestick pattern showed an uncertainty through its hesitation within the market’s current rally. The trend may flip to favor bulls if they succeed in overcoming strong resistance at $0.0000160.

Although price never broke out of this range it maintained a position of risk exposure. The sentiment would likely decrease if it closed below $0.0000130 thereby initiating a reduction towards the lows.

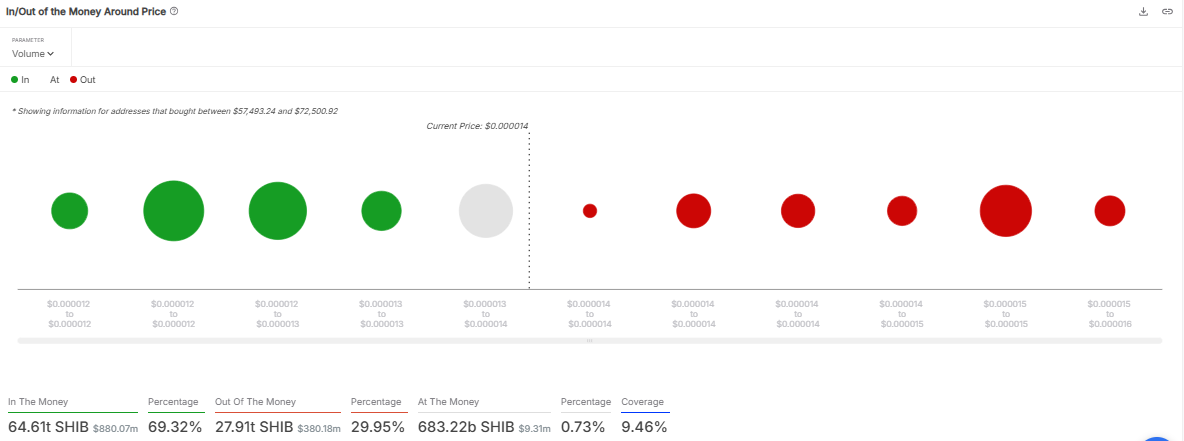

Shiba Inu Coin Profitability Around Price

The profit-bearing Shiba Inu coin holders consisted of 69.32% who held a total of 64.61 trillion SHIB tokens.

A total of 0.73% of SHIB tokens, 683.22 billion SHIB, registered no change in gains as holders were at break-even, but losses amount to 29.95% of SHIB tokens totaling 27.91 trillion SHIB.

The majority of holding tokens occupied price ranges between $0.000012 and $0.000013 since these areas served as support levels. These levels indicated that the supply held profits that could limit price drops.

The resistance areas started from $0.000015 since there were less SHIB token in profit at these levels.

If price breaks above these support and resistance levels, it could encounter challenge as holders who lost money could activate selling pressure.

If the price drops below $0.000013 holders at break-even and minor profit would start selling which would generate downward pressure moving toward $0.000012 support.

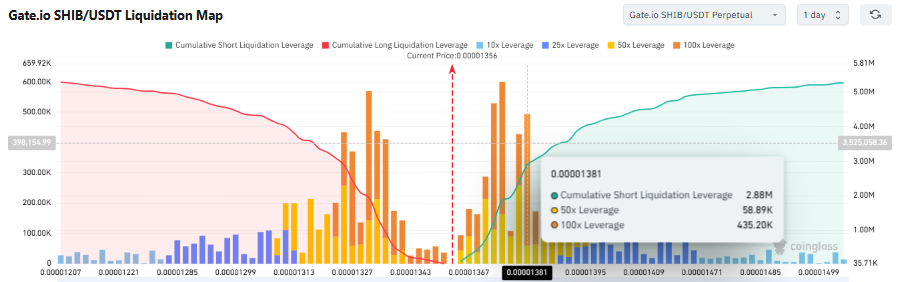

Liquidation Leverage on SHIB Price

The liquidation map for Shiba Inu revealed powerful short-term pressure points at $0.00001381 that held $2.88 million worth of cumulative short leverage.

The SHIB balance above 50x leverage amount reached 58.89K SHIB while 435.20K SHIB existed above 100x leverage. These shorts were under great pressure could push prices upwards.

The long position indicated a significant liquidation cluster from $0.000001310 to $0.00001280. Risk appeared likely for positions with largely high-leverage trades if the price fell below $0.00001310.

A price drop to that area could lead to consecutive long position liquidations that would decrease market value.

The price rise above $0.00001381 had the potential to trigger more short position liquidations that could strengthen market buying power through a short squeeze mechanism.

Price plunging beneath $0.00001310 would cause the dissolution of excessive leveraged long positions resulting in market sell-off.

The position of prices adjacent to the liquidation zones on the map could determine market volatility as it reflected the primary trading direction of liquidated participants.