Key Insights:

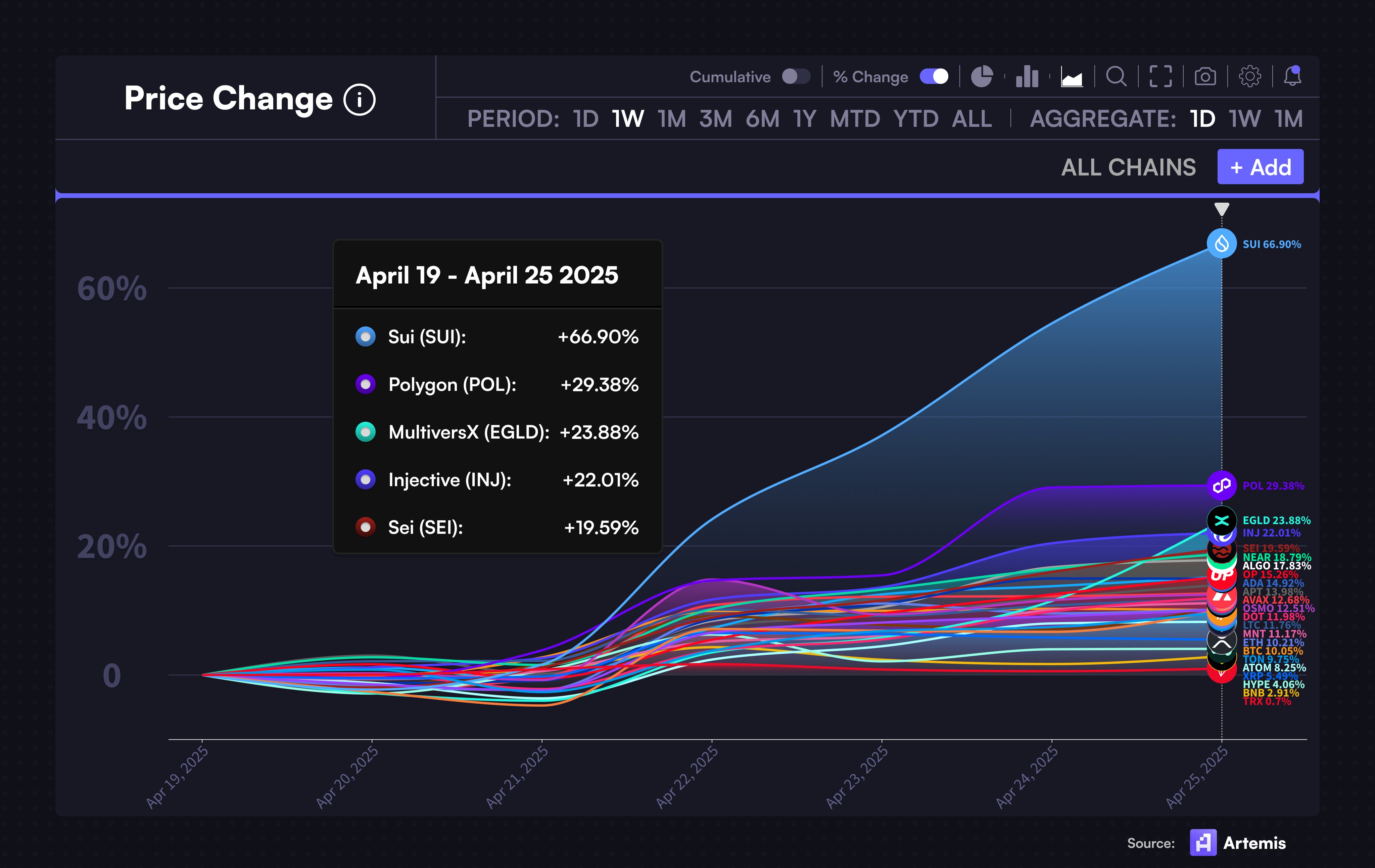

- SUI outperforms the crypto market with a 66.9% increase over the past 7 days.

- Sui price could be headed for a new high.

- TVL has risen 38% in the past week, reaching $1.645 billion. Meanwhile, DEXs’ volume surged to $599 million, a 177% increase from last week.

Sui price was the top gainer among the top 100 cryptos by market cap in the past week. This surge suggests a potential shift to bullish sentiment.

Sui Price Surge: Will Momentum Lead to Sustained Growth?

Sui price showed the highest market performance after achieving +66.90% in the past week, which outclassed all other chains. Polygon (POL) saw a +29.38% gain during this period, leading the pack.

Meanwhile, MultiversX (EGLD) rose by +23.88%, Injective (INJ) gained +22.01%, and Sei (SEI) added +19.59%. SUI dominance saw a +66.90% surge, propelling it as the leader of Layer 1 momentum. This reflected investors’ growing optimism toward bullish potential.

SUI’s tangible profit over a week reflected solid network growth and capital inflow. This momentum also set the stage for short-term profit-taking activities.

Future momentum for Sui price could determine whether it advances through new resistance areas. However, a failed momentum could create a significant retraction.

SUI’s recent market performance positioned it among altcoins with strong potential for future price movement. This outlook remains promising if the broader market continues its upward trend.

Sui Price Breakout: Will the Rally Lead to New Highs?

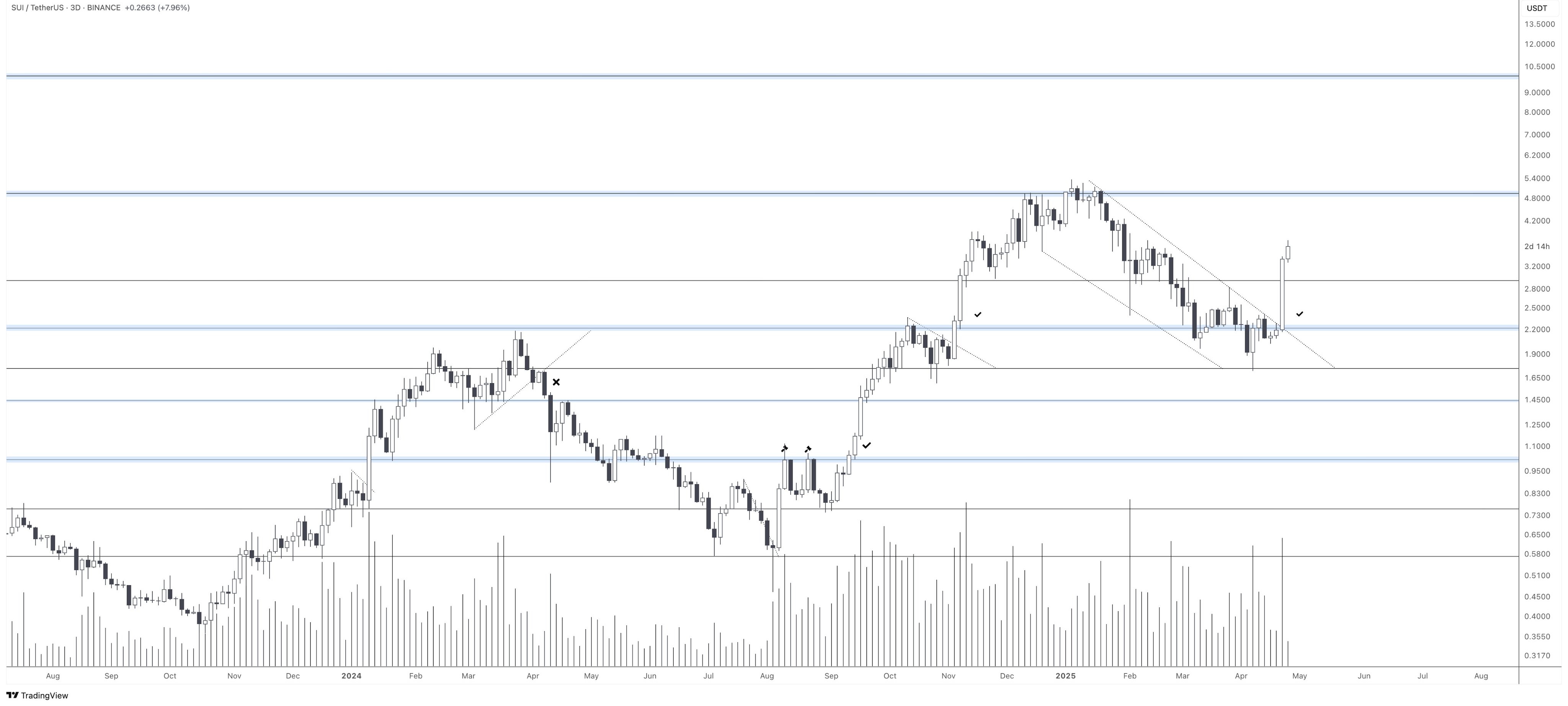

Keenly looking at the Sui price, it surged past its $3.20 resistance level on strong momentum. This sent the price closer to $4.00. The bullish breakout turned the $2.50–$2.80 zone from resistance into support. Lower-high patterns previously marked this shift.

SUI experienced a comparable price surge in late 2023, climbing from $0.80 to surpass $2.00. After this rise, it stabilized around key horizontal support and resistance levels.

SUI exhibited a potential pathway toward $5.40 if current conditions remained stable. If momentum continued, subsequent advances could push it toward a new all-time high (ATH) around $10.50. Market participation remained robust as the volume grew during the breakout period.

SUI surpassed $2.80 as it did during previous accumulation breakouts. This showed combination patterns between periods of consolidation and verification of breakout signals.

A failure to defend support at $3.20 could trigger a price revaluation within the $2.50 to $2.80 area. If the price drops below $2.50, it will invalidate bullish prospects. This decline could push the asset to $1.90 or even $1.40 support zones.

The market signals pointed toward a continuation pattern due to the solid breakout and rising trading volumes. Sui price may reach $5.40 and continue beyond that point as investors rebel against declining momentum to attempt an ATH breakout.

What’s Driving SUI Gains?

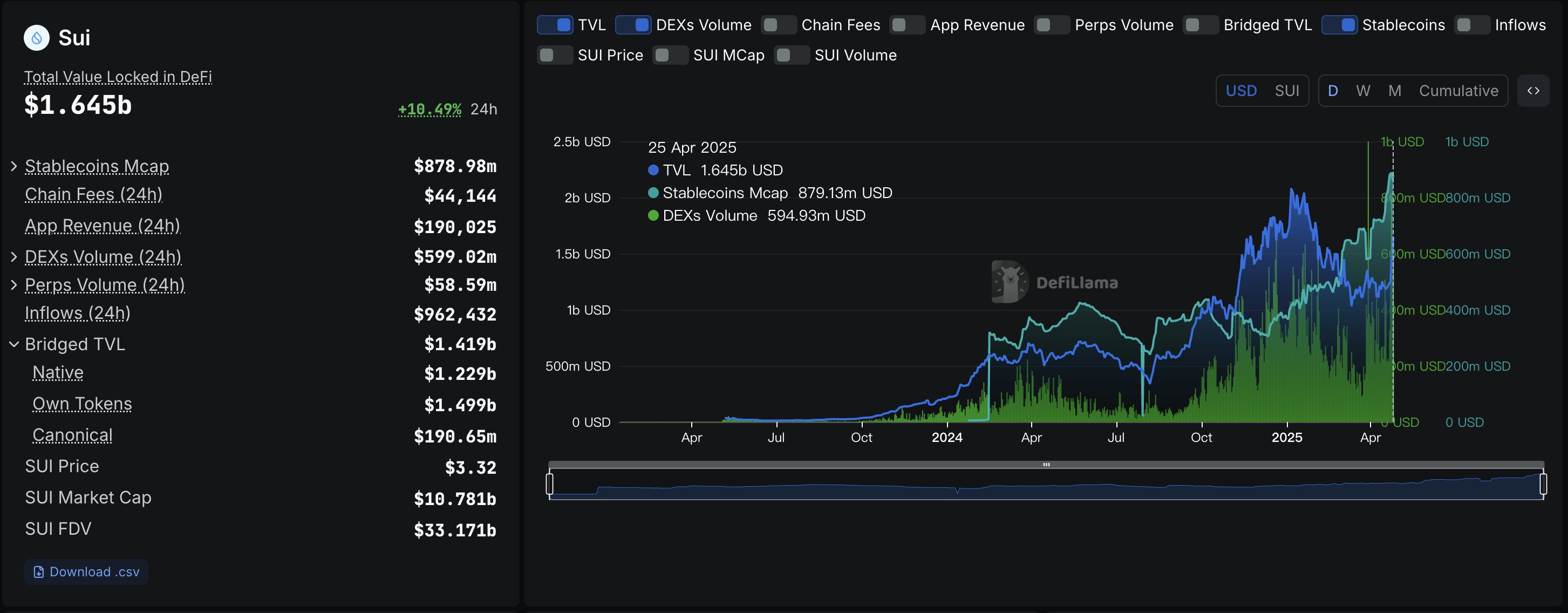

Assessing SUI growth, the strength in fundamentals propelled it to achieve an increase in its price over the past week. First, the DeFi sector saw increasing trust by following a 38% increase in Total Value Locked (TVL). This rose to $1.645 billion.

DEX saw a 177% increase in daily volume, reaching $599 million in the last 24 hours as of press time. Over two months, the Stablecoin market cap grew from $482 million to $879 million, marking an 82% increase. This surge highlights the market’s growing stability.

Also, the bullish indicators for the platform included daily app revenue exceeding $190K and receiving $962K worth of total inflows. The market valuation surpassed $10.78 billion.

However, FDV amounted to $33.17 billion. SUI benefited from expanding its ecosystem, which drove increased market demand.

These strong metrics could create the conditions for the price to rise further. The market gains could reach their limit if measurement metrics related to volume and TVL do not slow down.