SUI Price Prediction: Will $158M Token Unlock Trigger a Crash?

Key Insights:

- Sui price prediction suggests that the coin could see a crash if it fails to reclaim the $3.7 level.

- 44 million SUI coins worth $157.94 million are scheduled for unlock between May 25 and June 1, 2025.

- Exchange records show a $12.70 million outflow of SUI, hinting at potential accumulation amid market uncertainty.

SUI price prediction has become a must-discuss topic, especially as $157.94 million worth of tokens are set to be added to the circulating supply. The daily chart reveals that SUI has recently broken down from its prolonged consolidation, and now this significant token unlock is raising questions about whether the asset could crash or continue to move sideways.

$158 Million Worth of SUI Unlock

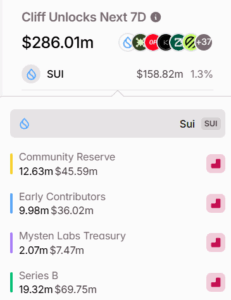

According to Tokenomics data, the SUI Network is set to unlock 44 million coins, equivalent to 1.3% of the total circulating supply, worth nearly $158 million.

As per the data, the Community Reserve is set to receive 12.63 million SUI tokens valued at approximately $45.59 million.

Early Contributors will gain 9.98 million tokens worth $36.02 million, while the Mysten Labs Treasury will be allocated 2.07 million tokens valued at $7.47 million.

Meanwhile, Series B investors stand out with the largest share, receiving 19.32 million SUI tokens, amounting to $69.75 million.

This substantial token unlock event raises concerns of potential sell pressure, especially given the substantial allocations to early backers and investors.

Current Price Momentum

At press time, SUI was trading near $3.60 and had registered a modest price decline of 0.30% over the past 24 hours. During the same period, its trading volume surged by 35%, indicating heightened participation from traders and investors compared to the previous day.

This steady price change following the consolidation breakdown is raising questions. Is it a preparation for a price dip, or are whales accumulating and preparing to pull off SUI coins to avoid further losses?

Key Technical Levels and Price Prediction

According to expert technical analysis, the SUI price prediction suggests that the asset is in a bearish phase and could soon experience a notable price dip.

On the daily time frame, the asset has broken down from its prolonged consolidation, opening the path for a significant decline, but is now moving sideways despite the recent token unlock.

SUI Price Prediction

Based on recent price action and historical patterns, if the SUI coin experiences a price decline and closes a daily candle below $3.50, then, according to the SUI price prediction, the asset could see a 20% drop and may reach the $2.81 support level.

On the other hand, the SUI price prediction could turn bullish and see upward momentum only if the asset closes a daily candle above the $4.15 level. If this happens, SUI could soar by 30%, and the price may reach the $5.50 level in the future.

Bullish Sign from On-Chain Metrics

Despite the bearish price action, investors and traders have been found betting on the bullish side, as revealed by the on-chain analytics firm Coinglass.

$12.70 Million Worth of SUI Outflow

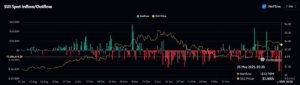

Data from spot inflows and outflows reveal that exchanges have recorded an outflow of $12.70 million worth of SUI coins over the past 24 hours. This substantial outflow hints at potential accumulation, which can reduce selling pressure and support upward momentum.

Major Liquidation Levels

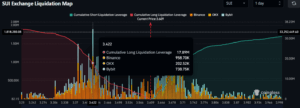

Meanwhile, traders are over-leveraged at $3.422 on the lower side (support), where they have built $17.89 million worth of long positions. Meanwhile, $3.666 is another over-leveraged level, where traders have built $9.07 million worth of short positions.

Combining these on-chain metrics with technical analysis, it appears that bulls are dominating and might be seizing the current conditions to buy the dip.