Tron Coin Price Prediction Eyes $0.305 as SEC Advances Staked TRX ETF

Key Insights

- Tron coin price prediction rises to $0.305 after TRX breaks out of a symmetrical triangle.

- SEC moves TRX staked ETF filing forward, while other ETF decisions are delayed

- Buy pressure returns to TRX with 2.68M active users and $217M+ daily DEX volume

The SEC has formally recognized Canary Capital’s application to launch a staked TRX (Tron) ETF. The proposal, which was filed with the Cboe BZX Exchange, seeks to list and trade shares supported by staked TRX. BitGo, a respected crypto custodian, will look after the fund.

While the comment phase begins for this filing, the SEC has also put off deciding on several other crypto ETFs. The proposals are for Bitwise and CoinShares spot XRP ETFs, a spot Litecoin ETF from CoinShares and Fidelity’s in-kind Bitcoin ETF. These delays are in line with what analysts expect for the final decisions to be made.

SEC Progress Boosts Tron Coin Price Prediction

Most ETF filings are examined throughout the entire review period, says Bloomberg Intelligence analyst James Seyffart.

He pointed out on X, “The first decision will be the one that is not typical.” For this reason, most final deadlines will likely be in October 2025, but a few might move ahead by late Q2 or early Q3.

The SEC’s decision on Canary’s TRX ETF is a sign that other crypto assets besides Bitcoin and Ethereum may gain traction. Canary has submitted ETF applications for Sui, Hedera and Litecoin as well. Although only the TRX ETF has advanced, it shows that many are interested in ETFs that use staking.

The TRX filing points out that staking is becoming more popular in decentralized finance. If granted approval, the ETF would allow investors to own TRX and receive staking rewards, which is not available in most traditional crypto ETFs.

On-Chain Strength Reinforces Tron Coin Price Prediction

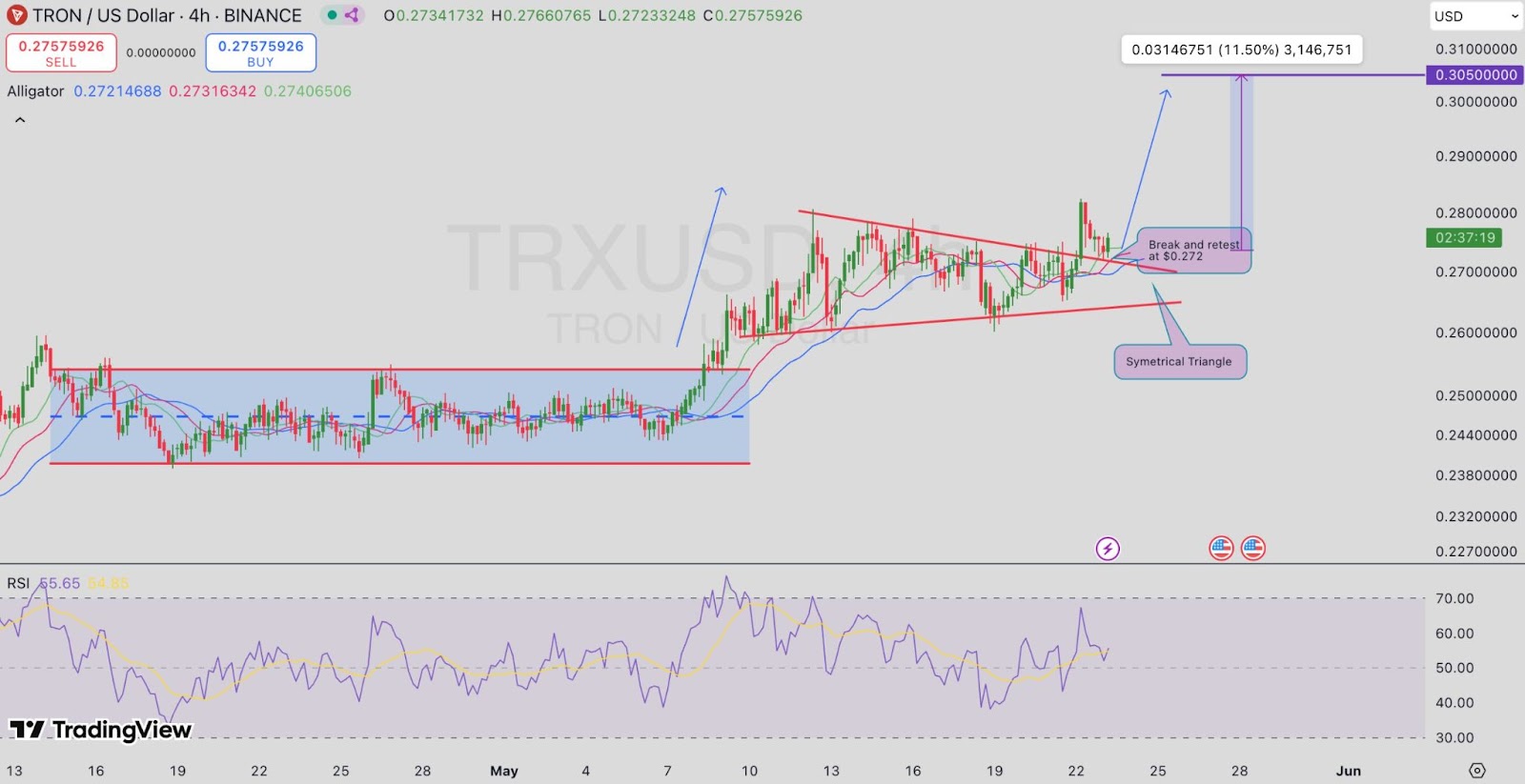

Regulatory progress has been accompanied by more buying activity for TRX on the blockchain. The 4-hour chart for TRX/USDT shows a symmetrical triangle has been broken, and the price is retesting the level near $0.272.

At the time of writing, the cryptocurrency is trading at $0.2757 and the chart suggests it could increase to $0.305, which is an 11.5% rise.

The RSI is currently above 55, which means the market is strong but not close to being overbought. Also, the convergence of moving averages has given the market a strong base for prices to keep moving up.

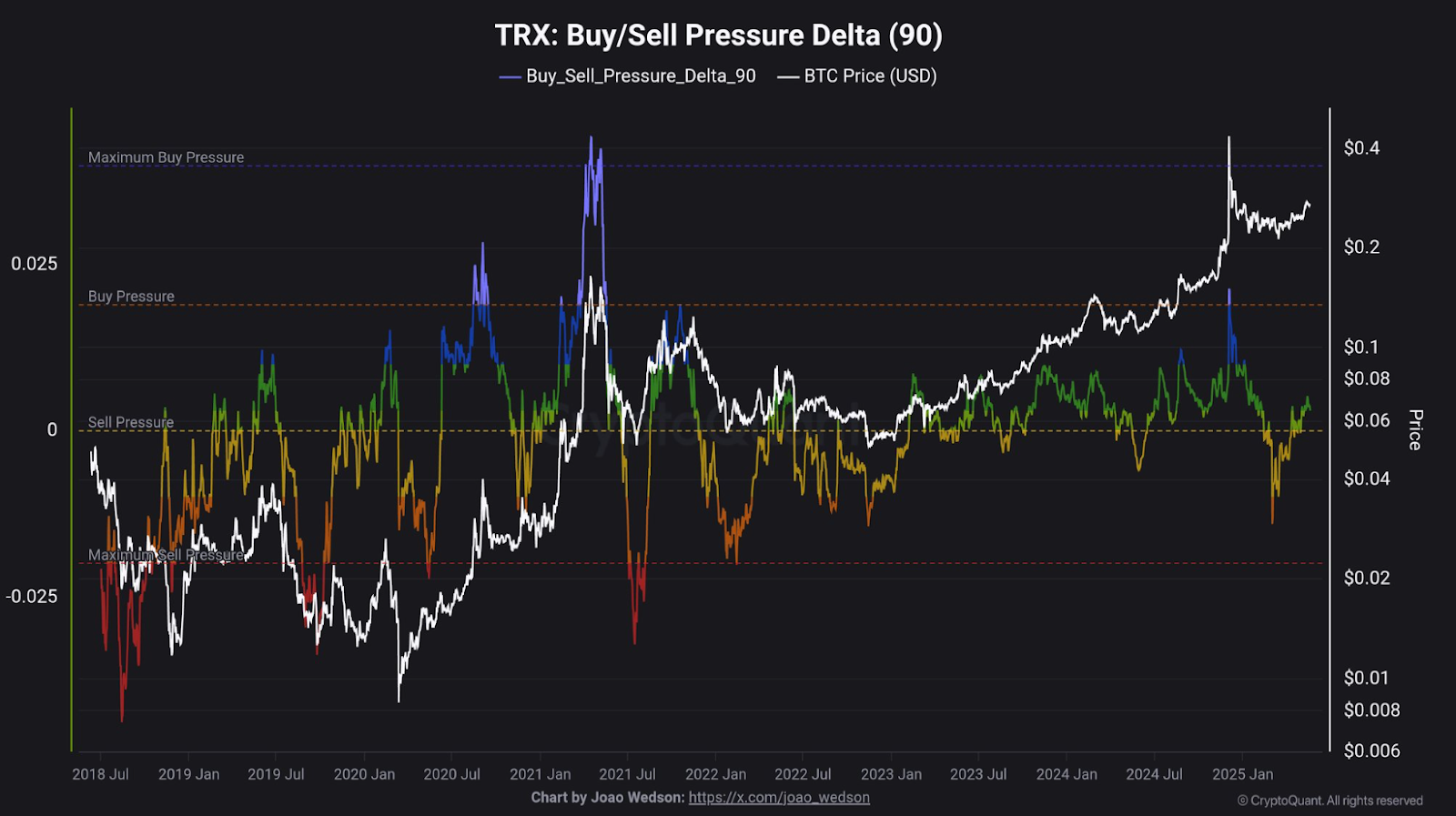

The increase is also backed up by data on the blockchain. CryptoQuant reports that TRX’s 90-day Buy/Sell Pressure Delta is now in the positive range, which indicates that bulls are back.

Previously, such news had triggered long-lasting rallies in the asset, mainly when accompanied by important events such as ETF filings.

Market Metrics Reflect Growing Demand for TRX

According to DeFi data, Tron’s TVL is currently $6.73 billion, up by 2.12% in the past day. Chain revenue and fees were both $2.08 million on the day, and DEX volume hit $217.6 million.

A total of 2.68 million active addresses showed that users are actively using the Tron blockchain.

TRX is now ranked 10th in the crypto market with a market capitalization of $25.96 billion. The total value of stablecoins on Tron is $76.5 billion and the bridged total value locked is $83.35 billion.

It seems that the ecosystem is strong enough to support higher prices when the market is positive.

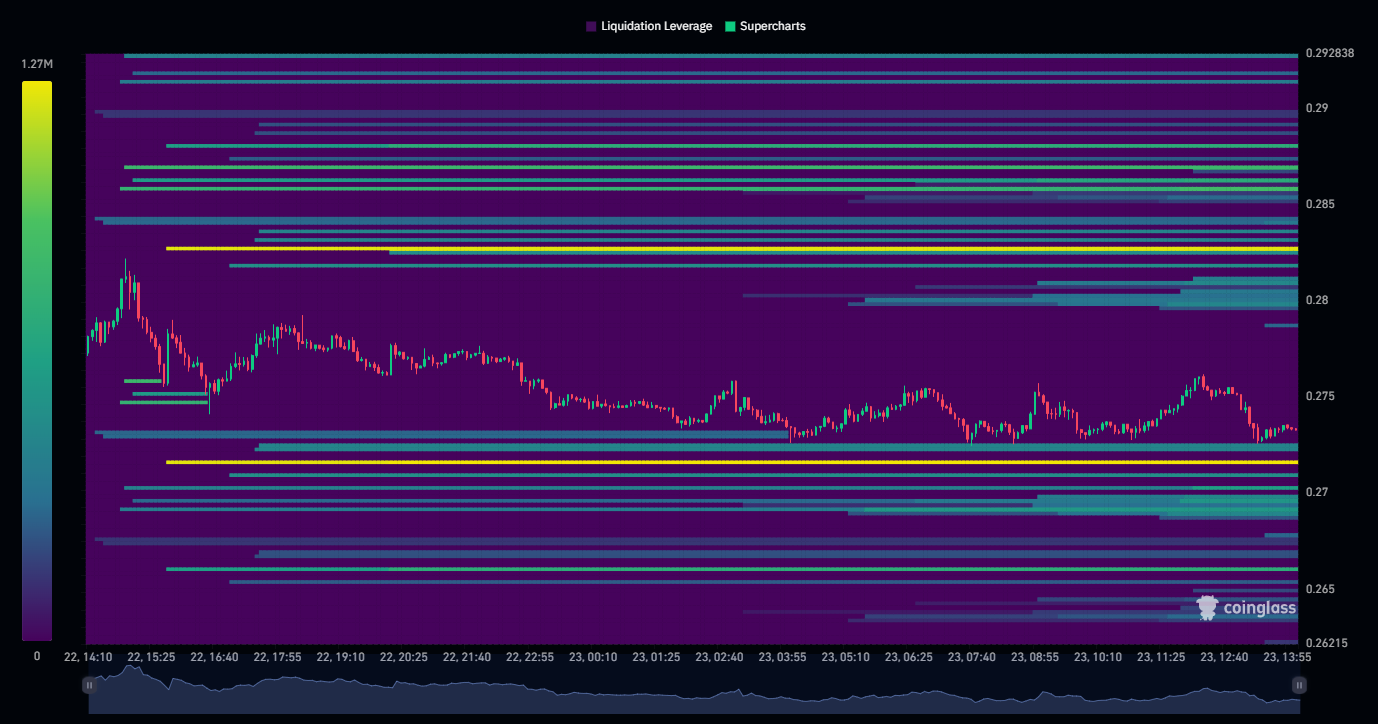

This level of activity supports the case for higher prices under the current tron coin price prediction. CoinGlass liquidation heatmaps show clustered short positions between $0.271 and $0.282. Open interest exceeds 1.27 million contracts below $0.271 and 1.06 million above $0.282, suggesting a breakout above that level could trigger a short squeeze.

If TRX pushes past $0.282, trapped short positions could accelerate price gains toward the $0.305 target, reinforcing bullish sentiment across technical and on-chain indicators.