Trump Meme Coin Price Shows Early Signs of Recovery After 33% Plunge

- The Trump meme coin price could rally, targeting $12–$12.5 initially, and then $16.

- Despite market uncertainty, whales have been accumulating, while traders continue to follow the market sentiment.

After plunging by 33% in recent days, the Trump meme coin price is now showing signs of recovery. As per the daily chart, the last time the meme coin reached this level, it rallied by 40%.

This raises the question: Will history repeat itself, or is this just a normal correction after a notable dip?

Trump Meme Coin Price Action and Technical Analysis

Amid the ongoing price recovery, the TRUMP meme coin is currently trading near $11.35 and has recorded a modest price surge of 1% in the past 24 hours. Despite its strong history of price reversals, traders and investors seem to be abandoning the meme coin.

The TRUMP meme coin’s trading volume has dropped by 55% compared to previous days. This drop in volume reflects traders’ and investors’ cautious approach to safeguarding their capital.

According to expert technical analysis, the Trump meme coin price has found support at the $10.80 level, which has a history of bullish reversals. The daily chart also revealed that the key focus is whether the $10.80–$11 support zone can hold.

Based on the recent price action, the Trump meme coin price could rally, targeting $12–$12.5 initially, and then $16, a major resistance level, if the support holds.

On the other hand, if the sentiment shifts and sellers take control, a breakdown of the key support level could be possible. If this happens, the Trump meme coin price could see a significant decline, with the price potentially hitting $9.5 or $8.75 in the future.

Besides these key levels, TRUMP’s Relative Strength Index (RSI) currently stands at 42.

This indicates that the asset is neither overbought nor oversold, but rather in neutral territory. Though it suggests potential for further consolidation or a bounce depending on upcoming market catalysts.

Furthermore, the 200-day exponential moving average (EMA) is still overhead, suggesting that the broader trend remains bearish.

Bullish On-Chain Metrics

Given the current market sentiment, investors and traders have taken it seriously as they continue to accumulate. Over the past few weeks, meme coin accumulation has skyrocketed, as reported by the on-chain analytics platform CoinGlass.

Data from spot inflow/outflow revealed that exchanges have witnessed $56.66 million worth of TRUMP meme coin. This substantial outflow occurred across the exchanges, and given the current market conditions, it appears to be a potential accumulation phase.

However, such outflows are generally considered a bullish sign for TRUMP holders, suggesting the possibility of a massive rally once sentiment shifts.

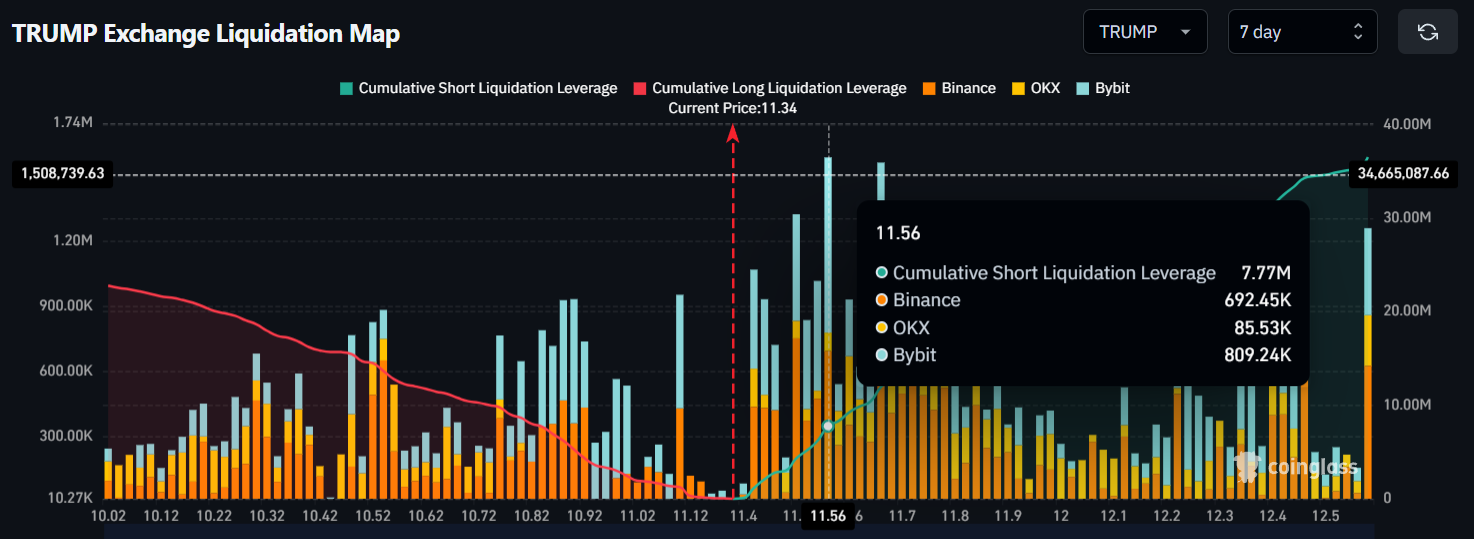

Major Liquidation Levels

Meanwhile, traders are strongly following the current bearish market sentiment. Data from Coinglass reveals that they have been heavily betting on short positions.

As of now, the major short positions, where traders are over-leveraged, are at $11.42, $11.56, $11.66, $11.78, and $12.58. At these levels, they have built short positions worth $1.15 million, $4.33 million, $7.77 million, $11.95 million, $11.36 million, and $36.50 million.

These levels between $11.42 and $12.58 seem like strong resistance built by traders, who believe that the TRUMP meme coin price won’t rise above them.

On the other hand, traders betting on long positions are over-leveraged at the $11.10, $10.88, $10.54, and $10.30 levels. At these points, they have built long positions worth $1.24 million, $6.20 million, $13.66 million, and $18.64 million, respectively.

These positions by bulls and bears have been established over a span of seven days, indicating that sellers are dominating while bulls appear exhausted.