Key Insights:

- VET prices needed to break and stay above $0.028 to advance to $0.033 and eventually to $0.08.

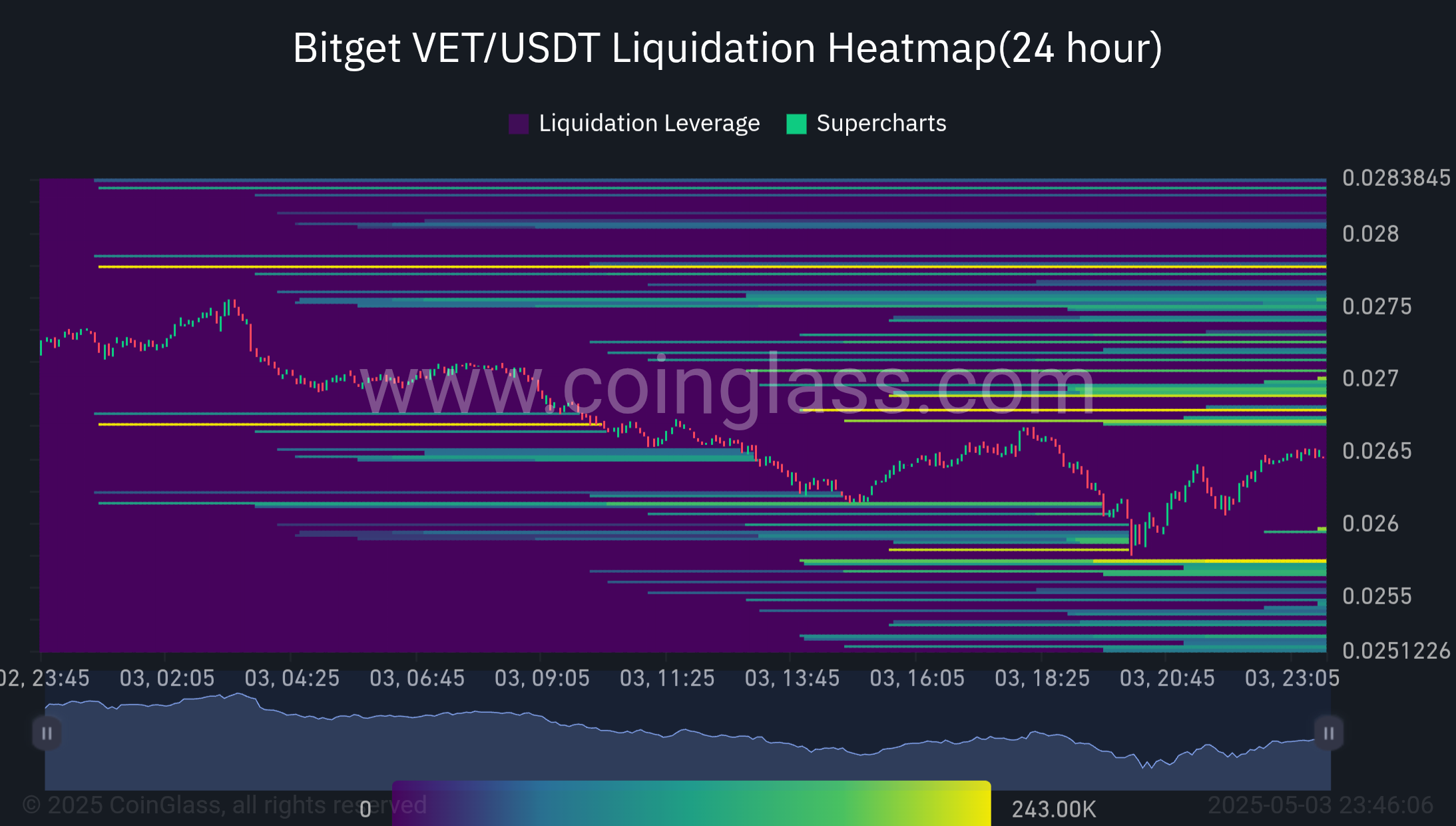

- About $243k in leveraged positions could be liquidated if VET price reached $0.267 while $227K could be liquidated if price hit $0.0257.

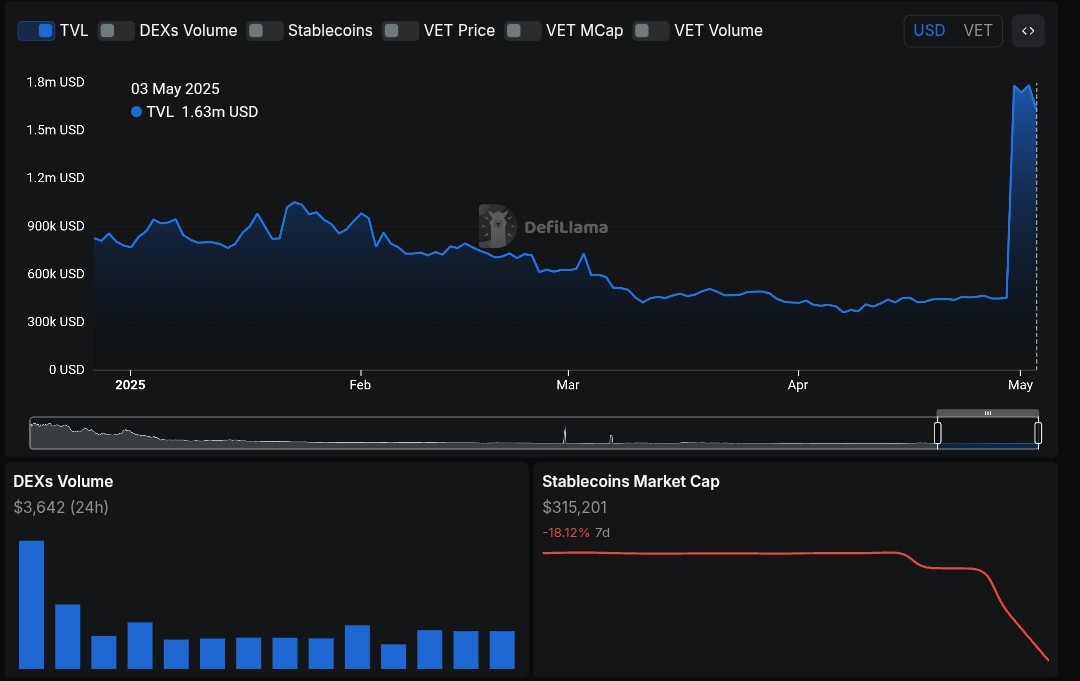

- VET TVL was up in the year 2025, stablecoins market cap was dropping while DEXs volume consistently stayed relatively low.

A VeChain (VET) price prediction analysis suggested potential uptrend following a breach of the falling wedge, a common bullish reversal pattern.

VET Price Prediction

Since January VET was quoting at $0.0265 while exhibiting resistance close to its price level after the break out from the falling wedge pattern successfully.

Bullish strength had potential to develop on the basis of the breakout formation along with the converging MACD indicators.

An uptrend could develop after the MACD line at 0.00094 rose above the signal line at 0.00077 while the positive histogram reached a value of 0.00017.

VET price could cross $0.0276 to establish additional gains. Continued trading above $0.0276 could potentially open the door for VET to reach $0.0333.

Following peaks at $0.08, VET must overcome the next level of resistance, which would appear at $0.08 before accessing higher value.

VET faced potential downward pressure that could extend to support at $0.0240 and potentially reach $0.0220 if prices did not sustain above $0.0276.

The descending wedge break established bullish potential, although price validation by increased volume along with sustained trading above key levels would make the confirmation successful.

Sideways market movement might resume if bears resist the $0.0276 price level for a second time.

Due to its weak price state, VET suggested an upward trend if buying power maintained $0.0276 resistance levels.

Liquidity Cluster for VET Price

The liquidation heatmap showed major price-level liquidity clusters gathering in various points.

The price level was static at $0.0267 with high potential for leveraged long position liquidation at $0.0257 at which over $227K worth of positions could be affected.

The decline in VET’s price below $0.0257 might serve to trigger various stop-losses and liquidations which would cause further market volatility and have additional price declines.

There were additional clusters of leveraged long positions below $0.0255 which reflected additional market liquidations on additional price declines.

Participants held deep positions short-betted which were clustered between $0.0276 and high prices.

Liquidation of short positions would drive price appreciation to $0.0283 after a break above $0.0276.

VET was sensitive in its price action as mounting pressure from liquidation positions below and above its position could lead to increased reactions.

The prevailing market position allowed for swift price action as it facilitated sudden upside or downside movement from initially formed clusters.

The $0.0257 and $0.0276 were major points of support and resistance for volatility in the short term.

TVL, Stablecoin Market Cap, DEX Volume

VET experienced a significant Total Value Locked (TVL) boost reaching $1.63 Million from its previous April figure of below $400K.

The positive change in capital indicated participants return towards the protocol.

The Stablecoins Market Cap tied to VeChain underwent a 18.12% decrease over the past seven days reaching $315,201 which showed decreasing stable-backed asset trust or reduced market liquidity in its ecosystem.

The actual trading volume on DEXs showed minimal change throughout a 24-hour period as the recorded volume reached $3,642.

The data indicated growing long-term capital on the platform but it failed to show satisfactory levels of transactional use combined with stablecoin liquidity.

The continued growth of TVL presented a potential positive effect on VET’s price as it would draw capital into DeFi protocols.

The decreasing stablecoin supply created challenges for immediate price advancement by reducing liquidity.

The stagnant activity on Flat DEX provided additional warnings about the market.

The fundamentals at VeChain continue to improve structurally yet the market might require increased stablecoin liquidity and trading volume to sustain short-term trading interest.