What Comes Next For $Binance Coin As SEC Drops 2-year Lawsuit Against Binance?

- The U.S. SEC officially dropped its near-two-year-old lawsuit against Binance and Changpeng Zhao “with prejudice” on May 29.

- This dismissal shows a major change in the SEC’s approach to crypto under new leadership.

- After the news, Binance.US promptly reinstated USD services, and BNB’s price briefly hit $678 with a 10% surge in 24-hour trading volume.

Binance has hit another important milestone in the US. According to reports, the US Securities and Exchange Commission (SEC) has officially dropped its lawsuit against Binance and its co-founder, Changpeng Zhao.

The decision, which was filed in federal court in Washington, D.C. on 29 May, ends nearly two years of legal uncertainty for Binance. Here’s what this development could bring for Binance, BNB and the rest of the market as a whole.

The SEC’s Case Against Binance

The SEC originally filed the lawsuit in June 2023, accusing Binance of multiple violations. Some of its accusations included diverting customer funds, inflating trading volumes, and allowing U.S. investors to access its unregistered international platform.

Additionally, the SEC charged Binance with listing tokens like Solana (SOL) and Cardano (ADA) as unregistered securities.

The lawsuit was later amended in October 2024 to add more allegations. However, after months of legal maneuvering and pauses in court proceedings, the SEC finally decided to dismiss the case “with prejudice”. This means that the agency cannot bring the same charges again.

Importantly, the agency clarified that the dismissal was made “as a policy matter,” and does not set any kind of tone for future crypto cases. Still, it is a major development that shows that the SEC, under new leadership, is approaching crypto differently.

From Enforcement to Policy

The dismissal comes amid earlier changes at the SEC under Acting Chairman Mark T. Uyeda and recently appointed Chairman Paul Atkins. Earlier in the year, the SEC launched a crypto task force to look into policy-based approaches, rather than jumping straight to lawsuits.

On a wider scale, the SEC has quietly backed off from enforcement actions against other major players in the crypto space, including Coinbase, Consensys, and Kraken. Industry insiders view these moves as a change from the agency’s combative approach under former Chairman Gary Gensler.

They also see this as a sign that the U.S. is ready to engage more with the crypto industry, rather than drag it to court, one entity at a time.

Binance Celebrates “Huge Win for Crypto”

Binance wasted no time reacting to the news. In a post on X (formerly Twitter), the exchange called the dismissal a “huge win for crypto.”

It also credited Chairman Atkins and the Trump administration for promoting innovation and pushing back against what it called “regulation by enforcement.”

“U.S. innovation is back on track – and it’s just the beginning,” Binance posted.

This optimism seems well-founded, because the case’s resolution removes a major overhang for Binance and reopens doors in the U.S. market.

Soon after the lawsuit’s dismissal, Binance.US quickly announced that its USD services were back online. American users can now once again deposit dollars and buy crypto using ACH bank transfers.

Trading activity also saw an immediate uptick with Binance Coin’s 24-hour volume surging to $1.5 billion in an almost 10% intraday increase. Even though BNB briefly touched $678 on TradingView before pulling back slightly, investor sentiment is still firmly bullish.

Can BNB Hit $2,000?

Now with legal uncertainty behind it and U.S. market access back in business, many analysts are now looking into the chances of BNB rallying. The token’s last all-time high was $793.35 in December of last year.

As of now, BNB trades at around $669, which is roughly 16% below its peak. Still, with bullish momentum building, experts believe the coin could double or even triple during this market cycle.

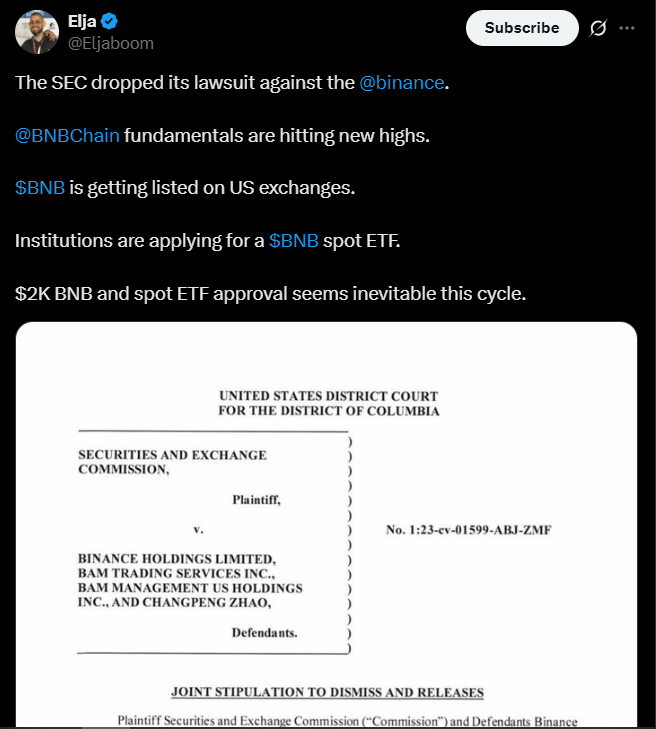

According to popular crypto influencer Eljaboom, a $2,000 BNB price and spot ETF approval “seems inevitable.” Keep in mind that BNB is also leading the charge on DEXs with over $143 billion in 30-day volume on its BNB Chain.

$2k BNB could be close | Source: X

From a charting perspective, BNB’s next resistance level is at $700 and a clean breakout above that could set the stage for a rally toward $1,000. If macro trends, especially Bitcoin’s rise toward $200,000 support the move, BNB reaching $2,000 isn’t out of the question by any means.