XRP ETF Debut Performance Sparks More Firms’ ETF Filings

Key Insights:

- A new leveraged XRP ETF from Teucrium saw a $5M volume on its debut day.

- About 11 asset managers with over $240 Billion AUM lined up XRP ETF filings, and more firms were expected to add in.

- XRP has massive bids stacking up between $1.30 and $1.

Ripple gained attention following Tecrium’s approval of the XRP ETF. The ETF, named XXRP, was introduced to broaden investment opportunities. It aimed to allow investors to profit from XRP’s price movements without owning the token directly.

XRP ETF Performance Since Debut

On April 8, 2025, NYSE Arca introduced Teucrium’s 2x Long Daily XRP ETF (XXRP). Its inaugural trading volume reached $5 Million, reflecting investor optimism toward XRP Ledger products.

Investor optimism increased following the launch announcement, while the SEC released its long-standing Ripple lawsuit. A Bloomberg ETF analyst, Eric Balchunas, posted on X that the ETF’s initial performance put it in the top 5% of new launches.

He also noted that its performance was about four times higher than the 2x Solana ETF (SOLT). XRP price saw a 14% increase that day, driving its value to about $1.87 as traders showed more interest.

The successful XRP ETF launch stimulated blockchain usage. This resulted in higher transaction volumes as new protocol users began interacting with XRP. If the momentum continued through this period, XRP could exceed its highs of about $3.00.

The continued involvement of ETF investors on the blockchain platform could create conditions for increasing dApp development to enhance platform utility.

Despite the significant ecological transformation after the ETF launched, the price decreased to $1.82. However, the token rebounded to around $1.90 at the time of writing.

Will More Firms Get XRP ETF Approval?

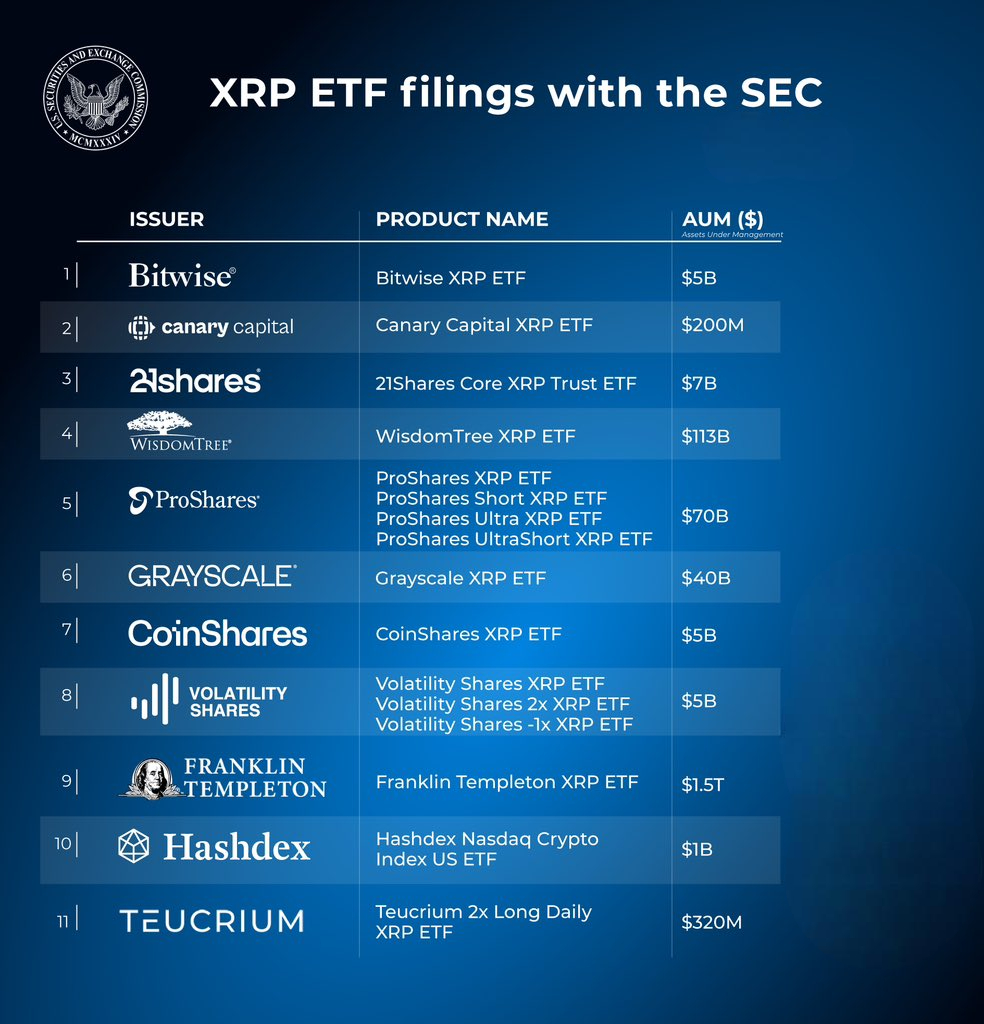

Following this, eleven major asset management firms filed additional XRP ETF applications. This surge in filings highlights the growing institutional interest in XRP, a digital asset once considered too volatile.

These SEC applications revealed that major firms such as Bitwise, Canary Capital, 21Shares, WisdomTree, and Grayscale wanted to establish XRP ETFs. CoinShares, Franklin Templeton, and Hashdex were also among the pending filings.

Tecrium’s launch of XXRP received positive feedback from investors. It sparked anticipation for more regulatory approvals as institutions leaned toward traditional crypto investment options.

The growing hype for XRP showed how public opinion had shifted, as being worried about legal uncertainty ranked lower. However, this did guarantee approvals but increased the possibility.

The increase in pending XRP ETF approvals suggested institutional investors viewed its technological infrastructure and high-level liquidity as attractive characteristics.

The SEC’s approval of multiple filings could strengthen XRP’s position as an official tradable asset. This development might attract new investment capital into the cryptocurrency market.

However, the ongoing momentum could be hurt if the filings fail to receive approval. The prevailing market environment indicated a gold rush potential, but caution was key before more official regulatory decisions were made.

Additional XRP ETF approval decisions from the SEC could significantly impact the asset’s performance as the cryptocurrency market transforms.

Impact of The Launch on Bids

Diving into the bids and asks following the launch, analysis showed a substantial support zone developed at $1.00 to $1.50 following massive bids within this range. This could generate solid purchase interest if the price revisits this area.

A cluster of buyers at $1.80 was previously dominant, but liquidity was swept, causing the XRP to rise above $1.90. XRP could continue the upward climb if it succeeds in pushing beyond emerging offers near $2.20.

The market could most likely retreat toward $1.30–$1.00 if sellers dominated near $1.90 or $2.00.

Market demand spikes could remove all existing price resistance and send prices toward $2.50 or beyond in the immediate future.

Alternatively, the market could likely decrease through breakdowns below $1.30 in case ETF-related optimism fails to maintain itself. Analyzing the arranged orders on the order book could help predict quick price changes.

Previous liquidity grabs at $1.80 and $2.00 led to swift shifts in market direction. A similar withdrawal at these levels might play a decisive role in shaping the market’s outcome.

The strong buy-side interest below $1.30 might provide temporary support. However, if prices fail to rise, it could lead to a surge in selling activity.