Key Insights:

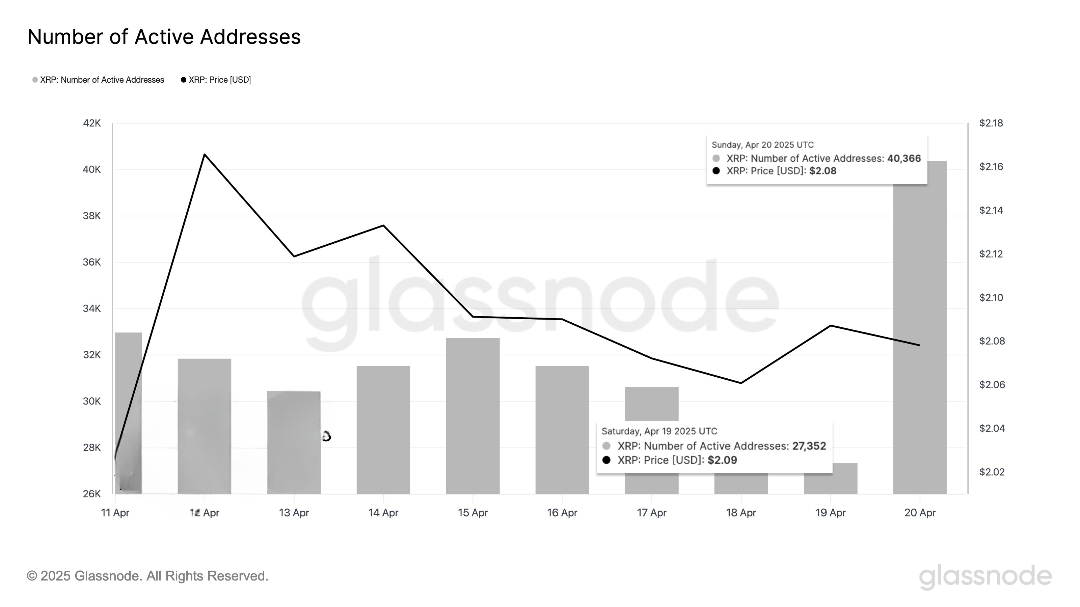

- XRP network activity jumped 67.50%, with active addresses rising from 27,352 to 40,366.

- Coinbase Derivatives, LLC also launched CFTC-regulated futures for XRP.

- Will the price of XRP react positively to these developments?

Ripple (XRP) is showing signs of increased network activity. The recent launch of XRP futures on Coinbase adds to its market momentum. Analysts believe this could signal a potential uptrend soon. Investors are watching closely for further bullish movement.

XRP Network Activity

XRP’s network activity saw a significant boost during this period. Active addresses surged 67.50%, rising from 27,352 to 40,366. Ripple reached its peak network activity with this number of active addresses throughout the 10 days.

On April 11, XRP hit 28,000 active addresses. The token then rose significantly, reaching over 40,000 active addresses on April 12.

XRP’s activity steadily declined through mid-April, hitting a low of 29,000 addresses. However, it soon experienced a sharp resurgence, signaling renewed momentum.

XRP price remained consistently stable even as the network activity of addresses increased or decreased. The token initially valued at $2.09, then settled at $2.08.

The price and behavioral indicators of the wallets showed no correlation. This could indicate a scenario where users bought XRP intensely or changed their holding practice.

Elevated network operations suggest user interest growth, which could increase XRP’s value. The absence of market volume and general trends would probably maintain modest price changes.

Coinbase Launches Regulated Futures for XRP

Again, Coinbase Derivatives obtained permission from the CFTC through a self-certification process to launch XRP futures. It started trading on April 21st, 2025, as a significant step for institutional XRP adoption.

The regulated futures option enhances market liquidity, making transactions smoother. It also improves capital allocation, allowing investors easier access to XRP, a highly liquid digital asset.

Coinbase Derivatives’ CFTC filing for XRP futures is a significant step forward. It strengthens XRP’s institutional legitimacy and expands its market presence.

The news comes amid growing on-chain usage, as Ripple active addresses rose 67.5% to 27,352 from 40,366. This indicated growing retail and institutional demand.

Nano (500 XRP) and standard (10,000 XRP) futures contracts provide strong liquidity. Their capital efficiency makes them increasingly appealing to traders seeking stable market exposure.

Increased demand for ETFs by organizations like Bitwise and 520 million token whale purchases during losses indicate strong investor confidence. This and the transparency of Ripple’s SEC settlement position XRP for broader adoption and a potential price increase.

XRP Predictions

A reversal sign emerged through the inverse head and shoulders pattern that XRP developed on its 1-hour timeframe. The left shoulder appeared at $2.08 before the price descended to $1.6129. On the other hand, the right shoulder developed above $2.04.

The neckline resistance decided to stay at around $2.2470. If XRP can break through this resistance, it could trigger a structured rally. This movement may push its price toward $2.75, aligning with the 1.618 Fibonacci extension target.

The first intermediate resistance is $2.4391, while the second is $2.578. These values may act as momentum-blocking barriers derived from the 1.272 and 1.414 extensions.

If XRP struggles to break past $2.2470, it could face rejection. This may lead to a retracement toward $1.9737 or even $1.7442.

It turned negative if the price structure fell below the $1.6129 mark. When this article was written, the market price of XRP was $2.1622.

The breakthrough will face potential delay if the price remains constrained below the $2.2470 point. The pattern indicated increasing strength. However, the price must exceed the neckline to confirm the rally will reach $2.70.